Sustainable finance integrates environmental, social, and governance (ESG) criteria into banking decisions to promote long-term ecological balance and social responsibility. Development finance focuses on funding projects that advance economic growth and infrastructure in emerging markets, often supported by governments and international organizations. Explore further to understand how these financing models shape global economic progress.

Why it is important

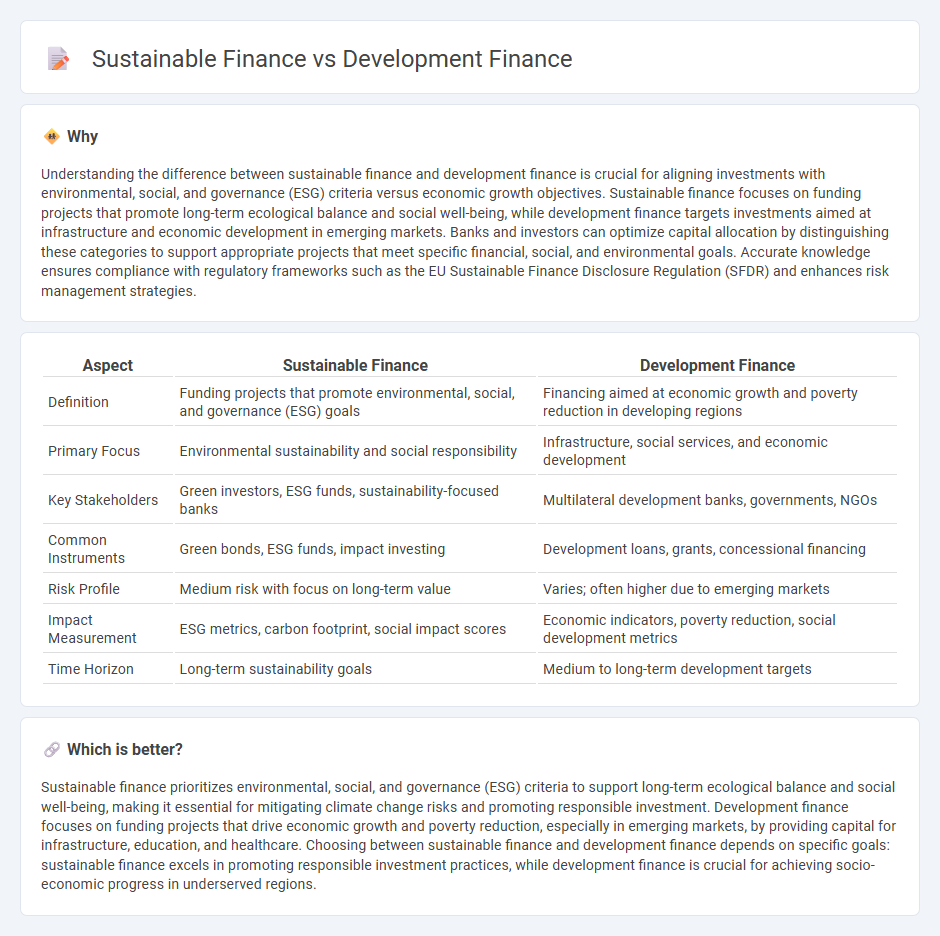

Understanding the difference between sustainable finance and development finance is crucial for aligning investments with environmental, social, and governance (ESG) criteria versus economic growth objectives. Sustainable finance focuses on funding projects that promote long-term ecological balance and social well-being, while development finance targets investments aimed at infrastructure and economic development in emerging markets. Banks and investors can optimize capital allocation by distinguishing these categories to support appropriate projects that meet specific financial, social, and environmental goals. Accurate knowledge ensures compliance with regulatory frameworks such as the EU Sustainable Finance Disclosure Regulation (SFDR) and enhances risk management strategies.

Comparison Table

| Aspect | Sustainable Finance | Development Finance |

|---|---|---|

| Definition | Funding projects that promote environmental, social, and governance (ESG) goals | Financing aimed at economic growth and poverty reduction in developing regions |

| Primary Focus | Environmental sustainability and social responsibility | Infrastructure, social services, and economic development |

| Key Stakeholders | Green investors, ESG funds, sustainability-focused banks | Multilateral development banks, governments, NGOs |

| Common Instruments | Green bonds, ESG funds, impact investing | Development loans, grants, concessional financing |

| Risk Profile | Medium risk with focus on long-term value | Varies; often higher due to emerging markets |

| Impact Measurement | ESG metrics, carbon footprint, social impact scores | Economic indicators, poverty reduction, social development metrics |

| Time Horizon | Long-term sustainability goals | Medium to long-term development targets |

Which is better?

Sustainable finance prioritizes environmental, social, and governance (ESG) criteria to support long-term ecological balance and social well-being, making it essential for mitigating climate change risks and promoting responsible investment. Development finance focuses on funding projects that drive economic growth and poverty reduction, especially in emerging markets, by providing capital for infrastructure, education, and healthcare. Choosing between sustainable finance and development finance depends on specific goals: sustainable finance excels in promoting responsible investment practices, while development finance is crucial for achieving socio-economic progress in underserved regions.

Connection

Sustainable finance and development finance are interconnected through their shared goal of promoting economic growth that is environmentally responsible and socially inclusive. Development finance institutions increasingly incorporate sustainable finance principles to fund projects that address climate change, poverty reduction, and infrastructure development. This integration ensures long-term investment returns while supporting global sustainability targets such as the United Nations Sustainable Development Goals (SDGs).

Key Terms

**Development Finance:**

Development finance concentrates on funding projects that promote economic growth and social progress in emerging and underdeveloped regions, often through investments in infrastructure, education, and healthcare. It aims to reduce poverty and enhance living standards by supporting initiatives from governments, development banks, and international organizations. Explore more about development finance and its impact on global socio-economic transformation.

Multilateral Development Banks (MDBs)

Development finance primarily targets economic growth and poverty reduction through long-term investments in infrastructure and social projects, while sustainable finance integrates environmental, social, and governance (ESG) criteria to drive climate-resilient and inclusive development. Multilateral Development Banks (MDBs) such as the World Bank, Asian Development Bank, and African Development Bank play a pivotal role by mobilizing capital and providing technical expertise to support sustainable development goals (SDGs) across emerging markets. Explore how MDBs balance development finance and sustainable finance to foster resilient economies and achieve global sustainability objectives.

Project Finance

Development finance focuses on funding infrastructure and social projects in emerging economies to promote economic growth and reduce poverty, often backed by multilateral development banks. Sustainable finance prioritizes environmental, social, and governance (ESG) criteria, funding projects that contribute to long-term ecological balance and social well-being, which increasingly aligns with project finance models that mitigate risks through structured financing. Explore how project finance bridges development and sustainability goals by optimizing capital allocation for impactful global projects.

Source and External Links

Development finance institution - A development finance institution (DFI) provides risk capital for projects aimed at economic development, often through non-commercial means.

Development Finance (DFi) - World Bank - This unit manages and monitors World Bank development financing policies and engages in strategic resource mobilization.

Financing for Development - UN - Finances sustainable development through a combination of public and private resources to support global development goals.

dowidth.com

dowidth.com