Pay by bank transactions enable customers to authorize payments directly from their bank accounts using secure online banking credentials, offering instant transfer and reduced processing fees. Direct debit allows businesses to collect variable payments automatically with customer authorization, ideal for recurring bills and subscriptions. Explore the benefits and differences between these payment methods to optimize your financial processes.

Why it is important

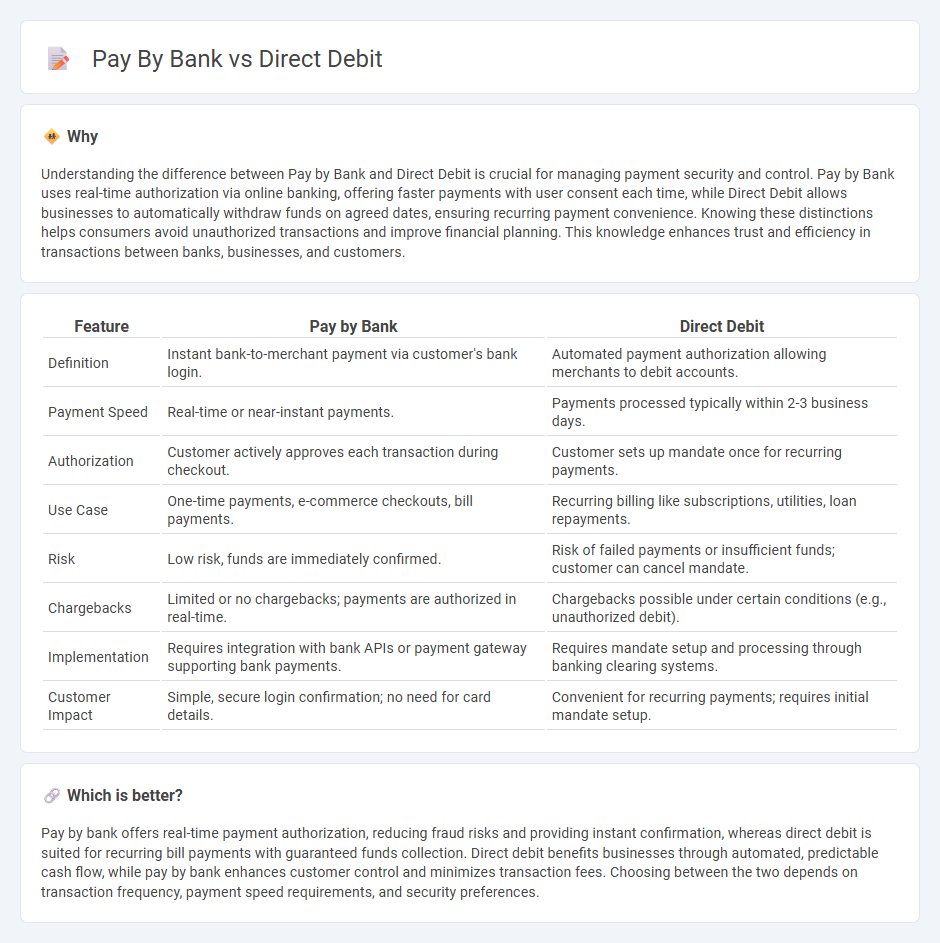

Understanding the difference between Pay by Bank and Direct Debit is crucial for managing payment security and control. Pay by Bank uses real-time authorization via online banking, offering faster payments with user consent each time, while Direct Debit allows businesses to automatically withdraw funds on agreed dates, ensuring recurring payment convenience. Knowing these distinctions helps consumers avoid unauthorized transactions and improve financial planning. This knowledge enhances trust and efficiency in transactions between banks, businesses, and customers.

Comparison Table

| Feature | Pay by Bank | Direct Debit |

|---|---|---|

| Definition | Instant bank-to-merchant payment via customer's bank login. | Automated payment authorization allowing merchants to debit accounts. |

| Payment Speed | Real-time or near-instant payments. | Payments processed typically within 2-3 business days. |

| Authorization | Customer actively approves each transaction during checkout. | Customer sets up mandate once for recurring payments. |

| Use Case | One-time payments, e-commerce checkouts, bill payments. | Recurring billing like subscriptions, utilities, loan repayments. |

| Risk | Low risk, funds are immediately confirmed. | Risk of failed payments or insufficient funds; customer can cancel mandate. |

| Chargebacks | Limited or no chargebacks; payments are authorized in real-time. | Chargebacks possible under certain conditions (e.g., unauthorized debit). |

| Implementation | Requires integration with bank APIs or payment gateway supporting bank payments. | Requires mandate setup and processing through banking clearing systems. |

| Customer Impact | Simple, secure login confirmation; no need for card details. | Convenient for recurring payments; requires initial mandate setup. |

Which is better?

Pay by bank offers real-time payment authorization, reducing fraud risks and providing instant confirmation, whereas direct debit is suited for recurring bill payments with guaranteed funds collection. Direct debit benefits businesses through automated, predictable cash flow, while pay by bank enhances customer control and minimizes transaction fees. Choosing between the two depends on transaction frequency, payment speed requirements, and security preferences.

Connection

Pay by bank and direct debit are connected through their use of bank account information to facilitate secure and automated payments. Pay by bank enables customers to authorize transactions directly from their bank accounts, while direct debit allows companies to collect recurring payments automatically. Both methods rely on secure banking networks and customer consent to streamline payment processes efficiently.

Key Terms

Authorization

Direct debit authorization involves a payer granting permission to a merchant or service provider to withdraw funds directly from their bank account on agreed dates, ensuring automated payments without needing repeated approvals. Pay by Bank authorization requires real-time verification by the account holder, initiating payments through their banking app or platform, offering enhanced control and security over individual transactions. Explore the detailed differences and benefits of each payment authorization method to choose the best fit for your financial needs.

Payment Initiation

Payment initiation through direct debit involves authorizing a creditor to withdraw funds directly from a payer's bank account, ensuring automated and recurring transactions. Pay by bank, also known as account-to-account payment, leverages open banking APIs to initiate payments directly from a consumer's bank, providing real-time processing and enhanced security. Explore the benefits and differences between these payment initiation methods to choose the best solution for your business.

Settlement

Direct debit settlements typically involve a predefined date when funds are withdrawn from the payer's bank account, ensuring predictable cash flow for merchants. Pay by bank settlements are often faster, leveraging real-time payment networks to transfer funds immediately, reducing settlement risks. Explore our detailed comparison to understand which method best suits your business needs.

Source and External Links

Direct Debit: How It Works, Key Benefits & More - Invoiced - Direct debit is a payment method where a customer authorizes a seller to collect ongoing payments directly from their bank account, typically used for recurring goods or services, and involves verification and transfer of funds through systems like ACH or SEPA.

Direct Debit Explained: How To Set It Up for Customers - Shopify - Direct debit is an automated payment system allowing businesses to pull funds directly from customers' bank accounts for recurring payments such as subscriptions or invoices, simplifying billing and reducing errors.

Direct debit - Wikipedia - A direct debit is a mandated financial transaction where a payer authorizes a payee to withdraw variable amounts directly from their bank account, commonly used for bills and subscriptions and processed electronically after authorization.

dowidth.com

dowidth.com