Sustainable banking focuses on integrating environmental, social, and governance (ESG) criteria into financial services, promoting responsible investments and reducing negative ecological impacts. Cooperative banking operates on a member-owned model, prioritizing community development and financial inclusivity through shared ownership and democratic control. Explore the key differences and benefits of sustainable and cooperative banking to understand their unique contributions to the financial sector.

Why it is important

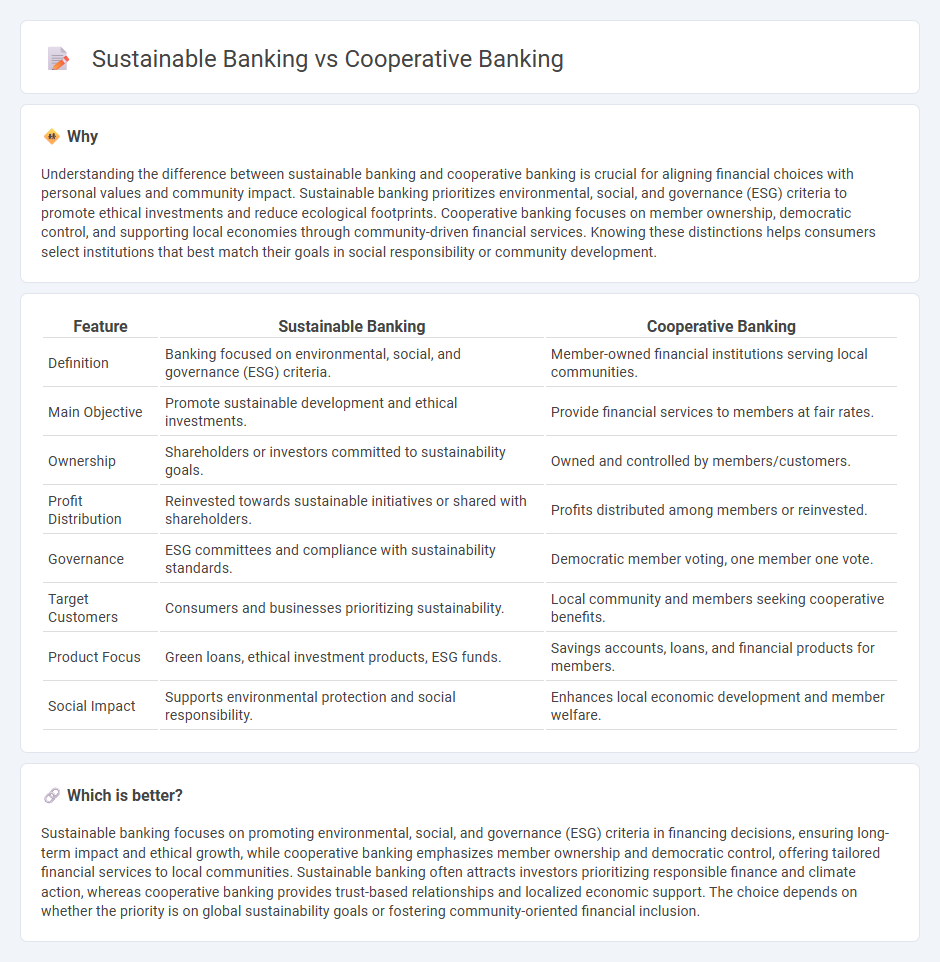

Understanding the difference between sustainable banking and cooperative banking is crucial for aligning financial choices with personal values and community impact. Sustainable banking prioritizes environmental, social, and governance (ESG) criteria to promote ethical investments and reduce ecological footprints. Cooperative banking focuses on member ownership, democratic control, and supporting local economies through community-driven financial services. Knowing these distinctions helps consumers select institutions that best match their goals in social responsibility or community development.

Comparison Table

| Feature | Sustainable Banking | Cooperative Banking |

|---|---|---|

| Definition | Banking focused on environmental, social, and governance (ESG) criteria. | Member-owned financial institutions serving local communities. |

| Main Objective | Promote sustainable development and ethical investments. | Provide financial services to members at fair rates. |

| Ownership | Shareholders or investors committed to sustainability goals. | Owned and controlled by members/customers. |

| Profit Distribution | Reinvested towards sustainable initiatives or shared with shareholders. | Profits distributed among members or reinvested. |

| Governance | ESG committees and compliance with sustainability standards. | Democratic member voting, one member one vote. |

| Target Customers | Consumers and businesses prioritizing sustainability. | Local community and members seeking cooperative benefits. |

| Product Focus | Green loans, ethical investment products, ESG funds. | Savings accounts, loans, and financial products for members. |

| Social Impact | Supports environmental protection and social responsibility. | Enhances local economic development and member welfare. |

Which is better?

Sustainable banking focuses on promoting environmental, social, and governance (ESG) criteria in financing decisions, ensuring long-term impact and ethical growth, while cooperative banking emphasizes member ownership and democratic control, offering tailored financial services to local communities. Sustainable banking often attracts investors prioritizing responsible finance and climate action, whereas cooperative banking provides trust-based relationships and localized economic support. The choice depends on whether the priority is on global sustainability goals or fostering community-oriented financial inclusion.

Connection

Sustainable banking and cooperative banking share a commitment to ethical finance, prioritizing social and environmental responsibility over profit maximization. Cooperative banks often implement sustainable banking principles by supporting community-focused projects and financing green initiatives, fostering inclusive growth. Their mutual ownership structures align with sustainable finance goals by promoting transparency, stakeholder engagement, and long-term community benefits.

Key Terms

Cooperative Banking:

Cooperative banking prioritizes member ownership and democratic control, offering financial services tailored to local communities and small businesses, often emphasizing trust and social responsibility. This model supports economic inclusion through transparent governance and profit-sharing, distinct from the broader environmental and ethical focus typical of sustainable banking. Explore how cooperative banking drives community development and financial empowerment.

Member-ownership

Cooperative banking operates on a member-ownership model where each member holds equal voting rights, emphasizing democratic control and profit-sharing among members. Sustainable banking incorporates member-ownership principles but prioritizes environmental, social, and governance (ESG) criteria to ensure long-term positive impact on society and the planet. Explore how member-ownership drives accountability and ethical practices in both banking models to learn more.

Democratic control

Cooperative banking operates on the principle of democratic control, where each member has equal voting rights regardless of their financial stake, fostering inclusive decision-making and member-driven governance. Sustainable banking prioritizes environmental, social, and governance (ESG) criteria but may not always guarantee democratic control, as its focus lies more on ethical investment and impact rather than member participation. Explore how democratic control differentiates cooperative banks from sustainable banks in shaping financial and social outcomes.

Source and External Links

Cooperative banking (Wikipedia) - Cooperative banking is retail and commercial banking organized on a cooperative basis, with institutions owned by their customers and operating under cooperative principles, including governance by members and often providing services to both members and non-members.

What is a Cooperative Bank? (Greenfield Coop Bank) - Cooperative banks are community-focused financial institutions where depositors have governance rights, prioritizing local benefit over external shareholders, and typically require member approval for major changes in ownership structure.

Community Impact (National Cooperative Bank) - National Cooperative Bank supports low- and moderate-income communities by providing dedicated financing for cooperatives and member-owned organizations, alongside offering banking services and community development initiatives.

dowidth.com

dowidth.com