Alternative credit data includes non-traditional financial information such as utility payments, rental history, and social data, enhancing credit risk assessment beyond conventional sources. Transactional data involves detailed records of bank account activity, providing real-time insights into spending habits and cash flow. Explore how integrating alternative credit and transactional data revolutionizes credit scoring and lending decisions.

Why it is important

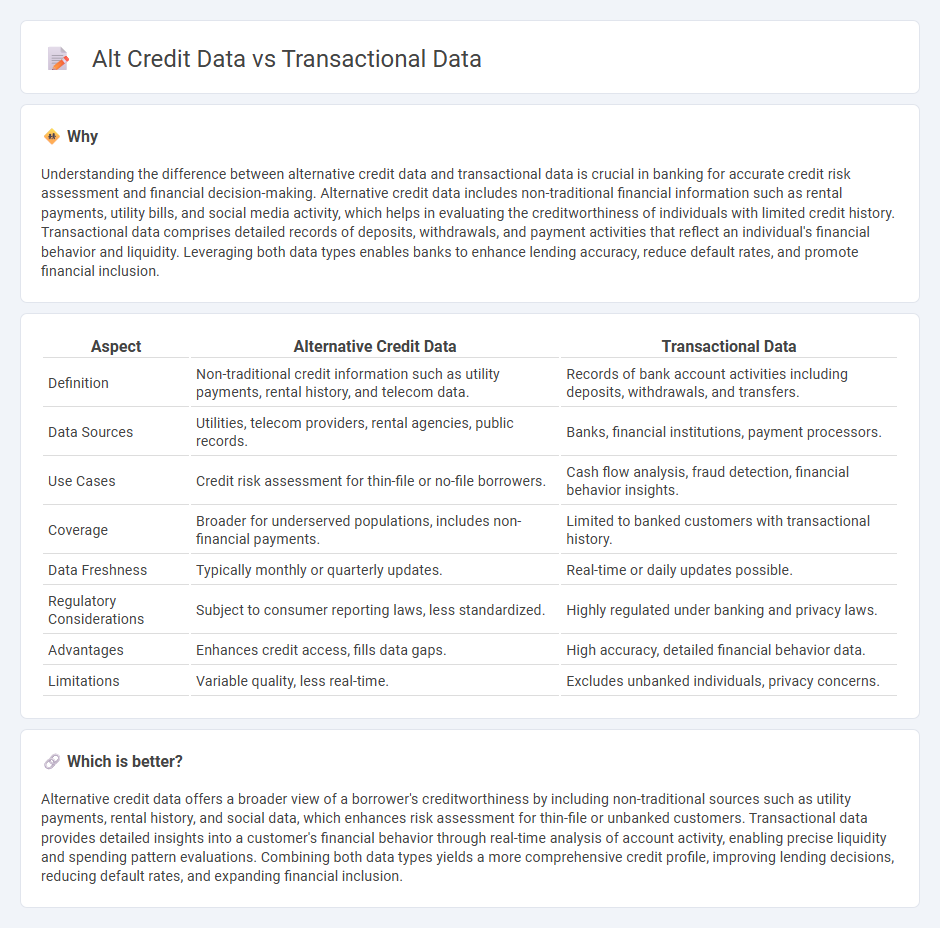

Understanding the difference between alternative credit data and transactional data is crucial in banking for accurate credit risk assessment and financial decision-making. Alternative credit data includes non-traditional financial information such as rental payments, utility bills, and social media activity, which helps in evaluating the creditworthiness of individuals with limited credit history. Transactional data comprises detailed records of deposits, withdrawals, and payment activities that reflect an individual's financial behavior and liquidity. Leveraging both data types enables banks to enhance lending accuracy, reduce default rates, and promote financial inclusion.

Comparison Table

| Aspect | Alternative Credit Data | Transactional Data |

|---|---|---|

| Definition | Non-traditional credit information such as utility payments, rental history, and telecom data. | Records of bank account activities including deposits, withdrawals, and transfers. |

| Data Sources | Utilities, telecom providers, rental agencies, public records. | Banks, financial institutions, payment processors. |

| Use Cases | Credit risk assessment for thin-file or no-file borrowers. | Cash flow analysis, fraud detection, financial behavior insights. |

| Coverage | Broader for underserved populations, includes non-financial payments. | Limited to banked customers with transactional history. |

| Data Freshness | Typically monthly or quarterly updates. | Real-time or daily updates possible. |

| Regulatory Considerations | Subject to consumer reporting laws, less standardized. | Highly regulated under banking and privacy laws. |

| Advantages | Enhances credit access, fills data gaps. | High accuracy, detailed financial behavior data. |

| Limitations | Variable quality, less real-time. | Excludes unbanked individuals, privacy concerns. |

Which is better?

Alternative credit data offers a broader view of a borrower's creditworthiness by including non-traditional sources such as utility payments, rental history, and social data, which enhances risk assessment for thin-file or unbanked customers. Transactional data provides detailed insights into a customer's financial behavior through real-time analysis of account activity, enabling precise liquidity and spending pattern evaluations. Combining both data types yields a more comprehensive credit profile, improving lending decisions, reducing default rates, and expanding financial inclusion.

Connection

Alternative credit data, including utility payments and rental history, enhances traditional credit assessments by providing a broader financial profile. Transactional data from bank accounts offers real-time insights into spending habits and cash flow, enabling more accurate risk evaluation. Combining these data sources allows banks to improve credit scoring models and extend financial services to underbanked populations.

Key Terms

Payment History

Transactional data provides detailed records of consumer purchases and payment behaviors, capturing real-time spending patterns and cash flow dynamics. Alternative credit data, particularly payment history from non-traditional sources such as utility bills, rent payments, and subscription services, offers insights into creditworthiness for individuals lacking conventional credit data. Explore deeper into how integrating these data types enhances credit risk assessment accuracy and financial inclusion.

Utility Bills

Utility bills provide a valuable source of alternative credit data, capturing consistent payment behavior for fundamental services like electricity, water, and gas. Unlike traditional transactional data, which tracks spending and income patterns, utility bill data highlights reliability and financial responsibility in non-credit contexts. Explore how integrating utility bill data can enhance credit assessments and unlock new lending opportunities.

Social Media Activity

Social media activity serves as a valuable source of alternative credit data by providing real-time insights into consumer behavior, preferences, and social connections that are often absent from traditional transactional data. Unlike transactional data, which primarily tracks financial exchanges and payment histories, social media data captures qualitative patterns such as engagement levels, sentiment analysis, and network influence, offering a deeper understanding of creditworthiness for underserved populations. Explore more to learn how integrating social media activity can revolutionize credit scoring models and expand financial inclusion.

Source and External Links

What is Transactional Data? - Explanation & Examples - Secoda - Transactional data is information recorded from business transactions like sales, purchases, and payments, capturing details such as who, what, when, and where, and is critical for analyzing business performance and profitability.

What is Transactional Data? | TIBCO - Transactional data is data captured at the point of sale or other transaction events, including time, place, items bought, payment method, and discounts, and is distinct from master and analytical data.

What is transactional data? | Definition from TechTarget - Transactional data details individual transactions and often references master and reference data to provide a complete picture, such as linking customer or product IDs to the transaction event.

dowidth.com

dowidth.com