RegTech focuses on leveraging technology to enhance regulatory compliance, risk management, and reporting processes within the banking sector. CryptoTech encompasses blockchain innovations, cryptocurrencies, and digital asset management, transforming financial transactions and security. Explore the evolving impact of RegTech and CryptoTech on modern banking to understand their distinct roles.

Why it is important

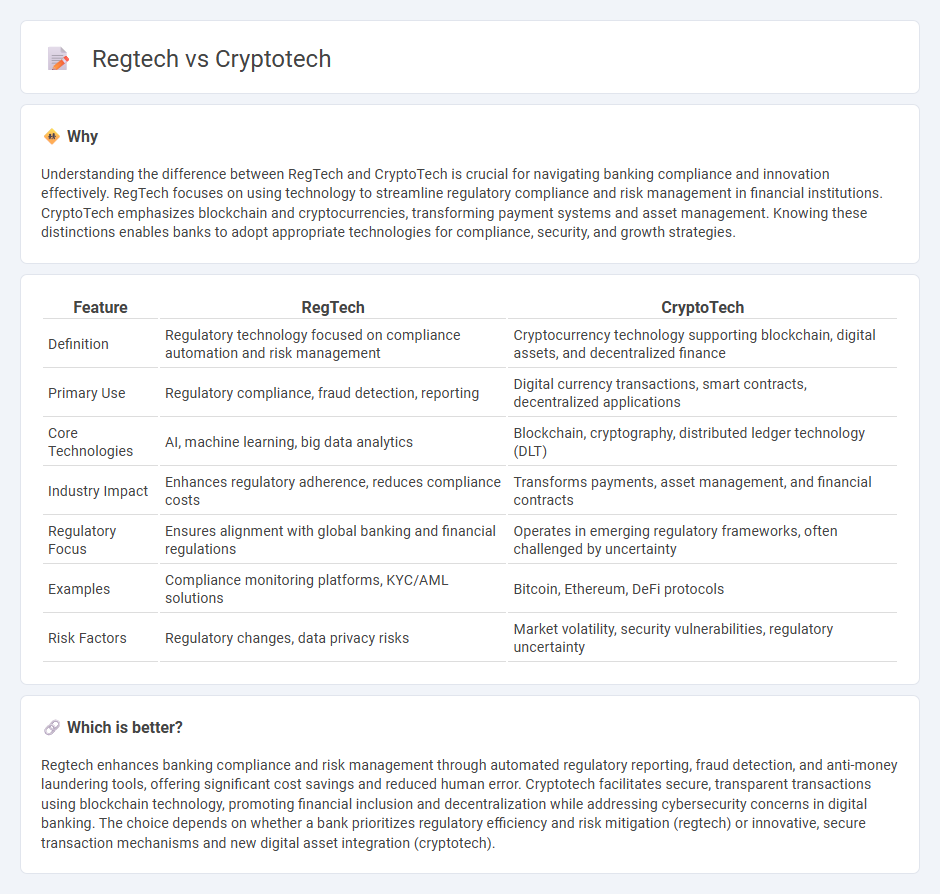

Understanding the difference between RegTech and CryptoTech is crucial for navigating banking compliance and innovation effectively. RegTech focuses on using technology to streamline regulatory compliance and risk management in financial institutions. CryptoTech emphasizes blockchain and cryptocurrencies, transforming payment systems and asset management. Knowing these distinctions enables banks to adopt appropriate technologies for compliance, security, and growth strategies.

Comparison Table

| Feature | RegTech | CryptoTech |

|---|---|---|

| Definition | Regulatory technology focused on compliance automation and risk management | Cryptocurrency technology supporting blockchain, digital assets, and decentralized finance |

| Primary Use | Regulatory compliance, fraud detection, reporting | Digital currency transactions, smart contracts, decentralized applications |

| Core Technologies | AI, machine learning, big data analytics | Blockchain, cryptography, distributed ledger technology (DLT) |

| Industry Impact | Enhances regulatory adherence, reduces compliance costs | Transforms payments, asset management, and financial contracts |

| Regulatory Focus | Ensures alignment with global banking and financial regulations | Operates in emerging regulatory frameworks, often challenged by uncertainty |

| Examples | Compliance monitoring platforms, KYC/AML solutions | Bitcoin, Ethereum, DeFi protocols |

| Risk Factors | Regulatory changes, data privacy risks | Market volatility, security vulnerabilities, regulatory uncertainty |

Which is better?

Regtech enhances banking compliance and risk management through automated regulatory reporting, fraud detection, and anti-money laundering tools, offering significant cost savings and reduced human error. Cryptotech facilitates secure, transparent transactions using blockchain technology, promoting financial inclusion and decentralization while addressing cybersecurity concerns in digital banking. The choice depends on whether a bank prioritizes regulatory efficiency and risk mitigation (regtech) or innovative, secure transaction mechanisms and new digital asset integration (cryptotech).

Connection

Regtech leverages advanced cryptography and blockchain technologies from cryptotech to enhance compliance, security, and transparency in banking operations. By integrating cryptographic protocols, regtech solutions enable real-time transaction monitoring, fraud detection, and secure data sharing between financial institutions and regulators. This synergy improves regulatory adherence while reducing costs and risks associated with traditional banking compliance methods.

Key Terms

Blockchain

Cryptotech harnesses blockchain technology to develop innovative solutions for secure transactions and data integrity, emphasizing decentralized finance and smart contracts. Regtech applies blockchain to streamline regulatory compliance, enhance transparency, and automate reporting processes in financial services. Explore how blockchain transforms both cryptotech and regtech sectors for improved efficiency and security.

Compliance Automation

Compliance automation enhances regulatory adherence by streamlining processes in both cryptotech and regtech sectors. Cryptotech integrates blockchain-based solutions to secure financial transactions, while regtech employs AI-driven tools for real-time risk assessment and reporting. Explore how these technologies transform compliance automation and shape the future of regulatory frameworks.

Smart Contracts

Cryptotech centers on blockchain innovations and the creation of smart contracts that automate and secure digital transactions with programmable conditions. Regtech specializes in using technology to streamline regulatory compliance, focusing on monitoring and reporting mechanisms that ensure adherence to legal standards. Explore how integrating smart contracts enhances compliance efficiency and transforms regulatory frameworks.

Source and External Links

CryptoTech Solutiona - A cybersecurity company specializing in cutting-edge IT security solutions certified with ISO 27001, providing comprehensive protection against cyber threats with over 20 years of expertise.

CryptoTech: Home - An AI-powered cloud-based cybersecurity platform offering threat detection, incident response, and automated protection to secure businesses from cyberattacks with a free 30-day trial.

CryptoTechFin: Automating your crypto investments - A platform that automates cryptocurrency investments using secure, European-compliant algorithmic technology for real-time trading decisions and risk management.

dowidth.com

dowidth.com