Alternative credit data offers a broader view of an individual's financial behavior by including non-traditional information such as utility payments, rental history, and digital transaction records, while credit bureau reports rely primarily on traditional credit accounts and loan repayments. Incorporating alt credit data enhances lending decisions by providing insights into underbanked or thin-file consumers who may lack extensive credit histories. Explore more to understand how alternative credit data transforms risk assessment and financial inclusion in banking.

Why it is important

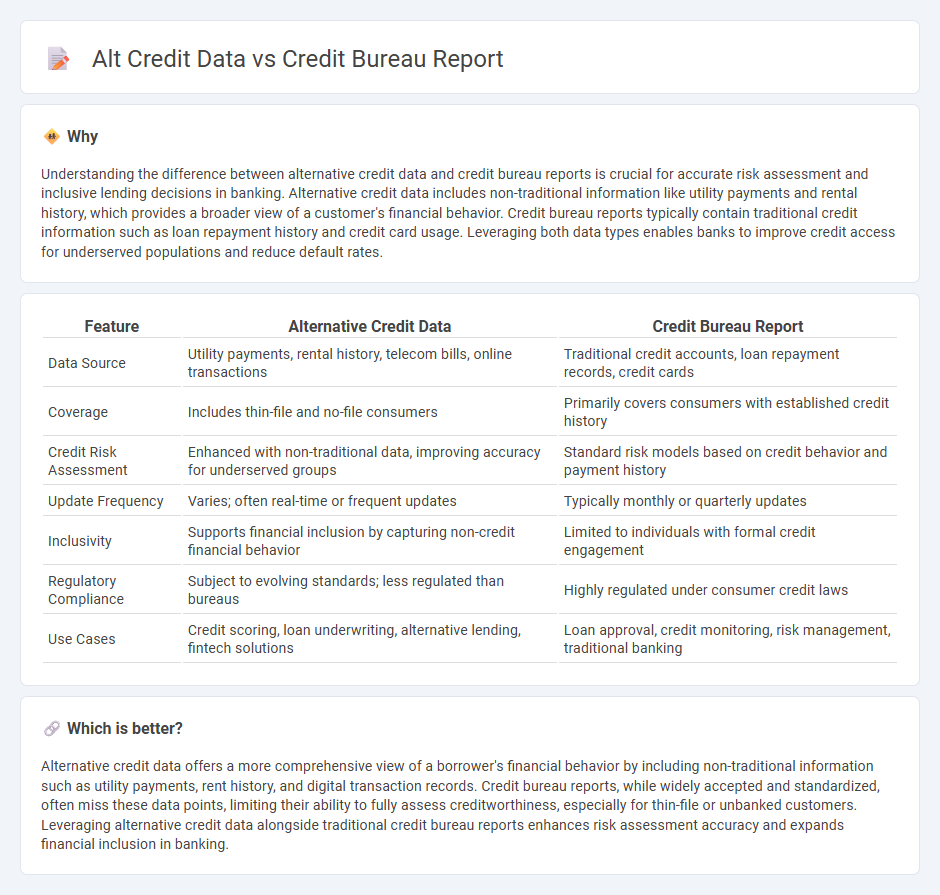

Understanding the difference between alternative credit data and credit bureau reports is crucial for accurate risk assessment and inclusive lending decisions in banking. Alternative credit data includes non-traditional information like utility payments and rental history, which provides a broader view of a customer's financial behavior. Credit bureau reports typically contain traditional credit information such as loan repayment history and credit card usage. Leveraging both data types enables banks to improve credit access for underserved populations and reduce default rates.

Comparison Table

| Feature | Alternative Credit Data | Credit Bureau Report |

|---|---|---|

| Data Source | Utility payments, rental history, telecom bills, online transactions | Traditional credit accounts, loan repayment records, credit cards |

| Coverage | Includes thin-file and no-file consumers | Primarily covers consumers with established credit history |

| Credit Risk Assessment | Enhanced with non-traditional data, improving accuracy for underserved groups | Standard risk models based on credit behavior and payment history |

| Update Frequency | Varies; often real-time or frequent updates | Typically monthly or quarterly updates |

| Inclusivity | Supports financial inclusion by capturing non-credit financial behavior | Limited to individuals with formal credit engagement |

| Regulatory Compliance | Subject to evolving standards; less regulated than bureaus | Highly regulated under consumer credit laws |

| Use Cases | Credit scoring, loan underwriting, alternative lending, fintech solutions | Loan approval, credit monitoring, risk management, traditional banking |

Which is better?

Alternative credit data offers a more comprehensive view of a borrower's financial behavior by including non-traditional information such as utility payments, rent history, and digital transaction records. Credit bureau reports, while widely accepted and standardized, often miss these data points, limiting their ability to fully assess creditworthiness, especially for thin-file or unbanked customers. Leveraging alternative credit data alongside traditional credit bureau reports enhances risk assessment accuracy and expands financial inclusion in banking.

Connection

Alternative credit data enhances the insights provided by credit bureau reports by incorporating non-traditional financial information such as utility payments, rental history, and mobile phone bills. This expanded data set offers a more comprehensive view of a borrower's creditworthiness, particularly for individuals with limited credit history. Integrating alt credit data with traditional credit bureau reports helps banks improve risk assessment, reduce default rates, and increase financial inclusion.

Key Terms

Credit Score

Credit bureau reports traditionally compile credit history from lenders, generating credit scores based on payment history, debt levels, and credit inquiries that significantly impact loan eligibility. Alternative credit data incorporates non-traditional financial information such as utility payments, rental history, and subscription services to provide a broader perspective on an individual's creditworthiness, especially for those with limited credit history. Explore the benefits and limitations of each approach to understand how they affect credit scoring and financial opportunities.

Payment History

Credit bureau reports primarily rely on traditional payment history from sources like credit cards, loans, and mortgages, providing lenders with standardized risk assessments. Alternative credit data includes non-traditional payment information such as utility bills, rent payments, and subscription services, offering a broader view of financial behavior for individuals with limited credit history. Discover how integrating both data types can enhance credit decision-making and improve accuracy in risk evaluation.

Non-traditional Data

Non-traditional data encompasses alternative credit information such as utility payments, rental history, and telecom bills, offering a broader view of creditworthiness beyond conventional credit bureau reports. While credit bureau reports primarily rely on traditional data like loan and credit card histories, incorporating non-traditional data enhances risk assessment accuracy for individuals with limited or no credit history. Explore how leveraging alternative credit data can improve financial inclusion and credit scoring methodologies.

Source and External Links

Free Credit Reports | Consumer Advice - A credit report is a summary of your personal credit history collected by three nationwide credit bureaus (Equifax, Experian, and TransUnion), which includes identifying info and credit payment history, and impacts your buying power, job chances, and insurance; you have the right to a free report each year and to correct errors under the Fair Credit Reporting Act.

How to Order Your Free Credit Reports | State of California - The three nationwide credit bureaus compile credit histories that contain data from financial institutions and others, and you can get one free report from each bureau every year or under specific circumstances, with suggestions on staggering requests to monitor your credit at no cost.

Credit reports and scores | Consumer Financial Protection Bureau - Your credit reports and scores affect your financial health; you can request your reports, learn how to correct errors, and understand differences between reports and scores, with resources available to help you review and dispute inaccuracies effectively.

dowidth.com

dowidth.com