Hyperpersonalization leverages real-time data analytics to create individualized banking experiences tailored to each customer's unique behaviors and preferences. Customer clustering segments clients into groups based on shared characteristics to deliver targeted marketing and product offerings. Explore how these strategies transform customer engagement in modern banking.

Why it is important

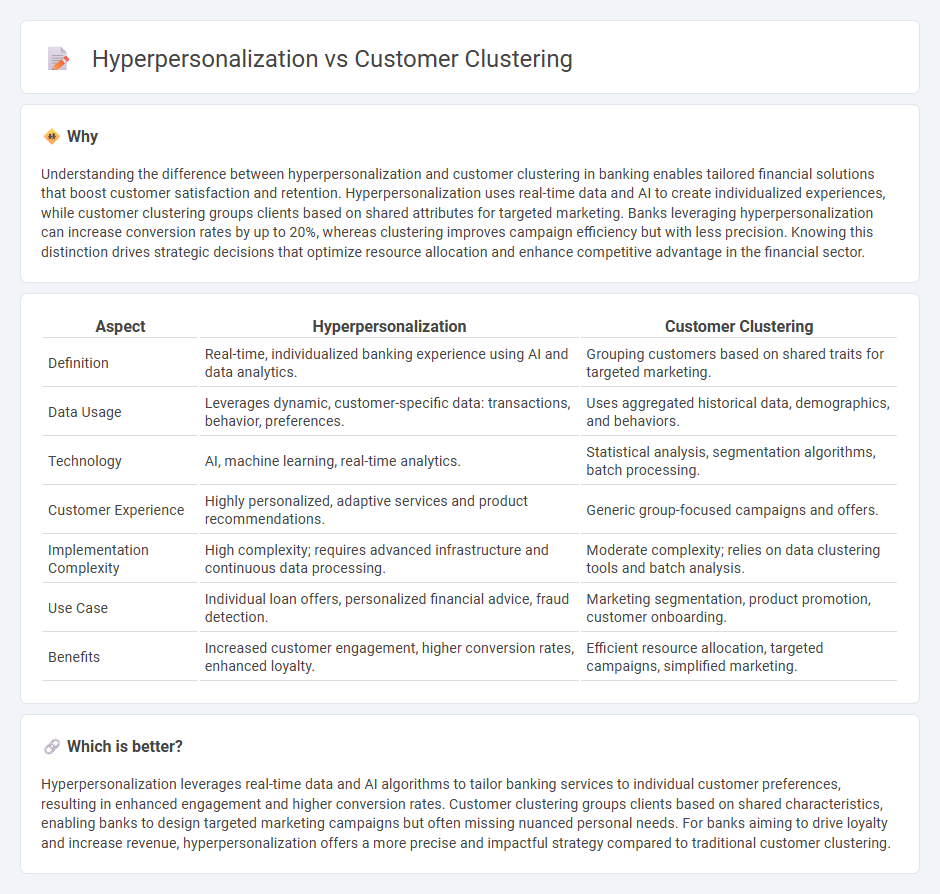

Understanding the difference between hyperpersonalization and customer clustering in banking enables tailored financial solutions that boost customer satisfaction and retention. Hyperpersonalization uses real-time data and AI to create individualized experiences, while customer clustering groups clients based on shared attributes for targeted marketing. Banks leveraging hyperpersonalization can increase conversion rates by up to 20%, whereas clustering improves campaign efficiency but with less precision. Knowing this distinction drives strategic decisions that optimize resource allocation and enhance competitive advantage in the financial sector.

Comparison Table

| Aspect | Hyperpersonalization | Customer Clustering |

|---|---|---|

| Definition | Real-time, individualized banking experience using AI and data analytics. | Grouping customers based on shared traits for targeted marketing. |

| Data Usage | Leverages dynamic, customer-specific data: transactions, behavior, preferences. | Uses aggregated historical data, demographics, and behaviors. |

| Technology | AI, machine learning, real-time analytics. | Statistical analysis, segmentation algorithms, batch processing. |

| Customer Experience | Highly personalized, adaptive services and product recommendations. | Generic group-focused campaigns and offers. |

| Implementation Complexity | High complexity; requires advanced infrastructure and continuous data processing. | Moderate complexity; relies on data clustering tools and batch analysis. |

| Use Case | Individual loan offers, personalized financial advice, fraud detection. | Marketing segmentation, product promotion, customer onboarding. |

| Benefits | Increased customer engagement, higher conversion rates, enhanced loyalty. | Efficient resource allocation, targeted campaigns, simplified marketing. |

Which is better?

Hyperpersonalization leverages real-time data and AI algorithms to tailor banking services to individual customer preferences, resulting in enhanced engagement and higher conversion rates. Customer clustering groups clients based on shared characteristics, enabling banks to design targeted marketing campaigns but often missing nuanced personal needs. For banks aiming to drive loyalty and increase revenue, hyperpersonalization offers a more precise and impactful strategy compared to traditional customer clustering.

Connection

Hyperpersonalization in banking leverages customer clustering by analyzing detailed data segments to tailor financial products and services uniquely to each group. Customer clustering algorithms identify patterns and behaviors within diverse client profiles, enabling banks to deliver targeted offers, personalized advice, and customized experiences. This strategic connection enhances customer satisfaction, loyalty, and revenue growth by aligning banking solutions precisely with individual needs and preferences.

Key Terms

Segmentation

Customer clustering segments consumers based on shared characteristics using algorithms like K-means or hierarchical clustering, enabling targeted marketing strategies. Hyperpersonalization leverages real-time data and AI to deliver individualized content, offers, and experiences at scale. Explore how these approaches enhance segmentation effectiveness for optimized customer engagement.

Predictive Analytics

Customer clustering segments consumers based on shared characteristics to target groups effectively, enhancing marketing strategies through pattern recognition and behavior prediction. Hyperpersonalization leverages predictive analytics to deliver individually tailored experiences by analyzing real-time data and anticipating customer needs at a granular level. Explore how blending customer clustering with hyperpersonalization can revolutionize predictive analytics in your business.

Real-time Personalization

Customer clustering segments users based on shared characteristics, enabling targeted marketing strategies by grouping similar behaviors or preferences. Hyperpersonalization leverages real-time data, AI, and machine learning to create individualized experiences that adapt instantly to user actions and contexts. Explore advanced techniques in real-time personalization to unlock deeper customer engagement and optimized marketing outcomes.

Source and External Links

Customer Engagement Solutions - C-Zentrix - Customer clustering is the process of dividing customers into groups (clusters) that reflect similarities among customers, enabling businesses to personalize engagement and maximize benefits for each segment.

Customer Segmentation via Cluster Analysis | GeeksforGeeks - Customer segmentation via cluster analysis groups customers by common traits--such as demographics, behavior, and preferences--allowing for targeted marketing, improved retention, and more efficient product and pricing strategies.

Customer Segmentation via Cluster Analysis - Optimove - Cluster analysis uses machine learning algorithms to uncover natural groups of similar customers, helping brands personalize offers, messages, and experiences for each cluster without relying on predetermined rules.

dowidth.com

dowidth.com