Core banking modernization upgrades legacy financial systems to enhance processing speed, data security, and customer experience, focusing on in-house infrastructure improvements. Banking-as-a-Service (BaaS) enables third-party providers to offer banking products via APIs, promoting agility and faster innovation. Discover how these transformative approaches redefine the future of banking technology.

Why it is important

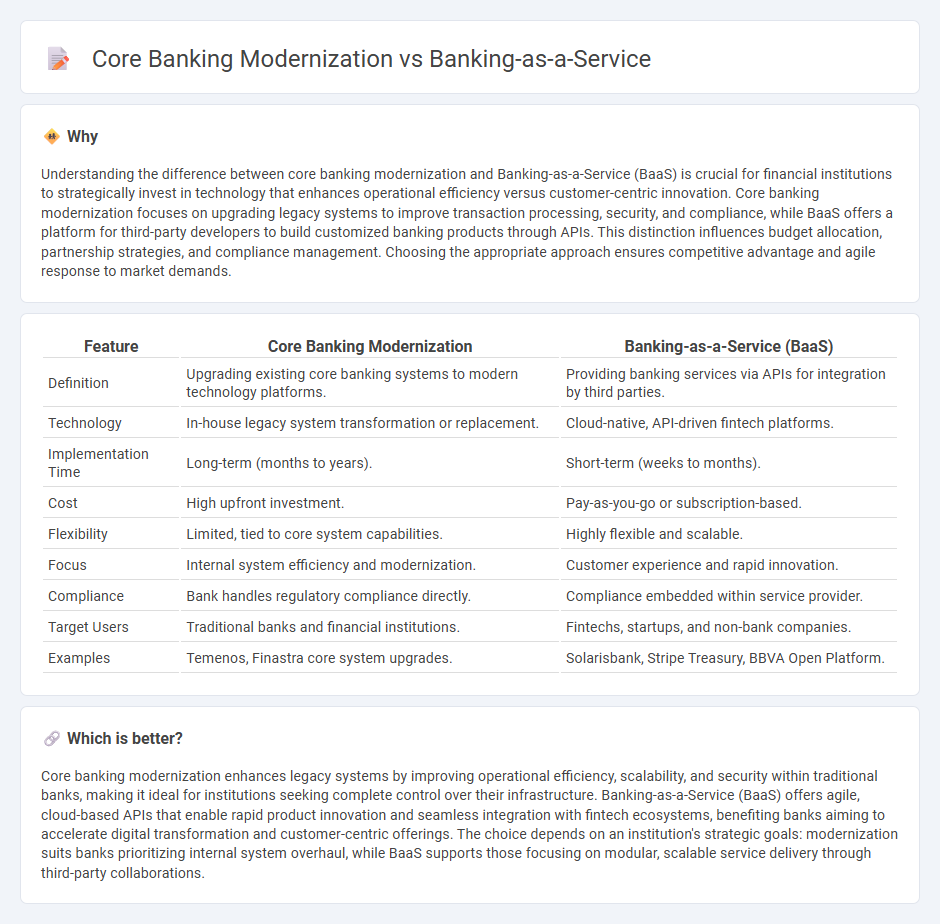

Understanding the difference between core banking modernization and Banking-as-a-Service (BaaS) is crucial for financial institutions to strategically invest in technology that enhances operational efficiency versus customer-centric innovation. Core banking modernization focuses on upgrading legacy systems to improve transaction processing, security, and compliance, while BaaS offers a platform for third-party developers to build customized banking products through APIs. This distinction influences budget allocation, partnership strategies, and compliance management. Choosing the appropriate approach ensures competitive advantage and agile response to market demands.

Comparison Table

| Feature | Core Banking Modernization | Banking-as-a-Service (BaaS) |

|---|---|---|

| Definition | Upgrading existing core banking systems to modern technology platforms. | Providing banking services via APIs for integration by third parties. |

| Technology | In-house legacy system transformation or replacement. | Cloud-native, API-driven fintech platforms. |

| Implementation Time | Long-term (months to years). | Short-term (weeks to months). |

| Cost | High upfront investment. | Pay-as-you-go or subscription-based. |

| Flexibility | Limited, tied to core system capabilities. | Highly flexible and scalable. |

| Focus | Internal system efficiency and modernization. | Customer experience and rapid innovation. |

| Compliance | Bank handles regulatory compliance directly. | Compliance embedded within service provider. |

| Target Users | Traditional banks and financial institutions. | Fintechs, startups, and non-bank companies. |

| Examples | Temenos, Finastra core system upgrades. | Solarisbank, Stripe Treasury, BBVA Open Platform. |

Which is better?

Core banking modernization enhances legacy systems by improving operational efficiency, scalability, and security within traditional banks, making it ideal for institutions seeking complete control over their infrastructure. Banking-as-a-Service (BaaS) offers agile, cloud-based APIs that enable rapid product innovation and seamless integration with fintech ecosystems, benefiting banks aiming to accelerate digital transformation and customer-centric offerings. The choice depends on an institution's strategic goals: modernization suits banks prioritizing internal system overhaul, while BaaS supports those focusing on modular, scalable service delivery through third-party collaborations.

Connection

Core banking modernization enhances legacy systems with cloud-native architectures and APIs, enabling seamless integration of Banking-as-a-Service (BaaS) platforms. This transformation allows banks to offer scalable, on-demand financial services through third-party providers while maintaining secure and compliant operations. By combining core modernization with BaaS, institutions accelerate innovation, improve customer experiences, and expand market reach efficiently.

Key Terms

APIs

Banking-as-a-Service (BaaS) platforms leverage APIs to enable seamless integration of financial services into third-party applications, promoting agility and innovation. Core banking modernization involves updating legacy systems with API-driven architectures to enhance scalability, interoperability, and customer experience. Explore how API strategies differentiate BaaS from core banking modernization to optimize your financial technology investments.

Legacy Systems

Banking-as-a-Service (BaaS) offers fintech firms and traditional banks cloud-based platforms to build and deploy applications without overhauling legacy systems, enabling faster innovation and reduced operational costs. Core banking modernization involves upgrading or replacing outdated legacy infrastructure to improve system scalability, security, and compliance with regulatory standards. Explore how integrating BaaS with modernized core systems can optimize performance and future-proof banking operations.

Cloud-Native Platform

Cloud-native platforms empower banks to modernize core banking systems by offering scalable, flexible infrastructures that support seamless integration with Banking-as-a-Service (BaaS) models, enhancing digital transformation. BaaS leverages cloud-native architecture to deliver modular financial services via APIs, enabling faster deployment, improved customer experiences, and innovative product offerings. Discover how adopting cloud-native platforms can revolutionize banking operations and accelerate your journey toward next-generation financial services.

Source and External Links

Top Banking as a Service Companies in 2025 - SDK.finance - Banking as a Service (BaaS) enables non-banks, such as fintechs and startups, to offer financial services by leveraging traditional banks' infrastructure and APIs, allowing quick integration of payments, account management, and compliance; the industry is projected to reach $7 trillion by 2030 with trends like open banking and RegTech driving growth.

A Primer on Banking-as-a-Service - BaaS is a model where licensed banks partner with fintech firms to provide banking infrastructure and products directly via third-party platforms, helping banks reduce customer acquisition costs and monetize their existing infrastructure while enabling fintechs to deliver banking services without full licenses.

Banking as a Service (BaaS): What It Is + Examples - InnReg - BaaS allows non-banking companies to offer tailored financial products by integrating with regulated bank infrastructure through APIs, creating an ecosystem of embedded banking services that drive financial innovation and new revenue streams for banks and fintechs alike.

dowidth.com

dowidth.com