Virtual cards provide a secure, temporary payment method with unique card numbers that reduce fraud risks, while mobile payments offer convenience through contactless transactions via smartphones and digital wallets. Both solutions leverage tokenization and encryption technologies to protect user data during online and in-store purchases. Discover more about how virtual cards and mobile payments are transforming modern banking security and convenience.

Why it is important

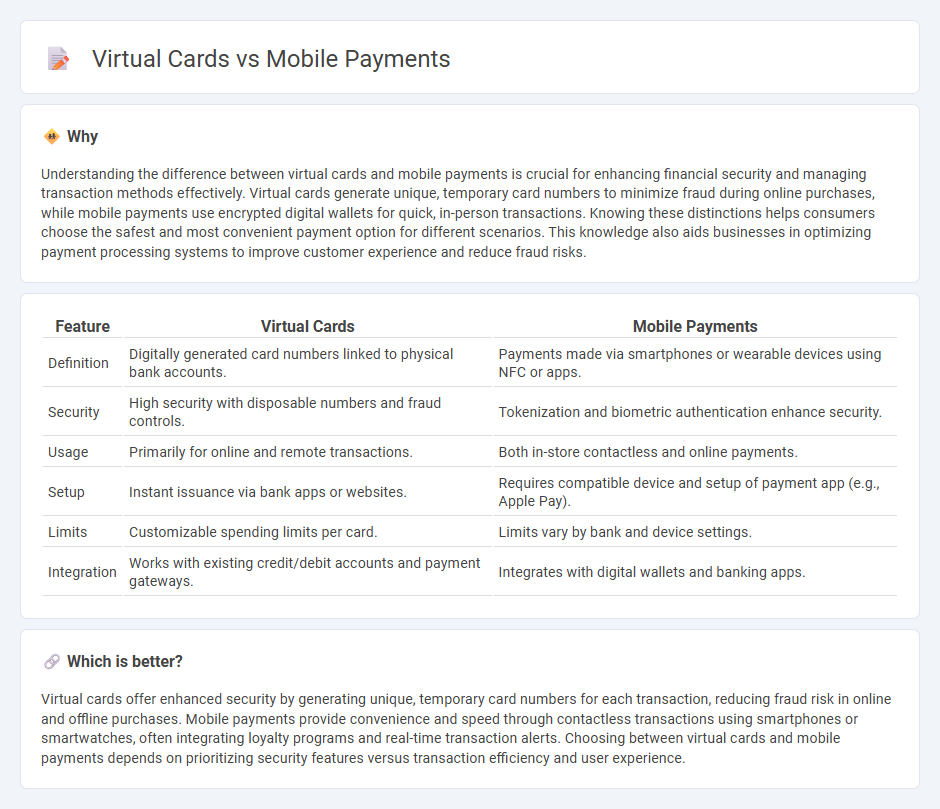

Understanding the difference between virtual cards and mobile payments is crucial for enhancing financial security and managing transaction methods effectively. Virtual cards generate unique, temporary card numbers to minimize fraud during online purchases, while mobile payments use encrypted digital wallets for quick, in-person transactions. Knowing these distinctions helps consumers choose the safest and most convenient payment option for different scenarios. This knowledge also aids businesses in optimizing payment processing systems to improve customer experience and reduce fraud risks.

Comparison Table

| Feature | Virtual Cards | Mobile Payments |

|---|---|---|

| Definition | Digitally generated card numbers linked to physical bank accounts. | Payments made via smartphones or wearable devices using NFC or apps. |

| Security | High security with disposable numbers and fraud controls. | Tokenization and biometric authentication enhance security. |

| Usage | Primarily for online and remote transactions. | Both in-store contactless and online payments. |

| Setup | Instant issuance via bank apps or websites. | Requires compatible device and setup of payment app (e.g., Apple Pay). |

| Limits | Customizable spending limits per card. | Limits vary by bank and device settings. |

| Integration | Works with existing credit/debit accounts and payment gateways. | Integrates with digital wallets and banking apps. |

Which is better?

Virtual cards offer enhanced security by generating unique, temporary card numbers for each transaction, reducing fraud risk in online and offline purchases. Mobile payments provide convenience and speed through contactless transactions using smartphones or smartwatches, often integrating loyalty programs and real-time transaction alerts. Choosing between virtual cards and mobile payments depends on prioritizing security features versus transaction efficiency and user experience.

Connection

Virtual cards enhance mobile payments by providing a secure, digital alternative to physical cards, enabling instant issuance and controlled spending through smartphone apps. Mobile payment platforms integrate virtual cards to facilitate seamless transactions using NFC or QR codes, improving convenience and reducing fraud risks. This synergy accelerates the adoption of contactless payments, supporting digital banking trends and increasing consumer trust in mobile financial services.

Key Terms

Digital Wallet

Mobile payments leverage digital wallets to facilitate seamless transactions by storing payment information securely on smartphones, enabling users to pay with a tap or scan. Virtual cards, often integrated into digital wallets, provide an extra layer of security by generating unique card numbers for online or contactless payments, reducing fraud risk. Explore the advantages of digital wallets and virtual cards to enhance your payment security and convenience.

Tokenization

Tokenization enhances security by replacing sensitive payment details with unique digital tokens in both mobile payments and virtual cards, minimizing fraud risk during transactions. Mobile payments rely on near-field communication (NFC) technology combined with tokenization to enable quick, contactless purchases, while virtual cards use tokenization to generate single-use or limited-use card numbers for safer online shopping. Explore in-depth how tokenization strengthens the security frameworks protecting your digital payments.

Card-Not-Present (CNP)

Mobile payments and virtual cards are both essential solutions for enhancing Card-Not-Present (CNP) transactions, offering heightened security and convenience. Virtual cards generate unique card numbers for each transaction, minimizing fraud risk, while mobile payments integrate tokenization and biometric authentication to protect sensitive data. Explore detailed comparisons and benefits of mobile payments versus virtual cards in securing CNP transactions to optimize your payment strategy.

Source and External Links

Mobile Payments: What They Are & How To Use Them - Mobile payments are contactless transactions using mobile devices like smartphones or tablets, primarily made via NFC, direct carrier billing, or mobile wallets such as Apple Pay, Google Pay, Venmo, and PayPal, enabling fast and convenient payment options linked to cards or bank accounts.

Mobile payments explained: A guide for businesses - Mobile payments use technologies like NFC, QR codes, SMS, and digital wallets secured by encryption, tokenization, and biometric verification, allowing customers to pay quickly and securely by tapping phones or scanning codes at physical and online points of sale.

Understanding the Mobile Payments Landscape - Mobile payments offer fast, convenient, and secure transactions, often faster than chip card payments; they reduce cash handling and enhance business efficiency, with added benefits like increased tipping rates in NFC-based payments.

dowidth.com

dowidth.com