Banking as a Service (BaaS) enables third-party providers to offer financial products through licensed banks via APIs, streamlining integration and accelerating innovation. Banking as a Platform (BaaP) expands this concept by creating a comprehensive ecosystem where multiple financial services and partners interact on a unified digital infrastructure. Discover how these models transform the future of digital finance and open new opportunities.

Why it is important

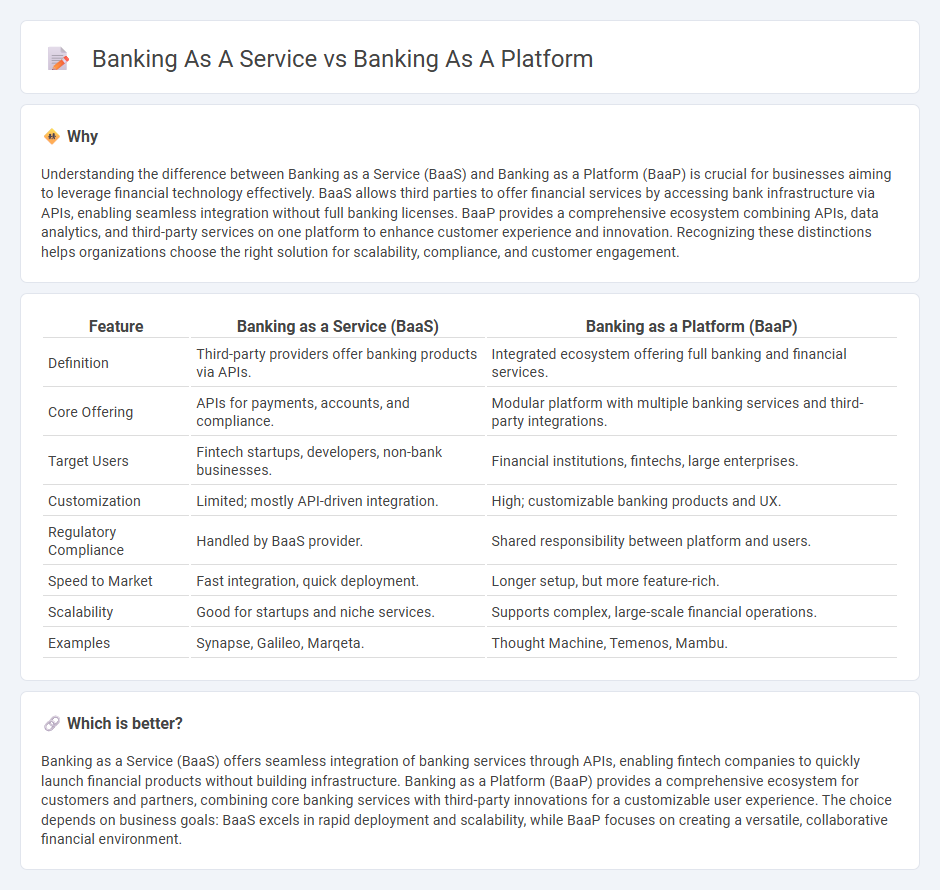

Understanding the difference between Banking as a Service (BaaS) and Banking as a Platform (BaaP) is crucial for businesses aiming to leverage financial technology effectively. BaaS allows third parties to offer financial services by accessing bank infrastructure via APIs, enabling seamless integration without full banking licenses. BaaP provides a comprehensive ecosystem combining APIs, data analytics, and third-party services on one platform to enhance customer experience and innovation. Recognizing these distinctions helps organizations choose the right solution for scalability, compliance, and customer engagement.

Comparison Table

| Feature | Banking as a Service (BaaS) | Banking as a Platform (BaaP) |

|---|---|---|

| Definition | Third-party providers offer banking products via APIs. | Integrated ecosystem offering full banking and financial services. |

| Core Offering | APIs for payments, accounts, and compliance. | Modular platform with multiple banking services and third-party integrations. |

| Target Users | Fintech startups, developers, non-bank businesses. | Financial institutions, fintechs, large enterprises. |

| Customization | Limited; mostly API-driven integration. | High; customizable banking products and UX. |

| Regulatory Compliance | Handled by BaaS provider. | Shared responsibility between platform and users. |

| Speed to Market | Fast integration, quick deployment. | Longer setup, but more feature-rich. |

| Scalability | Good for startups and niche services. | Supports complex, large-scale financial operations. |

| Examples | Synapse, Galileo, Marqeta. | Thought Machine, Temenos, Mambu. |

Which is better?

Banking as a Service (BaaS) offers seamless integration of banking services through APIs, enabling fintech companies to quickly launch financial products without building infrastructure. Banking as a Platform (BaaP) provides a comprehensive ecosystem for customers and partners, combining core banking services with third-party innovations for a customizable user experience. The choice depends on business goals: BaaS excels in rapid deployment and scalability, while BaaP focuses on creating a versatile, collaborative financial environment.

Connection

Banking as a Service (BaaS) provides third-party companies access to banking infrastructure via APIs, enabling them to offer financial products without acquiring a banking license. Banking as a Platform (BaaP) integrates BaaS offerings into a cohesive ecosystem where various fintech and service providers collaborate, enhancing customer experience through seamless financial services. The connection lies in BaaS supplying the foundational banking capabilities that BaaP leverages to build comprehensive, modular financial solutions.

Key Terms

API (Application Programming Interface)

Banking as a Platform (BaaP) leverages APIs to create an open ecosystem where third-party developers can build and integrate financial services, offering a comprehensive customer experience beyond traditional banking. Banking as a Service (BaaS) uses APIs to enable non-banks to access core banking functionalities like account management, payments, and compliance, effectively embedding banking services into their own products. Explore how API-driven innovation shapes the future of digital finance.

White-label Solutions

White-label solutions in banking as a platform (BaaP) provide comprehensive, customizable digital ecosystems allowing banks to integrate third-party services while maintaining brand identity. Banking as a service (BaaS) offers specific banking functionalities via APIs, enabling non-banks to deliver financial services under their own branding with less infrastructure overhead. Explore how white-label solutions in BaaP and BaaS reshape financial innovation and customer experience.

Embedded Finance

Banking as a Platform (BaaP) enables third-party developers to build financial products directly within a bank's ecosystem, offering seamless access to banking infrastructure and APIs. Banking as a Service (BaaS) provides white-label banking capabilities through APIs, allowing non-banks to offer financial services without owning a banking license, often used to power Embedded Finance solutions. Explore how these models revolutionize Embedded Finance and reshape customer experiences.

Source and External Links

Banking-as-a-Platform - Definition & Benefits | Virtusa - Banking-as-a-platform (BaaP) allows financial institutions to leverage third-party platforms' infrastructure and expertise, enabling them to focus on delivering enhanced banking experiences without managing digital infrastructure themselves.

Platform Banking: Revolutionizing Financial Services in Digital Age - Platform banking transforms banks into digital marketplaces by integrating a wide range of financial products--such as payments, lending, and investments--via APIs and open architectures, facilitating seamless customer access through a single interface.

What is banking as a platform? - Cognizant - In banking as a platform, technology providers supply banks with software, tools, and infrastructure, allowing banks to deliver custom solutions while reducing development time and costs and achieving a unified customer view.

dowidth.com

dowidth.com