Digital onboarding revolutionizes banking by allowing customers to open accounts remotely through secure online platforms, significantly reducing processing time and enhancing user experience. eKYC (electronic Know Your Customer) leverages biometric verification and document authentication technologies to instantly verify identities, ensuring compliance with regulatory standards while minimizing fraud risks. Discover how these innovations streamline financial services and improve customer satisfaction.

Why it is important

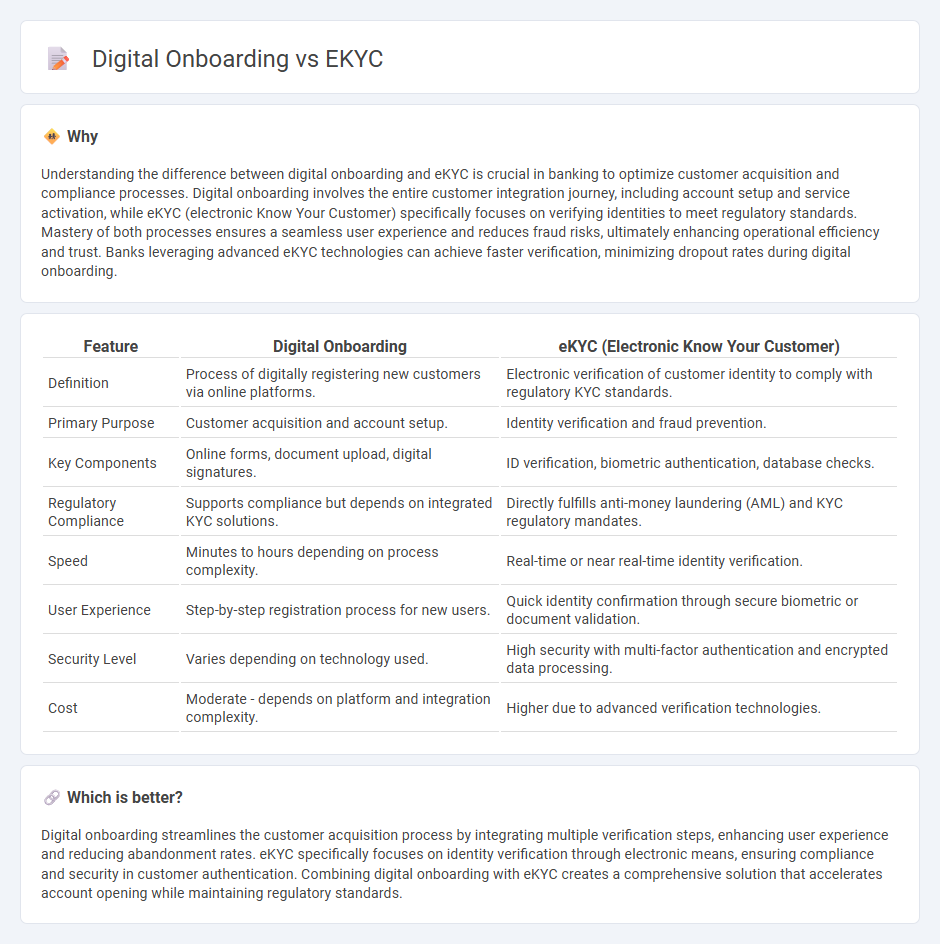

Understanding the difference between digital onboarding and eKYC is crucial in banking to optimize customer acquisition and compliance processes. Digital onboarding involves the entire customer integration journey, including account setup and service activation, while eKYC (electronic Know Your Customer) specifically focuses on verifying identities to meet regulatory standards. Mastery of both processes ensures a seamless user experience and reduces fraud risks, ultimately enhancing operational efficiency and trust. Banks leveraging advanced eKYC technologies can achieve faster verification, minimizing dropout rates during digital onboarding.

Comparison Table

| Feature | Digital Onboarding | eKYC (Electronic Know Your Customer) |

|---|---|---|

| Definition | Process of digitally registering new customers via online platforms. | Electronic verification of customer identity to comply with regulatory KYC standards. |

| Primary Purpose | Customer acquisition and account setup. | Identity verification and fraud prevention. |

| Key Components | Online forms, document upload, digital signatures. | ID verification, biometric authentication, database checks. |

| Regulatory Compliance | Supports compliance but depends on integrated KYC solutions. | Directly fulfills anti-money laundering (AML) and KYC regulatory mandates. |

| Speed | Minutes to hours depending on process complexity. | Real-time or near real-time identity verification. |

| User Experience | Step-by-step registration process for new users. | Quick identity confirmation through secure biometric or document validation. |

| Security Level | Varies depending on technology used. | High security with multi-factor authentication and encrypted data processing. |

| Cost | Moderate - depends on platform and integration complexity. | Higher due to advanced verification technologies. |

Which is better?

Digital onboarding streamlines the customer acquisition process by integrating multiple verification steps, enhancing user experience and reducing abandonment rates. eKYC specifically focuses on identity verification through electronic means, ensuring compliance and security in customer authentication. Combining digital onboarding with eKYC creates a comprehensive solution that accelerates account opening while maintaining regulatory standards.

Connection

Digital onboarding and electronic Know Your Customer (eKYC) are integral to streamlining customer acquisition in the banking sector. eKYC uses biometric verification and real-time data validation to authenticate customers remotely, reducing fraud and improving compliance with regulatory standards. Integrating eKYC within digital onboarding platforms accelerates account opening, enhances user experience, and drives operational efficiency for banks.

Key Terms

Identity Verification

Electronic Know Your Customer (eKYC) processes utilize biometric data and real-time document checks to streamline identity verification and reduce fraud in digital onboarding workflows. Digital onboarding encompasses broader steps, including customer data collection, risk assessment, and compliance, with identity verification as a critical component ensuring accurate user authentication. Discover how advanced identity verification technologies enhance eKYC and transform digital onboarding experiences.

Customer Due Diligence

eKYC (electronic Know Your Customer) streamlines Customer Due Diligence (CDD) by automating identity verification using biometric technology and government-issued ID databases, enhancing accuracy and compliance with AML/KYC regulations. Digital onboarding encompasses a broader process including eKYC, document collection, risk assessment, and user authentication to create a seamless customer experience while mitigating fraud. Explore the latest innovations in eKYC and digital onboarding to optimize compliance and customer satisfaction.

Biometric Authentication

Biometric authentication plays a crucial role in both eKYC (electronic Know Your Customer) and digital onboarding processes by ensuring secure and seamless identity verification through fingerprint, facial recognition, or iris scans. eKYC leverages biometric data to comply with regulatory standards and expedite customer verification, while digital onboarding integrates biometrics to enhance user experience and prevent identity fraud in real-time. Discover how biometric authentication transforms secure customer acquisition across industries by exploring its latest applications and technologies.

Source and External Links

What is eKYC? Meaning, Process & Benefits | Ondato Blog - eKYC is a fully digital version of the Know Your Customer process that uses technologies like biometric and document verification, two-factor authentication, and trusted data sources to verify a customer's identity quickly and securely online, replacing traditional paper-based KYC methods.

What is eKYC (Electronic Know Your Customer)? - Socure - eKYC is a real-time digital identity verification process using electronic documents, biometric selfies, and trusted digital data to speed up customer onboarding for financial services while meeting regulatory compliance for AML and data privacy.

What is eKYC: Meaning, Types, Benefits, and Use Cases - Regula - eKYC includes ID document verification, biometric authentication, risk monitoring, and AML/PEP checks to enhance security and prevent fraud during digital identity verification, often integrated with national ID systems like India's Aadhaar.

dowidth.com

dowidth.com