Income streaming in banking focuses on generating consistent revenue through diversified financial products such as fees, commissions, and service charges, enhancing overall profitability beyond traditional lending activities. Interest margin, commonly known as net interest margin, measures the difference between interest income earned from lending and interest paid on deposits, serving as a key indicator of a bank's core profitability. Explore deeper insights into how these two approaches shape modern banking strategies and financial stability.

Why it is important

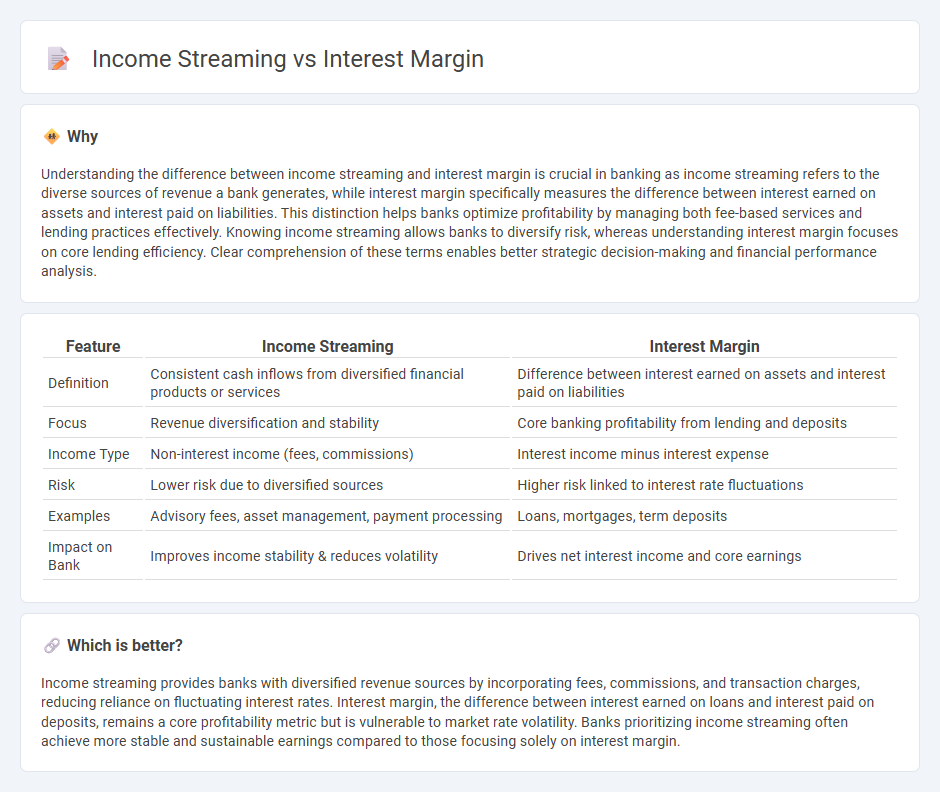

Understanding the difference between income streaming and interest margin is crucial in banking as income streaming refers to the diverse sources of revenue a bank generates, while interest margin specifically measures the difference between interest earned on assets and interest paid on liabilities. This distinction helps banks optimize profitability by managing both fee-based services and lending practices effectively. Knowing income streaming allows banks to diversify risk, whereas understanding interest margin focuses on core lending efficiency. Clear comprehension of these terms enables better strategic decision-making and financial performance analysis.

Comparison Table

| Feature | Income Streaming | Interest Margin |

|---|---|---|

| Definition | Consistent cash inflows from diversified financial products or services | Difference between interest earned on assets and interest paid on liabilities |

| Focus | Revenue diversification and stability | Core banking profitability from lending and deposits |

| Income Type | Non-interest income (fees, commissions) | Interest income minus interest expense |

| Risk | Lower risk due to diversified sources | Higher risk linked to interest rate fluctuations |

| Examples | Advisory fees, asset management, payment processing | Loans, mortgages, term deposits |

| Impact on Bank | Improves income stability & reduces volatility | Drives net interest income and core earnings |

Which is better?

Income streaming provides banks with diversified revenue sources by incorporating fees, commissions, and transaction charges, reducing reliance on fluctuating interest rates. Interest margin, the difference between interest earned on loans and interest paid on deposits, remains a core profitability metric but is vulnerable to market rate volatility. Banks prioritizing income streaming often achieve more stable and sustainable earnings compared to those focusing solely on interest margin.

Connection

Income streaming in banking relies heavily on net interest margin, which represents the difference between interest earned on assets and interest paid on liabilities. A higher net interest margin increases revenue streams from core lending activities, directly enhancing the bank's profitability. Efficient management of interest rate risk and loan portfolio quality optimizes these income streams while maintaining stable margins.

Key Terms

Net Interest Margin (NIM)

Net Interest Margin (NIM) measures the difference between interest income generated by banks and the amount of interest paid out to lenders, relative to their interest-earning assets. It serves as a critical indicator of a financial institution's profitability from its core lending activities, reflecting efficient asset-liability management rather than mere income streaming from diverse sources. Explore how optimizing NIM strategies can drive sustainable growth and enhanced revenue streams for banking institutions.

Fee-Based Income

Interest margin represents the difference between interest earned on loans and interest paid on deposits, impacting a bank's core profitability, while income streaming encompasses various revenue sources including fee-based income such as account maintenance fees, transaction charges, and advisory services. Fee-based income provides a stable and diversified revenue stream less sensitive to interest rate fluctuations, enhancing financial institutions' resilience in volatile markets. Explore detailed strategies to optimize fee-based income and balance your institution's revenue portfolio effectively.

Non-Interest Income

Interest margin reflects a bank's earnings from lending activities after subtracting interest paid on deposits, while non-interest income stems from fees, service charges, and trading gains that diversify revenue sources. Non-interest income plays a crucial role in stabilizing bank profitability by offsetting fluctuations in interest margins, especially during periods of volatile interest rates. Explore further to understand how focusing on non-interest income can enhance financial resilience and growth strategies.

Source and External Links

Net Interest Margin - A financial metric that calculates the difference between interest income earned and interest paid by banks, expressed as a percentage of average interest-earning assets.

Margin Requirements & Interest Rates - Provides information on margin loan rates and requirements from Charles Schwab, showing how rates vary based on debit balance tiers.

Net Interest Margin (NIM) Calculator - Offers a formula and calculator for determining the net interest margin, which compares interest income to interest expense over average interest-earning assets.

dowidth.com

dowidth.com