Negative interest rates occur when banks charge depositors for holding their money, effectively paying borrowers to take loans, which contrasts sharply with the effective interest rate that accounts for compound interest and fees, providing a true cost of borrowing or return on investment. While negative interest rates aim to stimulate economic activity by encouraging spending and lending, the effective interest rate offers a comprehensive measure of loan affordability and investment profitability. Discover more about how these contrasting rates impact your financial decisions and economic behavior.

Why it is important

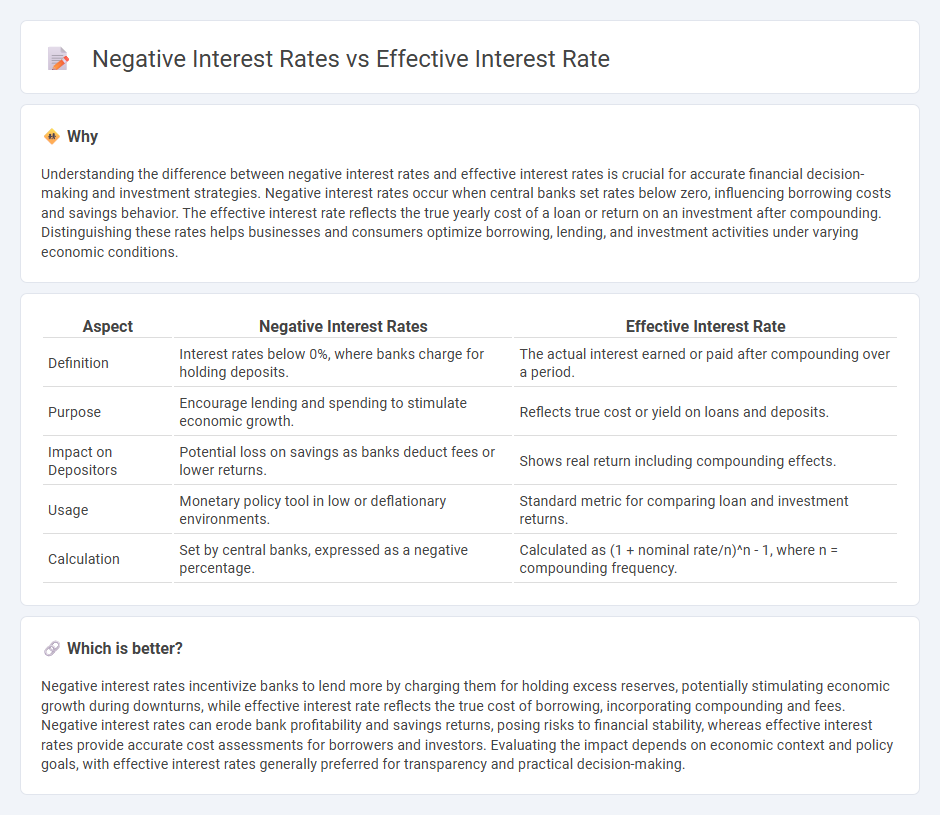

Understanding the difference between negative interest rates and effective interest rates is crucial for accurate financial decision-making and investment strategies. Negative interest rates occur when central banks set rates below zero, influencing borrowing costs and savings behavior. The effective interest rate reflects the true yearly cost of a loan or return on an investment after compounding. Distinguishing these rates helps businesses and consumers optimize borrowing, lending, and investment activities under varying economic conditions.

Comparison Table

| Aspect | Negative Interest Rates | Effective Interest Rate |

|---|---|---|

| Definition | Interest rates below 0%, where banks charge for holding deposits. | The actual interest earned or paid after compounding over a period. |

| Purpose | Encourage lending and spending to stimulate economic growth. | Reflects true cost or yield on loans and deposits. |

| Impact on Depositors | Potential loss on savings as banks deduct fees or lower returns. | Shows real return including compounding effects. |

| Usage | Monetary policy tool in low or deflationary environments. | Standard metric for comparing loan and investment returns. |

| Calculation | Set by central banks, expressed as a negative percentage. | Calculated as (1 + nominal rate/n)^n - 1, where n = compounding frequency. |

Which is better?

Negative interest rates incentivize banks to lend more by charging them for holding excess reserves, potentially stimulating economic growth during downturns, while effective interest rate reflects the true cost of borrowing, incorporating compounding and fees. Negative interest rates can erode bank profitability and savings returns, posing risks to financial stability, whereas effective interest rates provide accurate cost assessments for borrowers and investors. Evaluating the impact depends on economic context and policy goals, with effective interest rates generally preferred for transparency and practical decision-making.

Connection

Negative interest rates influence the calculation of the effective interest rate by reducing the nominal interest rate below zero, which can lead to a lower or even negative effective rate on loans and deposits. Banks adjust the nominal rates to account for these negative values, affecting how the effective interest rate reflects the true cost or yield of financial products. This connection impacts consumer borrowing costs, saving behavior, and overall monetary policy effectiveness.

Key Terms

Compounding

Effective interest rate measures the true return on an investment by incorporating the effects of compounding over multiple periods, reflecting actual growth more accurately than nominal rates. Negative interest rates, often employed by central banks, imply that depositors or investors may effectively pay to hold assets, influencing compounding by reducing the principal over time instead of growing it. Explore detailed comparisons and implications of compounding on effective and negative interest rates to optimize your financial strategies.

Nominal Rate

The nominal interest rate represents the stated annual percentage without adjustments for inflation or compounding, serving as a baseline for comparing effective interest rates and understanding negative interest rate environments. Effective interest rate incorporates compounding periods to reflect the true annual cost or return, which can diverge significantly from the nominal rate, especially under negative nominal rates where real yields turn unfavorable for lenders. Explore the detailed impact of nominal versus effective interest rates on borrowing and investment dynamics to grasp their full financial implications.

Deposit/Lending Policies

Effective interest rates determine the real cost of borrowing or the real yield on deposits, reflecting compounding periods and fees, crucial for banking institutions' deposit and lending policies. Negative interest rates compel banks to charge depositors for holding funds, discouraging savings and encouraging lending to stimulate economic activity. Explore how evolving monetary policies influence bank strategies in managing deposits and loans under these contrasting interest rate environments.

Source and External Links

Effective Interest Rate | Formula + Calculator - Wall Street Prep - The effective interest rate (EIR) reflects the annualized interest rate on a loan accounting for compounding frequency, calculated by adjusting the nominal interest rate for the number of compounding periods per year to give a true annual rate.

What is an effective annual interest rate? - Capital One - The effective annual interest rate is the actual annual return on an investment after compounding effects are included, making the rate higher than the nominal if interest compounds more than once a year.

Effective interest rate - Wikipedia - The effective interest rate is calculated as \( r = (1 + \frac{i}{n})^n - 1 \), where \(i\) is the nominal rate and \(n\) the compounding periods per year, representing the true annual interest rate considering compounding.

dowidth.com

dowidth.com