Robo advisors leverage automated algorithms to provide personalized investment management with minimal human intervention, focusing on long-term portfolio growth and risk management for individual investors. Algorithmic trading platforms use complex mathematical models to execute high-speed trades aiming to capitalize on market inefficiencies and generate short-term profits. Discover how these technologies transform financial markets and investment strategies.

Why it is important

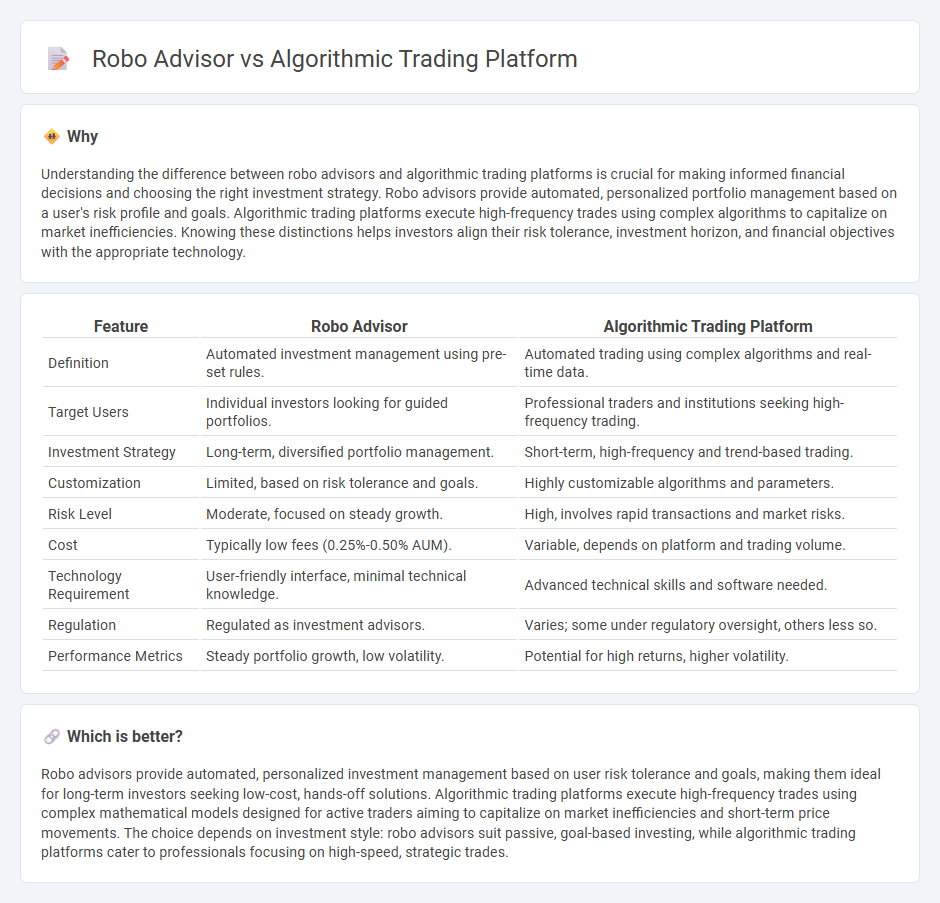

Understanding the difference between robo advisors and algorithmic trading platforms is crucial for making informed financial decisions and choosing the right investment strategy. Robo advisors provide automated, personalized portfolio management based on a user's risk profile and goals. Algorithmic trading platforms execute high-frequency trades using complex algorithms to capitalize on market inefficiencies. Knowing these distinctions helps investors align their risk tolerance, investment horizon, and financial objectives with the appropriate technology.

Comparison Table

| Feature | Robo Advisor | Algorithmic Trading Platform |

|---|---|---|

| Definition | Automated investment management using pre-set rules. | Automated trading using complex algorithms and real-time data. |

| Target Users | Individual investors looking for guided portfolios. | Professional traders and institutions seeking high-frequency trading. |

| Investment Strategy | Long-term, diversified portfolio management. | Short-term, high-frequency and trend-based trading. |

| Customization | Limited, based on risk tolerance and goals. | Highly customizable algorithms and parameters. |

| Risk Level | Moderate, focused on steady growth. | High, involves rapid transactions and market risks. |

| Cost | Typically low fees (0.25%-0.50% AUM). | Variable, depends on platform and trading volume. |

| Technology Requirement | User-friendly interface, minimal technical knowledge. | Advanced technical skills and software needed. |

| Regulation | Regulated as investment advisors. | Varies; some under regulatory oversight, others less so. |

| Performance Metrics | Steady portfolio growth, low volatility. | Potential for high returns, higher volatility. |

Which is better?

Robo advisors provide automated, personalized investment management based on user risk tolerance and goals, making them ideal for long-term investors seeking low-cost, hands-off solutions. Algorithmic trading platforms execute high-frequency trades using complex mathematical models designed for active traders aiming to capitalize on market inefficiencies and short-term price movements. The choice depends on investment style: robo advisors suit passive, goal-based investing, while algorithmic trading platforms cater to professionals focusing on high-speed, strategic trades.

Connection

Robo advisors leverage algorithmic trading platforms to automate investment decisions using complex mathematical models and real-time data analysis. These platforms continuously optimize portfolio allocations by executing trades based on predefined algorithms, enhancing efficiency and minimizing human bias. Integration of robo advisors with algorithmic trading systems enables personalized asset management with improved accuracy and cost-effectiveness in banking services.

Key Terms

**Algorithmic Trading Platform:**

Algorithmic trading platforms use sophisticated algorithms to execute trades based on pre-defined criteria, enabling high-speed, data-driven market decisions with minimal human intervention. These platforms offer advanced features such as backtesting, real-time market analysis, and customizable trading strategies suited for professional traders and institutions. Explore how algorithmic trading platforms can enhance trading efficiency and precision for your investment goals.

Execution Algorithms

Execution algorithms in algorithmic trading platforms use advanced quantitative models to automate order placement and optimize trade execution by minimizing market impact and transaction costs. Robo advisors primarily focus on portfolio management and asset allocation using predefined investment strategies rather than executing trades with sophisticated algorithms. Explore the differences in execution efficiency and technology to better understand which solution fits your investment style.

Market Data Feeds

Algorithmic trading platforms utilize high-frequency market data feeds with real-time price quotes, order book depth, and trade execution information to enable precise and rapid trade decisions. Robo advisors rely on less granular, often delayed market data primarily for portfolio rebalancing and asset allocation based on user profiles and risk tolerance. Explore the distinct market data technologies that power algorithmic trading platforms and robo advisors to better understand their capabilities and limitations.

Source and External Links

Best Algorithmic Trading Platforms - Provides a list of top algorithmic trading platforms in the U.S., including Interactive Brokers, TradeStation, and Thinkorswim, highlighting their features and user benefits.

The 7 Best Algorithmic Trading Platforms & Software - Includes QuantConnect among the top platforms, offering open-source and cloud-based solutions for algorithmic trading with support for multiple programming languages.

AlgoBulls - Offers a comprehensive platform for building, deploying, and scaling algorithmic strategies, catering to various users from retail traders to enterprises.

dowidth.com

dowidth.com