Super apps integrate multiple financial services within a single platform, offering seamless user experiences that include payments, lending, and investments. Challenger banks operate as digital-first entities focused solely on delivering innovative banking solutions, often with lower fees and faster customer service compared to traditional banks. Explore the evolving landscape of digital finance to understand how these models transform banking experiences.

Why it is important

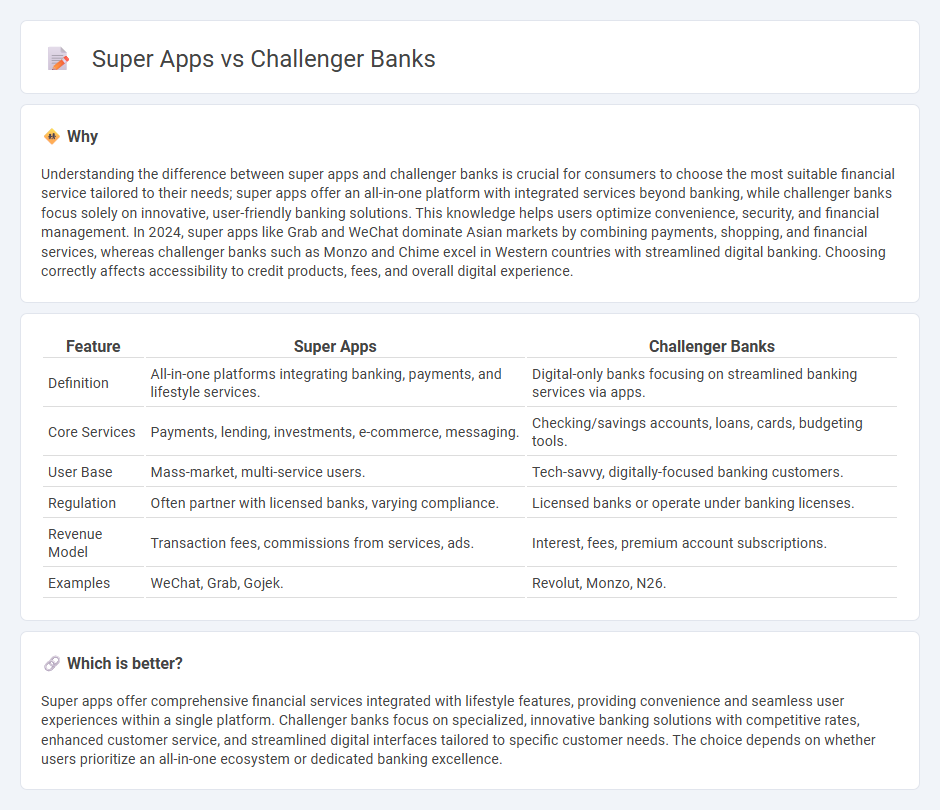

Understanding the difference between super apps and challenger banks is crucial for consumers to choose the most suitable financial service tailored to their needs; super apps offer an all-in-one platform with integrated services beyond banking, while challenger banks focus solely on innovative, user-friendly banking solutions. This knowledge helps users optimize convenience, security, and financial management. In 2024, super apps like Grab and WeChat dominate Asian markets by combining payments, shopping, and financial services, whereas challenger banks such as Monzo and Chime excel in Western countries with streamlined digital banking. Choosing correctly affects accessibility to credit products, fees, and overall digital experience.

Comparison Table

| Feature | Super Apps | Challenger Banks |

|---|---|---|

| Definition | All-in-one platforms integrating banking, payments, and lifestyle services. | Digital-only banks focusing on streamlined banking services via apps. |

| Core Services | Payments, lending, investments, e-commerce, messaging. | Checking/savings accounts, loans, cards, budgeting tools. |

| User Base | Mass-market, multi-service users. | Tech-savvy, digitally-focused banking customers. |

| Regulation | Often partner with licensed banks, varying compliance. | Licensed banks or operate under banking licenses. |

| Revenue Model | Transaction fees, commissions from services, ads. | Interest, fees, premium account subscriptions. |

| Examples | WeChat, Grab, Gojek. | Revolut, Monzo, N26. |

Which is better?

Super apps offer comprehensive financial services integrated with lifestyle features, providing convenience and seamless user experiences within a single platform. Challenger banks focus on specialized, innovative banking solutions with competitive rates, enhanced customer service, and streamlined digital interfaces tailored to specific customer needs. The choice depends on whether users prioritize an all-in-one ecosystem or dedicated banking excellence.

Connection

Super apps integrate financial services including banking, investments, and payments into a single platform, often partnering with or evolving into challenger banks to offer fully licensed banking products. Challenger banks leverage the super app ecosystem to access a broader customer base through seamless digital experiences and personalized financial solutions. This synergy drives innovation by combining the agility of fintech startups with the comprehensive service offerings of super apps, reshaping the future of banking.

Key Terms

Digital-Only Banking

Challenger banks offer streamlined, digital-only banking services focusing on mobile-first experiences, competitive fees, and user-friendly interfaces that challenge traditional banks. Super apps integrate digital-only banking within a broader ecosystem of services like payments, e-commerce, and social media, providing a seamless, all-in-one platform for users. Explore how these innovations are reshaping financial services and consumer behaviors in the digital economy.

Ecosystem Integration

Challenger banks offer streamlined financial services with a focus on user-friendly digital banking, while super apps integrate diverse services like payments, shopping, and social media within a single platform, creating a multifaceted ecosystem. The key difference lies in ecosystem integration, where super apps foster seamless interactions across varied services, enhancing user engagement and retention. Explore how these digital models are transforming customer experiences and driving innovation in the financial technology landscape.

Financial Inclusion

Challenger banks provide streamlined banking services with lower fees and enhanced digital accessibility, targeting underserved populations to promote financial inclusion. Super apps integrate multiple financial services, including payments, lending, and insurance, within a single platform, expanding access through convenience and user engagement. Explore how these innovations are transforming financial inclusion worldwide and what future trends to expect.

Source and External Links

Challenger Banks Explained: Trends and Opportunities - Ulam Labs - Challenger banks are digital-first financial institutions challenging traditional banks, with the global market projected to grow from USD 118 billion in 2023 to over USD 2.5 trillion by 2031, driven by major players like Monzo, Revolut, and Nubank expanding rapidly worldwide.

The Rise of Challenger Banks: Are the Apps Taking Over? - FT Partners - Challenger banks are reshaping global banking by gaining market share, blurring lines with other financial services, prompting traditional banks to launch FinTech solutions, while tech giants also enter the banking space.

Challenger Bank Definition - FinTech Weekly - Challenger banks, often small modern retail banks also known as neo banks, use advanced financial technology and customer focus to compete with long-established banks, originating largely from regulatory changes in the UK breaking up banking monopolies.

dowidth.com

dowidth.com