Loyalty fintech platforms leverage innovative reward systems and personalized financial products to enhance customer retention and engagement in banking. Big tech platforms integrate extensive user data and scalable infrastructures to offer seamless, all-in-one financial services that challenge traditional banking models. Discover how these distinct approaches are transforming the future of financial services.

Why it is important

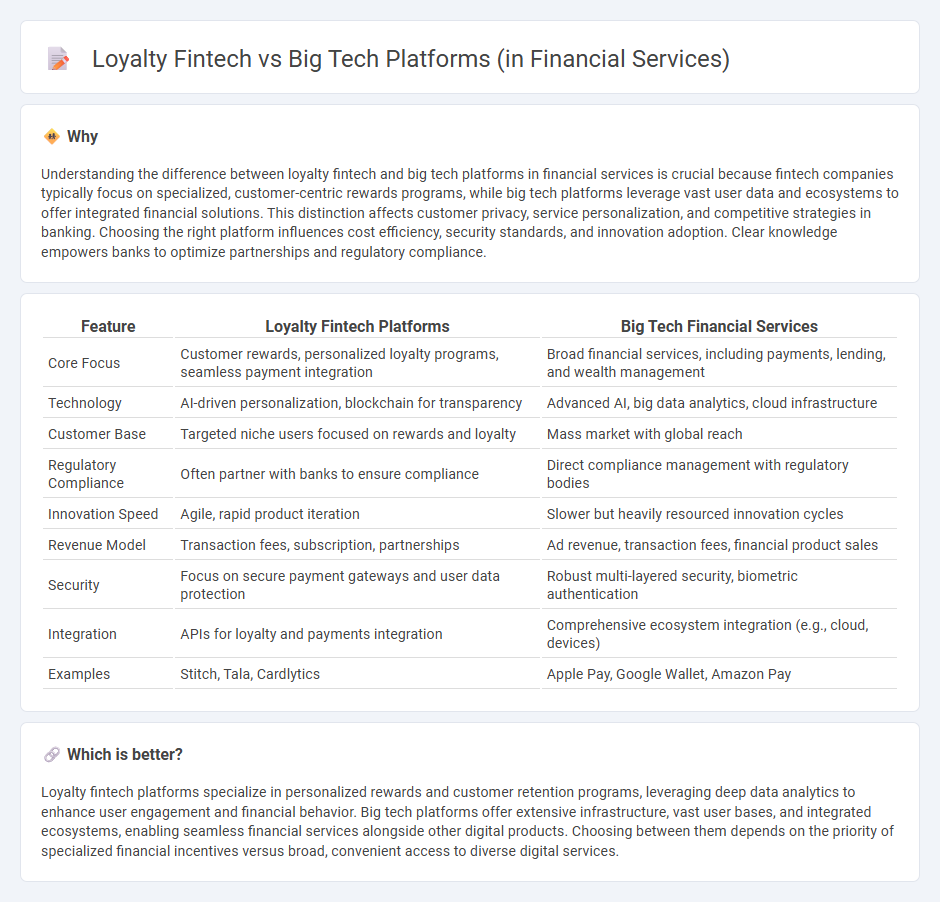

Understanding the difference between loyalty fintech and big tech platforms in financial services is crucial because fintech companies typically focus on specialized, customer-centric rewards programs, while big tech platforms leverage vast user data and ecosystems to offer integrated financial solutions. This distinction affects customer privacy, service personalization, and competitive strategies in banking. Choosing the right platform influences cost efficiency, security standards, and innovation adoption. Clear knowledge empowers banks to optimize partnerships and regulatory compliance.

Comparison Table

| Feature | Loyalty Fintech Platforms | Big Tech Financial Services |

|---|---|---|

| Core Focus | Customer rewards, personalized loyalty programs, seamless payment integration | Broad financial services, including payments, lending, and wealth management |

| Technology | AI-driven personalization, blockchain for transparency | Advanced AI, big data analytics, cloud infrastructure |

| Customer Base | Targeted niche users focused on rewards and loyalty | Mass market with global reach |

| Regulatory Compliance | Often partner with banks to ensure compliance | Direct compliance management with regulatory bodies |

| Innovation Speed | Agile, rapid product iteration | Slower but heavily resourced innovation cycles |

| Revenue Model | Transaction fees, subscription, partnerships | Ad revenue, transaction fees, financial product sales |

| Security | Focus on secure payment gateways and user data protection | Robust multi-layered security, biometric authentication |

| Integration | APIs for loyalty and payments integration | Comprehensive ecosystem integration (e.g., cloud, devices) |

| Examples | Stitch, Tala, Cardlytics | Apple Pay, Google Wallet, Amazon Pay |

Which is better?

Loyalty fintech platforms specialize in personalized rewards and customer retention programs, leveraging deep data analytics to enhance user engagement and financial behavior. Big tech platforms offer extensive infrastructure, vast user bases, and integrated ecosystems, enabling seamless financial services alongside other digital products. Choosing between them depends on the priority of specialized financial incentives versus broad, convenient access to diverse digital services.

Connection

Loyalty fintech and big tech platforms in financial services are interconnected through the integration of advanced data analytics, artificial intelligence, and user-centric financial products designed to enhance customer retention and engagement. These platforms leverage vast customer datasets to deliver personalized rewards, seamless payment solutions, and tailored financial advice, driving increased user loyalty and transaction frequency. By employing API ecosystems and open banking standards, big tech companies and fintech loyalty programs collaborate to create innovative financial experiences that blend convenience with value-added services.

Key Terms

Open Banking

Big tech platforms leverage Open Banking APIs to integrate financial services, enhancing customer experience through seamless data sharing and personalized offerings. Loyalty fintech firms utilize Open Banking to access transactional data, enabling tailored rewards and more effective customer engagement strategies. Explore how Open Banking is transforming financial ecosystems and loyalty solutions.

Customer Data Monetization

Big tech platforms in financial services leverage vast customer data sets to drive advanced monetization strategies, utilizing AI and machine learning to deliver personalized financial products and enhance customer insights. Loyalty fintech companies specialize in harnessing transaction and engagement data to optimize reward programs, boost customer retention, and create value through targeted offers and partnerships. Explore how these sectors harness customer data monetization to revolutionize financial services and loyalty experiences.

Digital Ecosystems

Big tech platforms in financial services leverage vast user bases and integrated digital ecosystems to offer seamless payment, lending, and investment solutions, driving enhanced customer engagement and data-driven personalization. Loyalty fintech companies specialize in creating tailored rewards programs and points-based systems that boost customer retention and foster brand affinity within these digital ecosystems. Explore how the interplay between big tech and loyalty fintech reshapes customer experiences in financial services.

Source and External Links

The Fintech Big Tech Convergence: How Google, Apple, and Amazon Are Quietly Becoming Banks - Major tech platforms like Google, Apple, and Amazon are reshaping financial services by embedding credit, payments, lending, and savings tools directly into their digital ecosystems, blurring the lines between tech and traditional banking.

The Growing Influence of BigTech Companies in Payments and Financial Services - Big Tech firms leverage their massive user bases, data analytics, and AI to offer mobile wallets, peer-to-peer payments, credit, and loans, increasingly bypassing traditional banks and disrupting the financial sector.

Big Tech and its role in the financial sector - Banco de Espana Blog - Big Tech platforms rapidly expand financial offerings--including lending and wealth management--using vast troves of user data to assess creditworthiness and personalize services, while their market capitalizations now rival or exceed those of the largest global banks.

dowidth.com

dowidth.com