Stablecoin rails offer faster, borderless transactions with lower fees compared to traditional SEPA transfers, which are limited to Eurozone countries and operate within banking hours. SEPA ensures regulatory compliance and widespread acceptance across European banks, while stablecoin rails leverage blockchain technology for enhanced transparency and speed. Explore how these payment systems are transforming the future of banking and cross-border transactions.

Why it is important

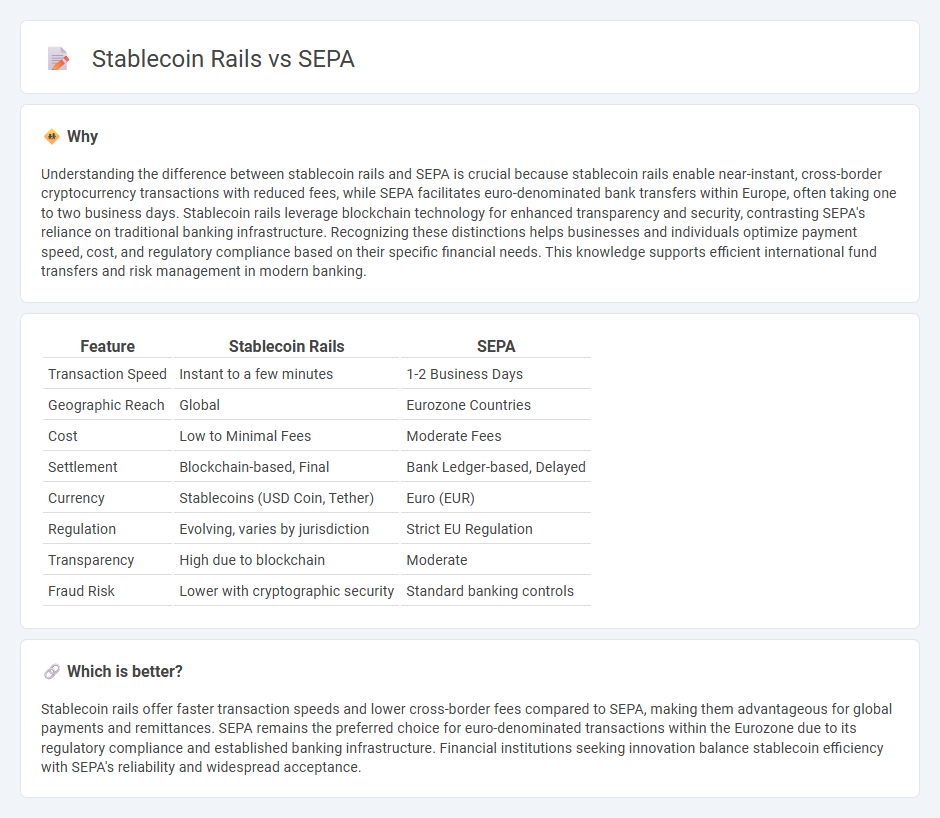

Understanding the difference between stablecoin rails and SEPA is crucial because stablecoin rails enable near-instant, cross-border cryptocurrency transactions with reduced fees, while SEPA facilitates euro-denominated bank transfers within Europe, often taking one to two business days. Stablecoin rails leverage blockchain technology for enhanced transparency and security, contrasting SEPA's reliance on traditional banking infrastructure. Recognizing these distinctions helps businesses and individuals optimize payment speed, cost, and regulatory compliance based on their specific financial needs. This knowledge supports efficient international fund transfers and risk management in modern banking.

Comparison Table

| Feature | Stablecoin Rails | SEPA |

|---|---|---|

| Transaction Speed | Instant to a few minutes | 1-2 Business Days |

| Geographic Reach | Global | Eurozone Countries |

| Cost | Low to Minimal Fees | Moderate Fees |

| Settlement | Blockchain-based, Final | Bank Ledger-based, Delayed |

| Currency | Stablecoins (USD Coin, Tether) | Euro (EUR) |

| Regulation | Evolving, varies by jurisdiction | Strict EU Regulation |

| Transparency | High due to blockchain | Moderate |

| Fraud Risk | Lower with cryptographic security | Standard banking controls |

Which is better?

Stablecoin rails offer faster transaction speeds and lower cross-border fees compared to SEPA, making them advantageous for global payments and remittances. SEPA remains the preferred choice for euro-denominated transactions within the Eurozone due to its regulatory compliance and established banking infrastructure. Financial institutions seeking innovation balance stablecoin efficiency with SEPA's reliability and widespread acceptance.

Connection

Stablecoin rails leverage blockchain technology to facilitate faster, transparent cross-border payments, integrating seamlessly with the SEPA network to enhance euro-denominated transactions. SEPA, designed for efficient euro transfers across participating European countries, benefits from stablecoin's immediacy and reduced costs, enabling near-instant settlement times. This synergy supports banking institutions in streamlining transaction processing while ensuring regulatory compliance within the European financial ecosystem.

Key Terms

Cross-border Payments

Cross-border payments using SEPA rails provide a secure, regulated environment with low fees for Eurozone transfers, but often experience slower processing times and limited currency options. Stablecoin rails offer near-instant settlement, multi-currency flexibility, and lower costs, leveraging blockchain technology to bypass traditional banking intermediaries. Explore how these payment infrastructures revolutionize international money transfers and which suits different business needs better.

Fiat Settlement

SEPA enables efficient euro transfers across Europe using traditional banking infrastructure with regulated fiat settlement. Stablecoin rails leverage blockchain technology for faster, borderless transactions while still relying on fiat currency backing for settlement stability. Explore how each system impacts transaction speed, cost, and regulatory compliance in cross-border payments.

Blockchain Integration

SEPA facilitates euro transfers across European banks with regulated, low-cost, and efficient clearing, leveraging established financial infrastructure. Stablecoin rails utilize blockchain technology to enable near-instant, borderless payments with enhanced transparency and programmability via smart contracts. Explore how blockchain integration is revolutionizing payment systems and driving global financial inclusion.

Source and External Links

Single Euro Payments Area (SEPA) - European Central Bank - SEPA allows customers to make fast, safe, and efficient cashless euro payments across the EU and several non-EU countries, harmonizing payment standards as if they were national payments since 2008.

Single Euro Payments Area - Wikipedia - SEPA is an EU payment integration initiative simplifying euro bank transfers with schemes like SEPA Credit Transfer, Instant Credit Transfer, and Direct Debit for consumers and businesses.

What is SEPA Direct Debit? - GoCardless - SEPA Direct Debit is a Europe-wide system enabling merchants to collect euro payments from accounts across 36 SEPA countries efficiently and in a harmonized manner.

dowidth.com

dowidth.com