Regulatory sandboxes provide a controlled environment where fintech innovations can be tested under relaxed regulatory requirements, enabling faster compliance evaluation and risk management. Pre-commercial testing involves trialing financial products or services in real-world settings before full market launch, focusing on user experience and operational performance. Explore more about how these approaches accelerate innovation and ensure safety in banking.

Why it is important

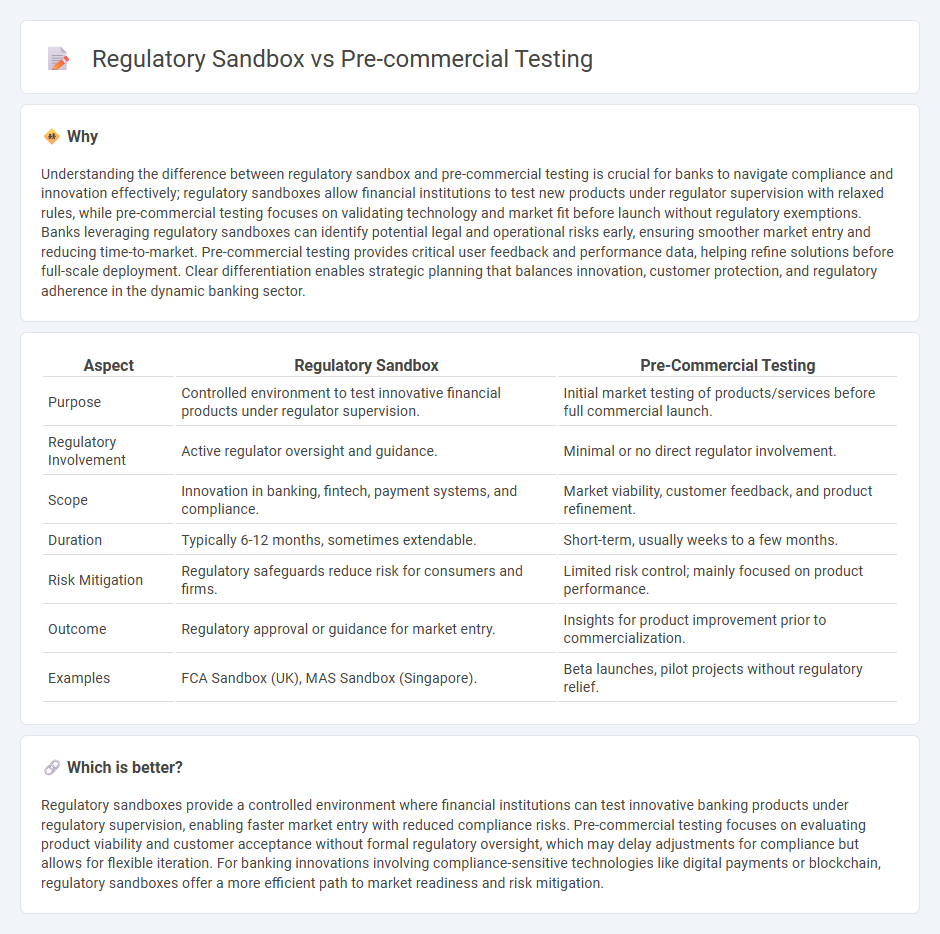

Understanding the difference between regulatory sandbox and pre-commercial testing is crucial for banks to navigate compliance and innovation effectively; regulatory sandboxes allow financial institutions to test new products under regulator supervision with relaxed rules, while pre-commercial testing focuses on validating technology and market fit before launch without regulatory exemptions. Banks leveraging regulatory sandboxes can identify potential legal and operational risks early, ensuring smoother market entry and reducing time-to-market. Pre-commercial testing provides critical user feedback and performance data, helping refine solutions before full-scale deployment. Clear differentiation enables strategic planning that balances innovation, customer protection, and regulatory adherence in the dynamic banking sector.

Comparison Table

| Aspect | Regulatory Sandbox | Pre-Commercial Testing |

|---|---|---|

| Purpose | Controlled environment to test innovative financial products under regulator supervision. | Initial market testing of products/services before full commercial launch. |

| Regulatory Involvement | Active regulator oversight and guidance. | Minimal or no direct regulator involvement. |

| Scope | Innovation in banking, fintech, payment systems, and compliance. | Market viability, customer feedback, and product refinement. |

| Duration | Typically 6-12 months, sometimes extendable. | Short-term, usually weeks to a few months. |

| Risk Mitigation | Regulatory safeguards reduce risk for consumers and firms. | Limited risk control; mainly focused on product performance. |

| Outcome | Regulatory approval or guidance for market entry. | Insights for product improvement prior to commercialization. |

| Examples | FCA Sandbox (UK), MAS Sandbox (Singapore). | Beta launches, pilot projects without regulatory relief. |

Which is better?

Regulatory sandboxes provide a controlled environment where financial institutions can test innovative banking products under regulatory supervision, enabling faster market entry with reduced compliance risks. Pre-commercial testing focuses on evaluating product viability and customer acceptance without formal regulatory oversight, which may delay adjustments for compliance but allows for flexible iteration. For banking innovations involving compliance-sensitive technologies like digital payments or blockchain, regulatory sandboxes offer a more efficient path to market readiness and risk mitigation.

Connection

Regulatory sandbox frameworks enable banks and fintech firms to conduct pre-commercial testing of innovative financial products in a controlled environment, minimizing risks while complying with regulatory requirements. This connection accelerates the development and deployment of new banking technologies by allowing real-world experimentation under regulator supervision. By facilitating iterative feedback and adjustments, regulatory sandboxes enhance the safety and effectiveness of pre-commercial trials, fostering innovation within the financial sector.

Key Terms

Pilot Testing

Pre-commercial testing evaluates a product's market viability and technical performance before full-scale commercialization, often involving real users to gather feedback and refine the offering. Regulatory sandboxes allow innovators to pilot new technologies under relaxed regulatory conditions to assess compliance and risk within a controlled environment. Explore how pilot testing bridges product validation and regulatory compliance for accelerated market entry.

Compliance Oversight

Pre-commercial testing allows companies to evaluate products under real market conditions with minimal regulatory intervention, focusing on iterative product refinement before full-scale launch. Regulatory sandbox frameworks provide a controlled environment for innovators to test new financial technologies under strict compliance oversight, ensuring adherence to existing laws while mitigating risks. Explore the key differences and benefits of both approaches in achieving effective compliance management.

Risk Assessment

Pre-commercial testing involves evaluating product performance and safety in real-world settings to identify potential risks before full market launch, emphasizing thorough risk assessment protocols. Regulatory sandboxes provide a controlled environment where businesses test innovative solutions under regulatory supervision, facilitating risk management and compliance in a flexible framework. Explore how these approaches differ in risk assessment to optimize innovation and regulatory adherence.

Source and External Links

Service of pre-commercial testing - Graper - Pre-commercial testing is a critical phase to assess the safety and effectiveness of products, particularly in agriculture, involving field research, use tests, reporting, and commercial technical support to optimize product dissemination.

Pre-Commercial Procurement - European Commission - Pre-commercial procurement is a public sector approach to procure R&D services competitively to develop innovative solutions by testing and comparing prototypes before commercial deployment.

Pre-Commercial Automated Dispatch System (ADS) Resource Test Procedure - This pre-commercial testing validates a resource's ability to receive, process, and execute automated dispatch signals accurately prior to full commercial operation approval.

dowidth.com

dowidth.com