Sustainable banking focuses on environmental and social responsibility by funding projects that promote renewable energy and ethical practices. Digital banking emphasizes advanced technology, offering convenient online services and seamless mobile transactions to enhance customer experience. Explore the key differences and benefits of sustainable and digital banking to understand their impact on the financial industry.

Why it is important

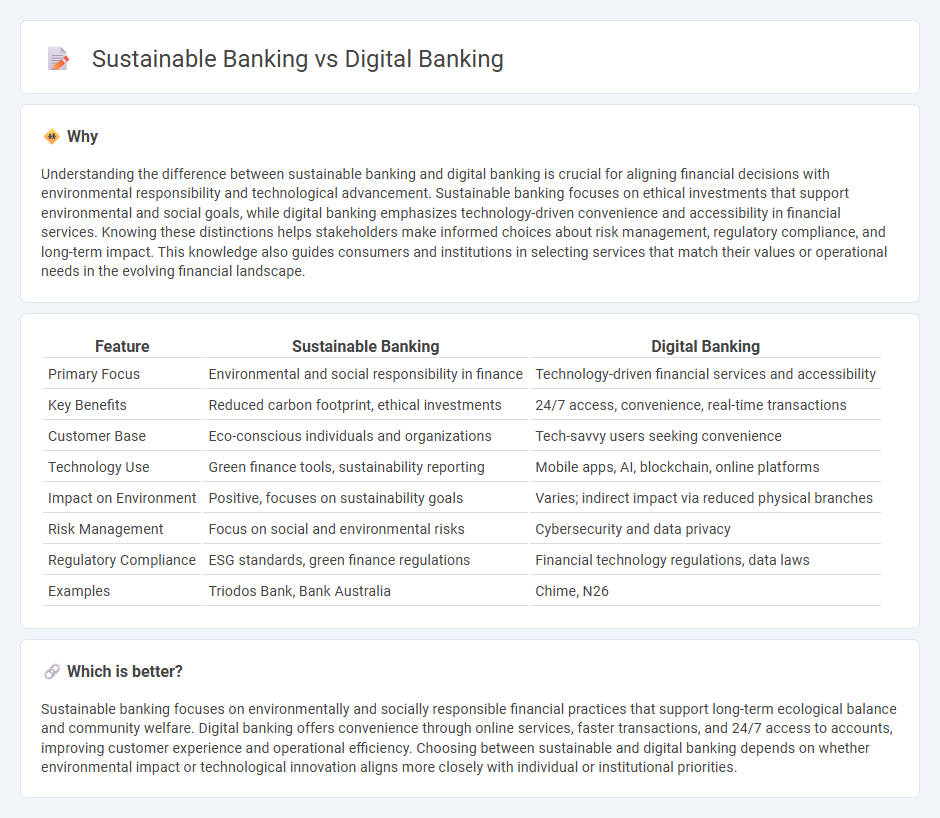

Understanding the difference between sustainable banking and digital banking is crucial for aligning financial decisions with environmental responsibility and technological advancement. Sustainable banking focuses on ethical investments that support environmental and social goals, while digital banking emphasizes technology-driven convenience and accessibility in financial services. Knowing these distinctions helps stakeholders make informed choices about risk management, regulatory compliance, and long-term impact. This knowledge also guides consumers and institutions in selecting services that match their values or operational needs in the evolving financial landscape.

Comparison Table

| Feature | Sustainable Banking | Digital Banking |

|---|---|---|

| Primary Focus | Environmental and social responsibility in finance | Technology-driven financial services and accessibility |

| Key Benefits | Reduced carbon footprint, ethical investments | 24/7 access, convenience, real-time transactions |

| Customer Base | Eco-conscious individuals and organizations | Tech-savvy users seeking convenience |

| Technology Use | Green finance tools, sustainability reporting | Mobile apps, AI, blockchain, online platforms |

| Impact on Environment | Positive, focuses on sustainability goals | Varies; indirect impact via reduced physical branches |

| Risk Management | Focus on social and environmental risks | Cybersecurity and data privacy |

| Regulatory Compliance | ESG standards, green finance regulations | Financial technology regulations, data laws |

| Examples | Triodos Bank, Bank Australia | Chime, N26 |

Which is better?

Sustainable banking focuses on environmentally and socially responsible financial practices that support long-term ecological balance and community welfare. Digital banking offers convenience through online services, faster transactions, and 24/7 access to accounts, improving customer experience and operational efficiency. Choosing between sustainable and digital banking depends on whether environmental impact or technological innovation aligns more closely with individual or institutional priorities.

Connection

Sustainable banking integrates environmental, social, and governance (ESG) criteria into financial services, promoting responsible investment and resource efficiency. Digital banking accelerates this by enabling eco-friendly transactions, reducing paper use, and enhancing transparency through blockchain and AI-driven reporting. Together, they transform the banking sector by fostering sustainable practices while leveraging technology to improve customer experience and operational efficiency.

Key Terms

Digital banking:

Digital banking leverages advanced technologies such as AI, blockchain, and mobile platforms to deliver seamless, secure financial services accessible anytime and anywhere. It enhances user experience through personalized services, real-time transactions, and data-driven insights while reducing operational costs. Explore how digital banking transforms financial ecosystems and drives innovation in the modern economy.

Online Banking

Digital banking leverages technology to offer seamless online banking services, including real-time transactions, mobile app accessibility, and AI-driven customer support. Sustainable banking integrates environmental, social, and governance (ESG) criteria into online platforms by promoting green financing options and carbon footprint tracking for digital transactions. Explore how leading banks blend digital innovation with sustainability to transform the future of online banking.

Mobile Payments

Mobile payments in digital banking leverage advanced technologies like NFC and QR codes to offer seamless, instant transactions with robust security protocols. Sustainable banking integrates mobile payments by promoting eco-friendly practices, such as reducing paper use and enabling transparent tracking of ethical investments. Explore how mobile payment innovations drive both convenience and sustainability in the evolving financial landscape.

Source and External Links

Digital Banking: 2025 Market Overview, Trends & Insights - Digital banking digitizes traditional banking products and processes, enabling customers to access services via online channels, with trends including mobile banking, AI-driven personalization, and the rise of digital-only banks.

Digital banking - Digital banking refers to the delivery of all banking services over the internet, integrating mobile, online, and ATM access with high automation and middleware connecting front-end, back-end, and cross-institutional systems.

Digital Banking - UNFCU Digital Banking provides secure, global account management via computer or mobile, offering features like account opening, global transfers, loan applications, card controls, and real-time notifications.

dowidth.com

dowidth.com