Loyalty fintech platforms leverage customer spending data to enhance rewards and personalized offers, driving increased engagement and retention in banking services. Buy now, pay later (BNPL) platforms focus on providing flexible payment options to consumers, influencing purchasing behavior and credit usage patterns within the financial ecosystem. Explore how these innovations are reshaping consumer finance and banking strategies.

Why it is important

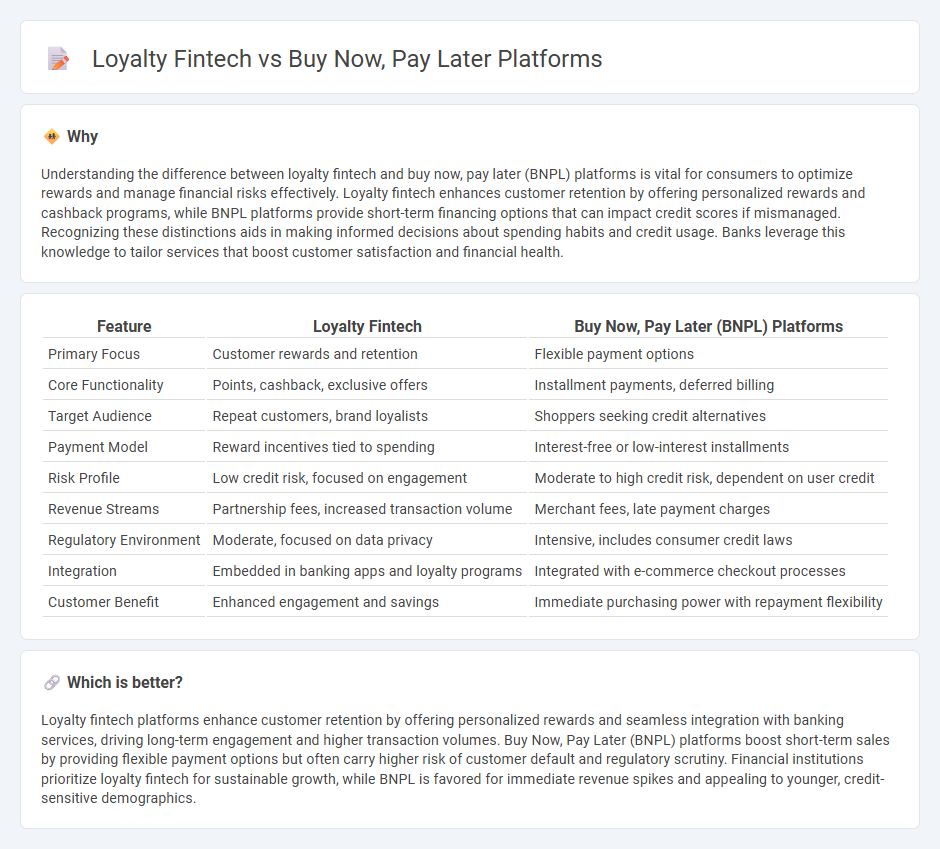

Understanding the difference between loyalty fintech and buy now, pay later (BNPL) platforms is vital for consumers to optimize rewards and manage financial risks effectively. Loyalty fintech enhances customer retention by offering personalized rewards and cashback programs, while BNPL platforms provide short-term financing options that can impact credit scores if mismanaged. Recognizing these distinctions aids in making informed decisions about spending habits and credit usage. Banks leverage this knowledge to tailor services that boost customer satisfaction and financial health.

Comparison Table

| Feature | Loyalty Fintech | Buy Now, Pay Later (BNPL) Platforms |

|---|---|---|

| Primary Focus | Customer rewards and retention | Flexible payment options |

| Core Functionality | Points, cashback, exclusive offers | Installment payments, deferred billing |

| Target Audience | Repeat customers, brand loyalists | Shoppers seeking credit alternatives |

| Payment Model | Reward incentives tied to spending | Interest-free or low-interest installments |

| Risk Profile | Low credit risk, focused on engagement | Moderate to high credit risk, dependent on user credit |

| Revenue Streams | Partnership fees, increased transaction volume | Merchant fees, late payment charges |

| Regulatory Environment | Moderate, focused on data privacy | Intensive, includes consumer credit laws |

| Integration | Embedded in banking apps and loyalty programs | Integrated with e-commerce checkout processes |

| Customer Benefit | Enhanced engagement and savings | Immediate purchasing power with repayment flexibility |

Which is better?

Loyalty fintech platforms enhance customer retention by offering personalized rewards and seamless integration with banking services, driving long-term engagement and higher transaction volumes. Buy Now, Pay Later (BNPL) platforms boost short-term sales by providing flexible payment options but often carry higher risk of customer default and regulatory scrutiny. Financial institutions prioritize loyalty fintech for sustainable growth, while BNPL is favored for immediate revenue spikes and appealing to younger, credit-sensitive demographics.

Connection

Loyalty fintech and Buy Now, Pay Later (BNPL) platforms are connected through their shared goal of enhancing customer engagement and retention within the banking ecosystem. Loyalty fintech integrates rewards and personalized incentives into BNPL transactions, encouraging repeat purchases and fostering brand loyalty. By leveraging data analytics, these platforms provide banks with actionable insights to optimize personalized offers and credit risk management.

Key Terms

**Buy Now, Pay Later Platforms:**

Buy Now, Pay Later (BNPL) platforms revolutionize consumer financing by allowing users to split purchases into interest-free installments, driving increased conversion rates and average order values for merchants. These platforms leverage advanced credit risk algorithms and seamless integration with e-commerce to offer instant credit approval, enhancing user experience and financial accessibility. Explore the growing impact of BNPL technologies on modern retail and consumer behavior by learning more.

Installment Payments

Installment payment solutions in buy now, pay later (BNPL) platforms offer flexible financing options that enable consumers to split purchases into manageable payments, driving higher conversion rates and average order values for merchants. Loyalty fintech programs integrating installment payments enhance customer retention by rewarding repeat purchases with exclusive benefits, fostering long-term engagement. Explore how combining BNPL with loyalty fintech can revolutionize payment experiences and boost business growth.

Credit Risk Assessment

Buy now, pay later (BNPL) platforms and loyalty fintech companies approach credit risk assessment with distinct strategies tailored to their business models; BNPL providers emphasize real-time credit scoring using transaction data and behavioral analytics to mitigate default risks, while loyalty fintechs integrate purchase patterns and reward redemption histories to gauge customer reliability. Advanced machine learning algorithms and AI-driven tools enhance predictive accuracy in both sectors, enabling dynamic risk profiling and personalized credit limits. Explore the evolving credit risk assessment techniques shaping BNPL and loyalty fintech innovations.

Source and External Links

What is buy now, pay later? BNPL platforms for businesses - Stripe - Buy now, pay later (BNPL) lets customers finance purchases in fixed installments without paying upfront, with popular providers including Affirm, Afterpay, Klarna, and Zip, helping businesses increase revenue and customer reach by receiving full payment immediately minus fees while BNPL providers manage the repayment process.

7 Popular Buy Now Pay Later Companies - Edvisors - Popular BNPL companies are Affirm, Afterpay, Klarna, Sezzle, PayPal Credit, Zip, and Splitit, offering flexible, interest-free installment payments that appeal especially to younger consumers and e-commerce retailers by easing cash flow and boosting sales.

What is Buy Now Pay Later? 6 Best BNPL Providers (2024) - Shopify - Leading BNPL providers include Shopify's Shop Pay Installments, Affirm, Afterpay, Sezzle, PayPal, and Klarna, each offering various repayment options like installment rescheduling and credit-building features, with merchant fees and interest rates varying across platforms.

dowidth.com

dowidth.com