Banking as a Service (BaaS) enables third-party providers to offer banking products through APIs, integrating financial services into non-bank platforms, while digital banking delivers a fully online banking experience directly from traditional banks. BaaS focuses on embedding banking features in diverse applications, whereas digital banking emphasizes customer interaction through digital channels like mobile apps and websites. Explore more to understand how BaaS and digital banking reshape financial services and customer engagement.

Why it is important

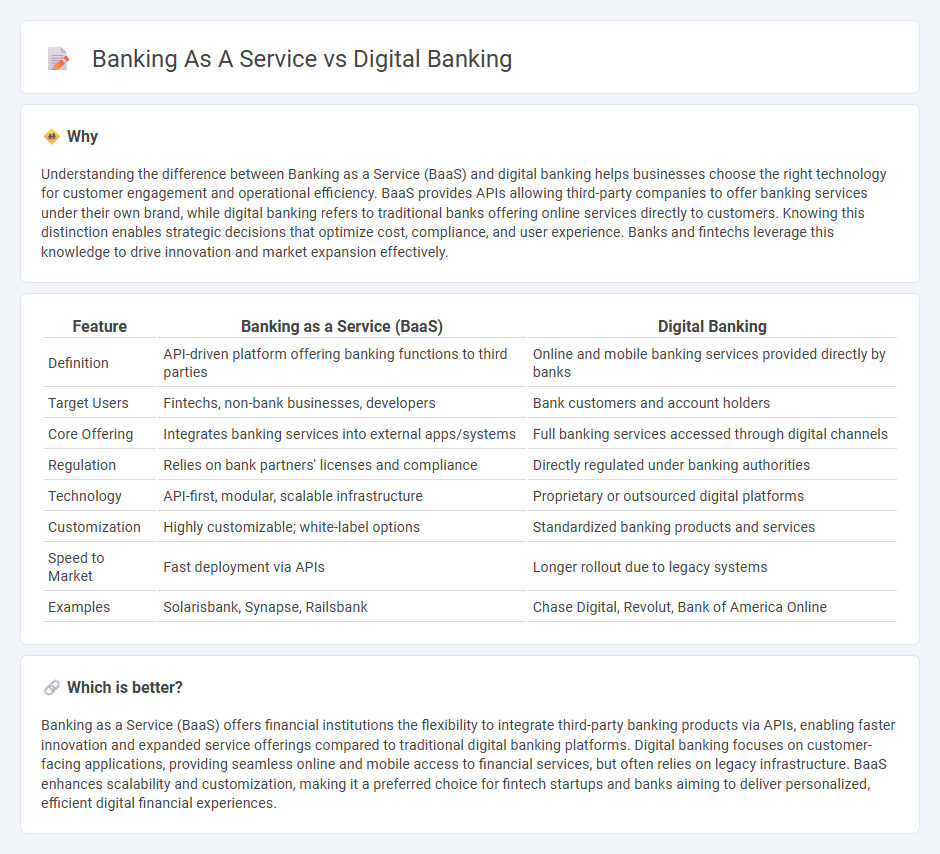

Understanding the difference between Banking as a Service (BaaS) and digital banking helps businesses choose the right technology for customer engagement and operational efficiency. BaaS provides APIs allowing third-party companies to offer banking services under their own brand, while digital banking refers to traditional banks offering online services directly to customers. Knowing this distinction enables strategic decisions that optimize cost, compliance, and user experience. Banks and fintechs leverage this knowledge to drive innovation and market expansion effectively.

Comparison Table

| Feature | Banking as a Service (BaaS) | Digital Banking |

|---|---|---|

| Definition | API-driven platform offering banking functions to third parties | Online and mobile banking services provided directly by banks |

| Target Users | Fintechs, non-bank businesses, developers | Bank customers and account holders |

| Core Offering | Integrates banking services into external apps/systems | Full banking services accessed through digital channels |

| Regulation | Relies on bank partners' licenses and compliance | Directly regulated under banking authorities |

| Technology | API-first, modular, scalable infrastructure | Proprietary or outsourced digital platforms |

| Customization | Highly customizable; white-label options | Standardized banking products and services |

| Speed to Market | Fast deployment via APIs | Longer rollout due to legacy systems |

| Examples | Solarisbank, Synapse, Railsbank | Chase Digital, Revolut, Bank of America Online |

Which is better?

Banking as a Service (BaaS) offers financial institutions the flexibility to integrate third-party banking products via APIs, enabling faster innovation and expanded service offerings compared to traditional digital banking platforms. Digital banking focuses on customer-facing applications, providing seamless online and mobile access to financial services, but often relies on legacy infrastructure. BaaS enhances scalability and customization, making it a preferred choice for fintech startups and banks aiming to deliver personalized, efficient digital financial experiences.

Connection

Banking as a Service (BaaS) enables digital banking platforms by providing the underlying infrastructure, regulatory compliance, and financial products through APIs. Digital banking leverages BaaS to offer seamless, real-time customer experiences, including account management, payments, and loans without traditional branch visits. This integration accelerates innovation and expands accessibility in the financial services ecosystem.

Key Terms

API Integration

API integration in digital banking enables seamless access to financial services through apps and platforms, enhancing user experience with real-time transactions and personalized features. Banking as a Service (BaaS) leverages APIs to allow third-party developers to embed banking functionalities directly into their products, expanding service reach without full banking infrastructure. Explore how these API-driven models transform financial ecosystems and customer engagement.

White-label Solutions

White-label solutions in digital banking allow financial institutions to offer branded banking services powered by third-party providers, enabling rapid market entry without extensive infrastructure development. Banking as a Service (BaaS) platforms provide APIs that facilitate seamless integration of banking functionalities into existing non-bank platforms, enhancing customer experience and expanding service offerings. Explore how white-label solutions and BaaS can transform your digital strategy by offering customizable, scalable financial services.

Core Banking Systems

Core banking systems serve as the backbone for both digital banking and Banking as a Service (BaaS) platforms, enabling real-time transaction processing, customer account management, and regulatory compliance. Digital banking emphasizes direct customer interfaces powered by these core systems, while BaaS leverages APIs to offer banking functionalities to third-party providers, expanding financial services beyond traditional institutions. Explore how core banking innovations are reshaping the financial ecosystem.

Source and External Links

Digital Banking: 2025 Market Overview, Trends & Insights - Digital banking refers to the digitization of all traditional banking products and activities, enabling customers to access services, manage accounts, and conduct transactions via online platforms and mobile apps, with trends including the rise of mobile banking, growth of digital-only banks, increased use of artificial intelligence, and the popularity of digital payments.

Digital banking - Digital banking is the delivery of banking services over the internet, encompassing online and mobile banking, process automation, and integration of APIs for cross-institutional services, with a complete digital bank covering all functional levels of banking from front-end user interfaces to back-end operations and middleware.

Digital Banking - UNFCU Digital Banking allows users to securely manage all their accounts, transfer money globally, apply for loans and credit cards, control card settings, and receive notifications, accessible anytime from computers, laptops, or mobile devices with robust security features.

dowidth.com

dowidth.com