Virtual cards offer enhanced security for online transactions by generating temporary card numbers, reducing fraud risks compared to traditional payment methods. E-wallets provide a convenient digital platform to store multiple payment options, facilitating quick and seamless checkout experiences both online and in-store. Explore the key differences and benefits of virtual cards versus e-wallets to optimize your digital payment strategy.

Why it is important

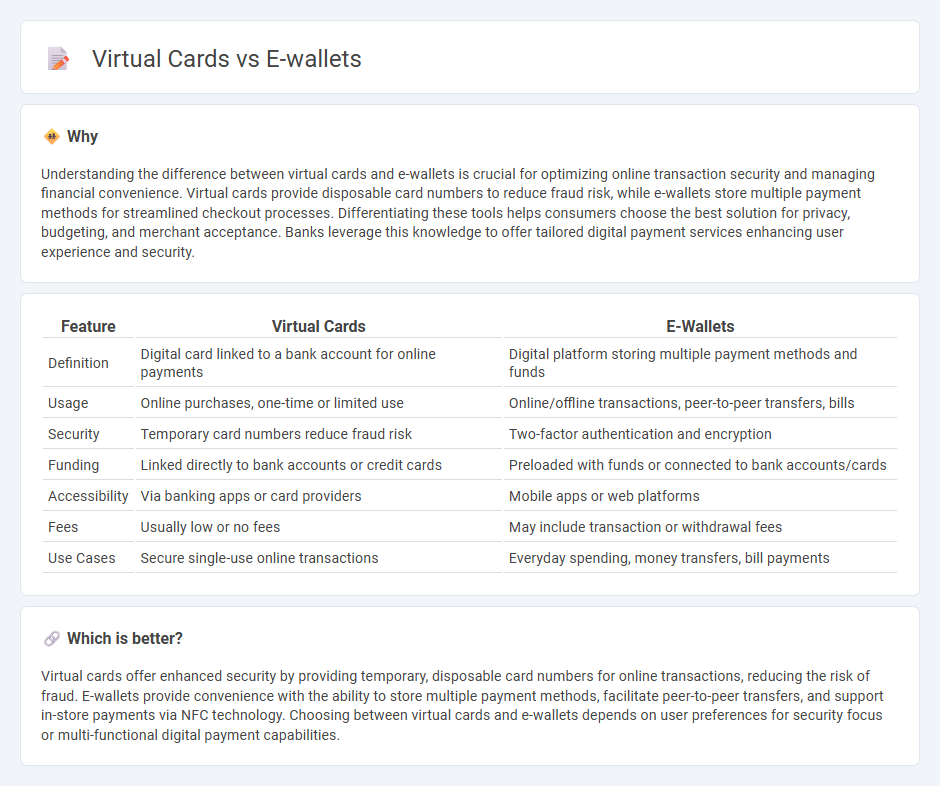

Understanding the difference between virtual cards and e-wallets is crucial for optimizing online transaction security and managing financial convenience. Virtual cards provide disposable card numbers to reduce fraud risk, while e-wallets store multiple payment methods for streamlined checkout processes. Differentiating these tools helps consumers choose the best solution for privacy, budgeting, and merchant acceptance. Banks leverage this knowledge to offer tailored digital payment services enhancing user experience and security.

Comparison Table

| Feature | Virtual Cards | E-Wallets |

|---|---|---|

| Definition | Digital card linked to a bank account for online payments | Digital platform storing multiple payment methods and funds |

| Usage | Online purchases, one-time or limited use | Online/offline transactions, peer-to-peer transfers, bills |

| Security | Temporary card numbers reduce fraud risk | Two-factor authentication and encryption |

| Funding | Linked directly to bank accounts or credit cards | Preloaded with funds or connected to bank accounts/cards |

| Accessibility | Via banking apps or card providers | Mobile apps or web platforms |

| Fees | Usually low or no fees | May include transaction or withdrawal fees |

| Use Cases | Secure single-use online transactions | Everyday spending, money transfers, bill payments |

Which is better?

Virtual cards offer enhanced security by providing temporary, disposable card numbers for online transactions, reducing the risk of fraud. E-wallets provide convenience with the ability to store multiple payment methods, facilitate peer-to-peer transfers, and support in-store payments via NFC technology. Choosing between virtual cards and e-wallets depends on user preferences for security focus or multi-functional digital payment capabilities.

Connection

Virtual cards and e-wallets are interconnected digital payment solutions that enhance online transaction security and convenience. Virtual cards, generated within e-wallet platforms, provide a temporary card number linked to the user's primary account, reducing fraud risks during online purchases. E-wallets serve as a centralized hub for storing virtual cards, payment methods, and digital funds, streamlining the management of financial transactions across multiple merchants.

Key Terms

Digital Payments

E-wallets provide a holistic digital payment solution by storing multiple payment methods and enabling quick, contactless transactions across various platforms. Virtual cards offer enhanced security through single-use or limited-use card numbers, reducing fraud risk in online payments. Explore the differences and benefits of e-wallets and virtual cards to optimize your digital payment strategies.

Tokenization

E-wallets and virtual cards both leverage tokenization to enhance security by replacing sensitive payment information with unique tokens, minimizing fraud risk during transactions. Tokenization ensures that actual card details are never exposed or stored on merchant systems, providing a secure layer for mobile payments and online purchases. Explore how tokenization drives innovation in digital payments for safer financial interactions.

Security Authentication

E-wallets utilize multi-factor authentication, biometric verification, and device recognition to ensure secure access, while virtual cards offer unique card numbers with limited validity and transaction scope to minimize fraud risks. Both technologies incorporate tokenization and encryption standards, enhancing protection against unauthorized transactions and data breaches. Explore how these security features compare to choose the optimal digital payment method for your needs.

Source and External Links

Digital wallet - A digital wallet, or e-wallet, is an electronic service or software allowing users to make electronic transactions, store payment cards, loyalty cards, and IDs, and transact via mobile or computer with added features like NFC and credential authentication.

10 best digital wallets in 2025 you need to know - E-wallets provide convenience, security, centralized payment options, seamless integration with financial services, and versatile functionalities such as online purchases, bill payments, and fund transfers, often secured by encryption and biometric authentication.

What Is a Digital Wallet and Is It Safe? - Digital wallets store credit, debit, and gift card info on mobile devices to enable fast, secure in-store and online payments, with protections like encryption and tokenization keeping user payment data safe during transactions.

dowidth.com

dowidth.com