Alternative credit data, such as rental and telecom payments, offers a broader view of consumer creditworthiness beyond traditional banking scores. Utility payment history provides reliable insights into financial responsibility as it reflects consistent, recurring bills over time. Explore how integrating these data sources can enhance credit decisions and expand access to banking services.

Why it is important

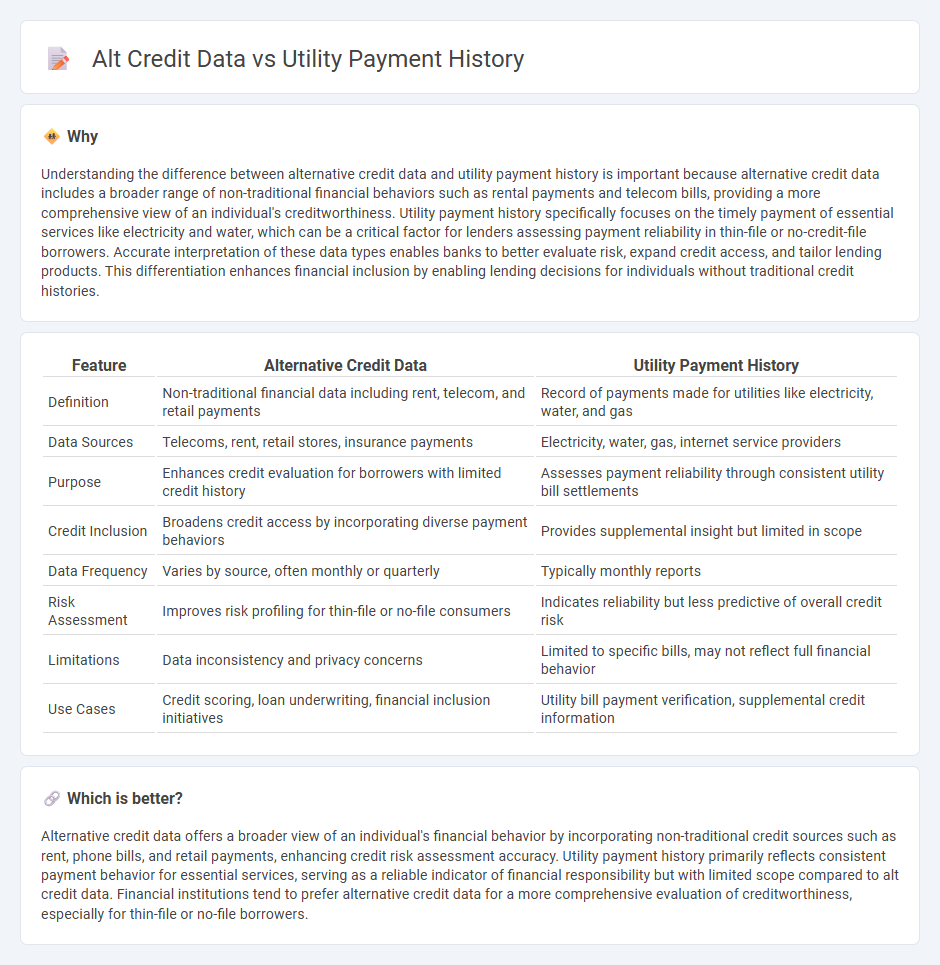

Understanding the difference between alternative credit data and utility payment history is important because alternative credit data includes a broader range of non-traditional financial behaviors such as rental payments and telecom bills, providing a more comprehensive view of an individual's creditworthiness. Utility payment history specifically focuses on the timely payment of essential services like electricity and water, which can be a critical factor for lenders assessing payment reliability in thin-file or no-credit-file borrowers. Accurate interpretation of these data types enables banks to better evaluate risk, expand credit access, and tailor lending products. This differentiation enhances financial inclusion by enabling lending decisions for individuals without traditional credit histories.

Comparison Table

| Feature | Alternative Credit Data | Utility Payment History |

|---|---|---|

| Definition | Non-traditional financial data including rent, telecom, and retail payments | Record of payments made for utilities like electricity, water, and gas |

| Data Sources | Telecoms, rent, retail stores, insurance payments | Electricity, water, gas, internet service providers |

| Purpose | Enhances credit evaluation for borrowers with limited credit history | Assesses payment reliability through consistent utility bill settlements |

| Credit Inclusion | Broadens credit access by incorporating diverse payment behaviors | Provides supplemental insight but limited in scope |

| Data Frequency | Varies by source, often monthly or quarterly | Typically monthly reports |

| Risk Assessment | Improves risk profiling for thin-file or no-file consumers | Indicates reliability but less predictive of overall credit risk |

| Limitations | Data inconsistency and privacy concerns | Limited to specific bills, may not reflect full financial behavior |

| Use Cases | Credit scoring, loan underwriting, financial inclusion initiatives | Utility bill payment verification, supplemental credit information |

Which is better?

Alternative credit data offers a broader view of an individual's financial behavior by incorporating non-traditional credit sources such as rent, phone bills, and retail payments, enhancing credit risk assessment accuracy. Utility payment history primarily reflects consistent payment behavior for essential services, serving as a reliable indicator of financial responsibility but with limited scope compared to alt credit data. Financial institutions tend to prefer alternative credit data for a more comprehensive evaluation of creditworthiness, especially for thin-file or no-file borrowers.

Connection

Alternative credit data, including utility payment history, enhances traditional banking credit assessments by providing a broader financial profile of borrowers. Utility payment records, such as electricity, water, and gas bills, offer reliable indicators of timely payment behavior that traditional credit reports may overlook. Incorporating utility payment history allows banks to improve credit risk evaluation, especially for thin-file or unbanked consumers, leading to more inclusive lending decisions.

Key Terms

Payment Reporting

Utility payment history offers a reliable snapshot of a consumer's on-time payments for essential services like electricity and water, often excluded from traditional credit reports. Alternative credit data includes payment details from utility accounts, rent, and telecommunications, enriching credit profiles with non-traditional payment behavior. Explore how incorporating alternative credit data can enhance credit scoring models and improve financial inclusion.

Alternative Data Sources

Utility payment history offers a reliable indicator of financial responsibility by reflecting timely payments for essential services like electricity and water. Alternative data sources include rental payments, mobile phone bills, and subscription services, providing a broader view of creditworthiness for those with limited traditional credit records. Explore how integrating these diverse alternative data points can enhance credit scoring models and improve financial inclusion.

Credit Scoring

Utility payment history offers a reliable indicator of a borrower's financial responsibility by reflecting consistent, on-time payments for essential services like electricity and water. Alternative credit data, which includes rental payments, telecommunications bills, and subscription services, broadens the scope to non-traditional financial behaviors that often go unreported in standard credit reports. Explore more to understand how integrating utility payment history with alternative credit data can significantly enhance credit scoring accuracy and inclusivity.

Source and External Links

Pay Online | City of Keller, TX - You can schedule automatic monthly payments and view your utility payment history and consumption history online anytime, with payments posted within two business days.

Utility Payments | Cleburne, TX - Official Website - Creating an online account allows you to pay bills and view your monthly billing statements, payment history, and water consumption conveniently at any time.

Utility Billing Department | Sherman, TX - Official Website - Customers can pay bills and access recent payment history 24/7 online or by phone, with options for scheduling future payments and enrolling in automatic bank drafting for convenience.

dowidth.com

dowidth.com