Loyalty fintech platforms leverage advanced technology and data analytics to offer personalized rewards and seamless digital experiences, attracting tech-savvy customers seeking convenience and flexibility. Credit unions emphasize member-centric values, local community support, and favorable interest rates, appealing to individuals prioritizing trust and relationship-driven banking. Explore how these distinct financial models shape the future of customer engagement and financial services.

Why it is important

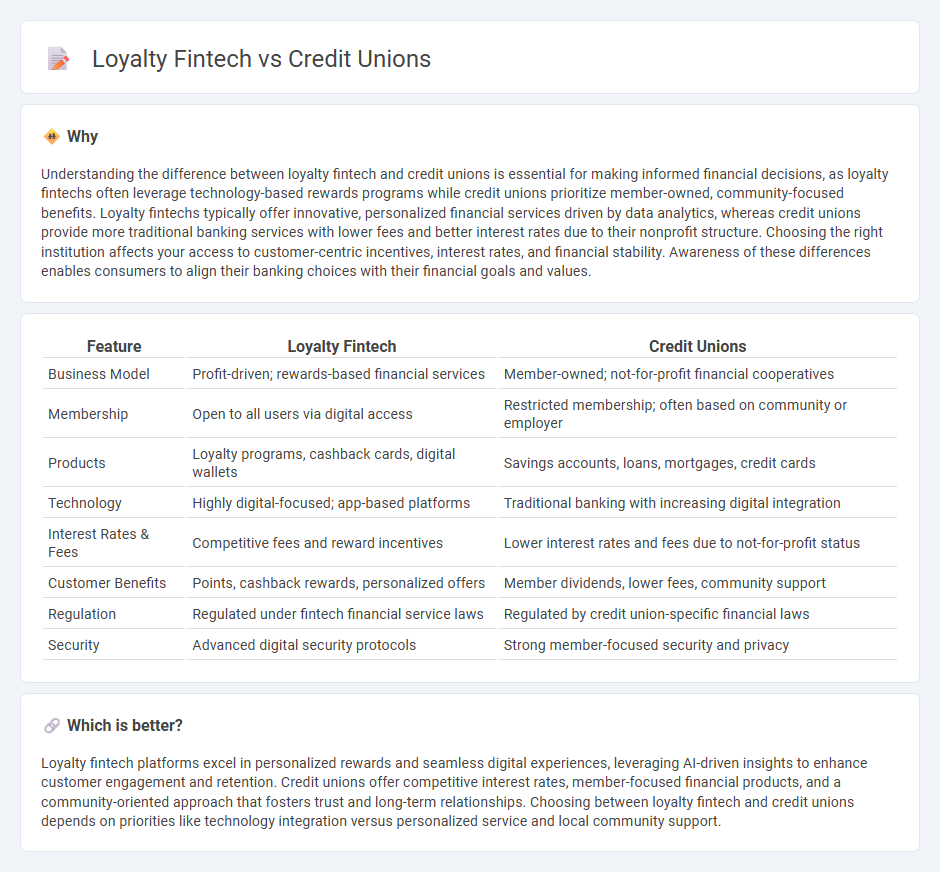

Understanding the difference between loyalty fintech and credit unions is essential for making informed financial decisions, as loyalty fintechs often leverage technology-based rewards programs while credit unions prioritize member-owned, community-focused benefits. Loyalty fintechs typically offer innovative, personalized financial services driven by data analytics, whereas credit unions provide more traditional banking services with lower fees and better interest rates due to their nonprofit structure. Choosing the right institution affects your access to customer-centric incentives, interest rates, and financial stability. Awareness of these differences enables consumers to align their banking choices with their financial goals and values.

Comparison Table

| Feature | Loyalty Fintech | Credit Unions |

|---|---|---|

| Business Model | Profit-driven; rewards-based financial services | Member-owned; not-for-profit financial cooperatives |

| Membership | Open to all users via digital access | Restricted membership; often based on community or employer |

| Products | Loyalty programs, cashback cards, digital wallets | Savings accounts, loans, mortgages, credit cards |

| Technology | Highly digital-focused; app-based platforms | Traditional banking with increasing digital integration |

| Interest Rates & Fees | Competitive fees and reward incentives | Lower interest rates and fees due to not-for-profit status |

| Customer Benefits | Points, cashback rewards, personalized offers | Member dividends, lower fees, community support |

| Regulation | Regulated under fintech financial service laws | Regulated by credit union-specific financial laws |

| Security | Advanced digital security protocols | Strong member-focused security and privacy |

Which is better?

Loyalty fintech platforms excel in personalized rewards and seamless digital experiences, leveraging AI-driven insights to enhance customer engagement and retention. Credit unions offer competitive interest rates, member-focused financial products, and a community-oriented approach that fosters trust and long-term relationships. Choosing between loyalty fintech and credit unions depends on priorities like technology integration versus personalized service and local community support.

Connection

Loyalty fintech solutions enhance credit unions by offering tailored rewards programs that increase member engagement and satisfaction. Credit unions leverage these technologies to provide personalized financial products, fostering long-term relationships and competitive advantages. Integration of loyalty fintech drives member retention, boosts transaction volume, and supports community-focused banking initiatives.

Key Terms

Membership

Credit unions prioritize member ownership and democratic control, offering personalized financial services with often lower fees and better interest rates due to their not-for-profit status. Loyalty fintech platforms enhance member engagement by using data-driven rewards and personalized incentives, fostering customer retention through seamless digital experiences. Explore how these different membership models impact financial loyalty and benefits.

Rewards Programs

Credit unions typically offer rewards programs that emphasize member benefits such as lower fees, competitive interest rates, and cash-back on everyday purchases, leveraging their cooperative structure to maximize value. Loyalty fintech platforms, however, provide dynamic, customizable rewards often integrated with multiple merchants, using data-driven analytics to personalize offers and enhance user engagement. Explore the evolving landscape of rewards programs to discover how each approach can uniquely benefit your financial goals.

Interest Rates

Credit unions typically offer lower interest rates on loans and higher rates on savings compared to loyalty fintech platforms, which may provide variable rates based on user engagement and rewards programs. Loyalty fintechs often integrate cashback and points systems that supplement traditional interest benefits but might come with higher base rates or fees. Discover how these interest rate structures impact your financial growth and rewards potential.

Source and External Links

What is a Credit Union? - Credit unions are member-owned, not-for-profit financial institutions that prioritize members' well-being by returning profits as reduced fees, better rates, and providing community-focused services.

Credit union - A credit union is a member-owned nonprofit cooperative financial institution offering financial services similar to commercial banks.

America's Credit Unions: Homepage - This organization advocates for credit unions at the federal level, provides professional development, compliance support, and resources to help credit unions thrive nationwide.

dowidth.com

dowidth.com