Fraud orchestration integrates multiple detection tools and intelligence sources to provide a coordinated response to fraudulent activities, enhancing the efficiency of fraud prevention in banking. Fraud detection focuses on identifying suspicious transactions or behaviors using specific algorithms and rule-based systems to flag potential fraud attempts. Explore the distinctions between these approaches to strengthen your bank's security framework.

Why it is important

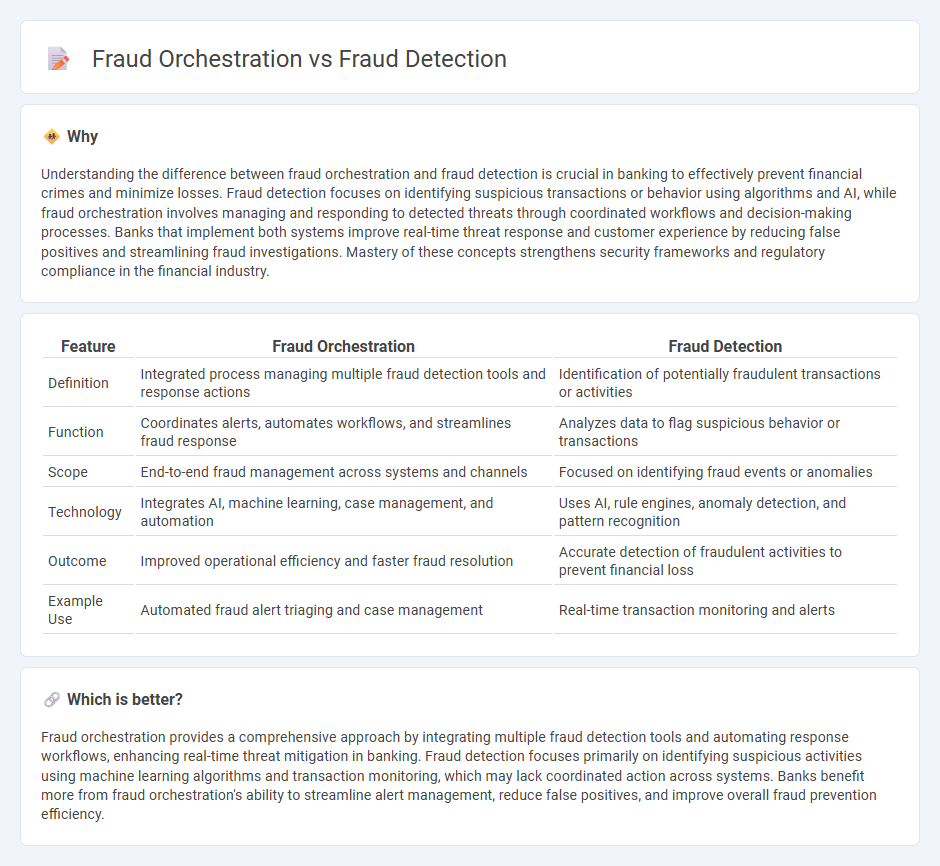

Understanding the difference between fraud orchestration and fraud detection is crucial in banking to effectively prevent financial crimes and minimize losses. Fraud detection focuses on identifying suspicious transactions or behavior using algorithms and AI, while fraud orchestration involves managing and responding to detected threats through coordinated workflows and decision-making processes. Banks that implement both systems improve real-time threat response and customer experience by reducing false positives and streamlining fraud investigations. Mastery of these concepts strengthens security frameworks and regulatory compliance in the financial industry.

Comparison Table

| Feature | Fraud Orchestration | Fraud Detection |

|---|---|---|

| Definition | Integrated process managing multiple fraud detection tools and response actions | Identification of potentially fraudulent transactions or activities |

| Function | Coordinates alerts, automates workflows, and streamlines fraud response | Analyzes data to flag suspicious behavior or transactions |

| Scope | End-to-end fraud management across systems and channels | Focused on identifying fraud events or anomalies |

| Technology | Integrates AI, machine learning, case management, and automation | Uses AI, rule engines, anomaly detection, and pattern recognition |

| Outcome | Improved operational efficiency and faster fraud resolution | Accurate detection of fraudulent activities to prevent financial loss |

| Example Use | Automated fraud alert triaging and case management | Real-time transaction monitoring and alerts |

Which is better?

Fraud orchestration provides a comprehensive approach by integrating multiple fraud detection tools and automating response workflows, enhancing real-time threat mitigation in banking. Fraud detection focuses primarily on identifying suspicious activities using machine learning algorithms and transaction monitoring, which may lack coordinated action across systems. Banks benefit more from fraud orchestration's ability to streamline alert management, reduce false positives, and improve overall fraud prevention efficiency.

Connection

Fraud orchestration integrates multiple fraud detection systems to provide a unified and efficient response to suspicious activities in banking. By consolidating data from transaction monitoring, identity verification, and behavioral analytics, fraud orchestration enhances the accuracy and speed of fraud detection processes. This synergy reduces false positives and enables real-time mitigation of financial crimes.

Key Terms

Fraud detection:

Fraud detection leverages advanced machine learning algorithms and real-time transaction monitoring to identify suspicious patterns and prevent fraudulent activities before they cause damage. Key technologies include behavior analytics, anomaly detection, and biometric verification, which enable accurate risk scoring and reduce false positives. Explore how integrating fraud detection solutions can strengthen your security infrastructure and safeguard your business assets.

Anomaly Detection

Fraud detection primarily focuses on identifying unusual patterns and anomalies in transaction data to prevent financial losses, employing machine learning algorithms and real-time analytics for high accuracy. Fraud orchestration integrates these anomaly detection systems into a broader framework, enabling coordinated response actions across multiple platforms and improving overall fraud management efficiency. Explore how advanced anomaly detection enhances fraud orchestration strategies for comprehensive protection.

Machine Learning

Fraud detection leverages machine learning algorithms to identify suspicious patterns and anomalies in real-time transactions, minimizing false positives and improving accuracy. Fraud orchestration integrates multiple detection systems, automating response workflows and prioritizing alerts to streamline decision-making and enhance overall security. Explore advanced machine learning techniques in fraud orchestration to elevate your organization's anti-fraud capabilities.

Source and External Links

What is fraud detection and why is it needed? - Fraud detection is the process of identifying whether transactions or activities are fraudulent by analyzing data patterns and customer behavior, often using advanced analytics and AI to spot anomalies and prevent financial loss.

How Fraud Detection Works: Common Software and Tools - Fraud detection systems collect and aggregate data from multiple sources, apply feature engineering and machine learning models to identify suspicious patterns, and monitor activities across channels like web, mobile, and call centers to flag potential fraud in real time.

What Is Fraud Detection? - Fraud detection involves using statistical analysis, data mining, and AI-driven techniques like neural networks to uncover and predict fraudulent activities, with organizations increasingly adopting machine learning to stay ahead of evolving fraud trends.

dowidth.com

dowidth.com