Alternative credit data includes non-traditional information such as rent payments, utility bills, and mobile phone usage, expanding the scope of creditworthiness assessment beyond FICO scores. FICO scores primarily rely on traditional credit history from credit cards, loans, and payment patterns reported to credit bureaus. Explore more to understand how alternative credit data enhances lending decisions and financial inclusion.

Why it is important

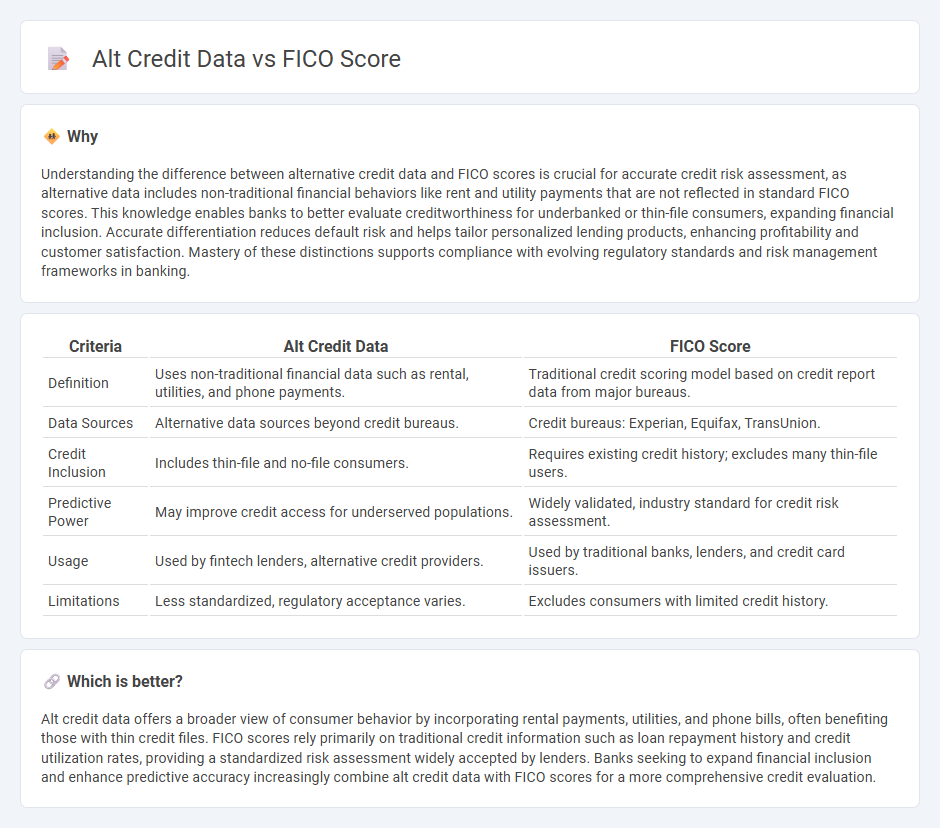

Understanding the difference between alternative credit data and FICO scores is crucial for accurate credit risk assessment, as alternative data includes non-traditional financial behaviors like rent and utility payments that are not reflected in standard FICO scores. This knowledge enables banks to better evaluate creditworthiness for underbanked or thin-file consumers, expanding financial inclusion. Accurate differentiation reduces default risk and helps tailor personalized lending products, enhancing profitability and customer satisfaction. Mastery of these distinctions supports compliance with evolving regulatory standards and risk management frameworks in banking.

Comparison Table

| Criteria | Alt Credit Data | FICO Score |

|---|---|---|

| Definition | Uses non-traditional financial data such as rental, utilities, and phone payments. | Traditional credit scoring model based on credit report data from major bureaus. |

| Data Sources | Alternative data sources beyond credit bureaus. | Credit bureaus: Experian, Equifax, TransUnion. |

| Credit Inclusion | Includes thin-file and no-file consumers. | Requires existing credit history; excludes many thin-file users. |

| Predictive Power | May improve credit access for underserved populations. | Widely validated, industry standard for credit risk assessment. |

| Usage | Used by fintech lenders, alternative credit providers. | Used by traditional banks, lenders, and credit card issuers. |

| Limitations | Less standardized, regulatory acceptance varies. | Excludes consumers with limited credit history. |

Which is better?

Alt credit data offers a broader view of consumer behavior by incorporating rental payments, utilities, and phone bills, often benefiting those with thin credit files. FICO scores rely primarily on traditional credit information such as loan repayment history and credit utilization rates, providing a standardized risk assessment widely accepted by lenders. Banks seeking to expand financial inclusion and enhance predictive accuracy increasingly combine alt credit data with FICO scores for a more comprehensive credit evaluation.

Connection

Alt credit data enhances traditional credit evaluations by incorporating non-traditional financial behaviors such as utility payments and rental history, complementing FICO scores. FICO scores primarily rely on credit card and loan repayment data, making alt credit data valuable for assessing creditworthiness of individuals with limited credit history. Integrating alt credit data with FICO scoring models improves risk assessment accuracy and broadens access to banking services for underbanked populations.

Key Terms

Creditworthiness

FICO scores primarily rely on traditional credit data such as payment history, credit utilization, and length of credit history to evaluate creditworthiness, often excluding alternative financial behaviors. Alternative credit data incorporates non-traditional sources like rent payments, utility bills, and mobile phone payments, providing a broader picture of a consumer's financial reliability, especially for thin-file or no-file borrowers. Explore how integrating alt credit data complements FICO scores to enhance credit assessments and improve lending decisions.

Traditional Credit History

FICO scores primarily evaluate traditional credit history, including payment records on credit cards, mortgages, and installment loans, influencing lenders' risk assessments. Alternative credit data, such as rent, utility payments, and subscription services, can supplement credit profiles but are not included in classic FICO calculations. Explore how integrating alternative credit data reshapes lending decisions beyond the conventional FICO framework.

Alternative Data Sources

Alternative credit data sources, such as utility payments, rental history, and telecom records, provide a broader view of creditworthiness beyond traditional FICO scores. These alternative data points enhance credit access for underserved populations by including financial behaviors not captured in standard credit reports. Explore how integrating alternative data can revolutionize credit assessments and improve lending decisions.

Source and External Links

FICO Credit Score - The FICO Score is the most widely used credit score by lenders to assess consumer credit risk quickly and reliably, guiding billions of credit decisions annually.

How To Check Your FICO Scores For Free - You can check your FICO Scores for free via websites like myFICO.com, Capital One, Bank of America, and Discover, with each score reflecting various factors such as payment history and amounts owed.

myFICO: Your FICO Score, from FICO - myFICO offers access to your official FICO Scores, credit reports, and monitoring services, providing important identity theft protection and updates monthly or quarterly based on subscription.

dowidth.com

dowidth.com