Predictive analytics leverages historical banking data and machine learning algorithms to identify patterns that forecast future financial trends, enhancing risk management and customer insights. Cash flow forecasting specifically projects a bank's incoming and outgoing funds over a period to ensure liquidity and operational stability. Explore how integrating predictive analytics with cash flow forecasting can optimize financial decision-making.

Why it is important

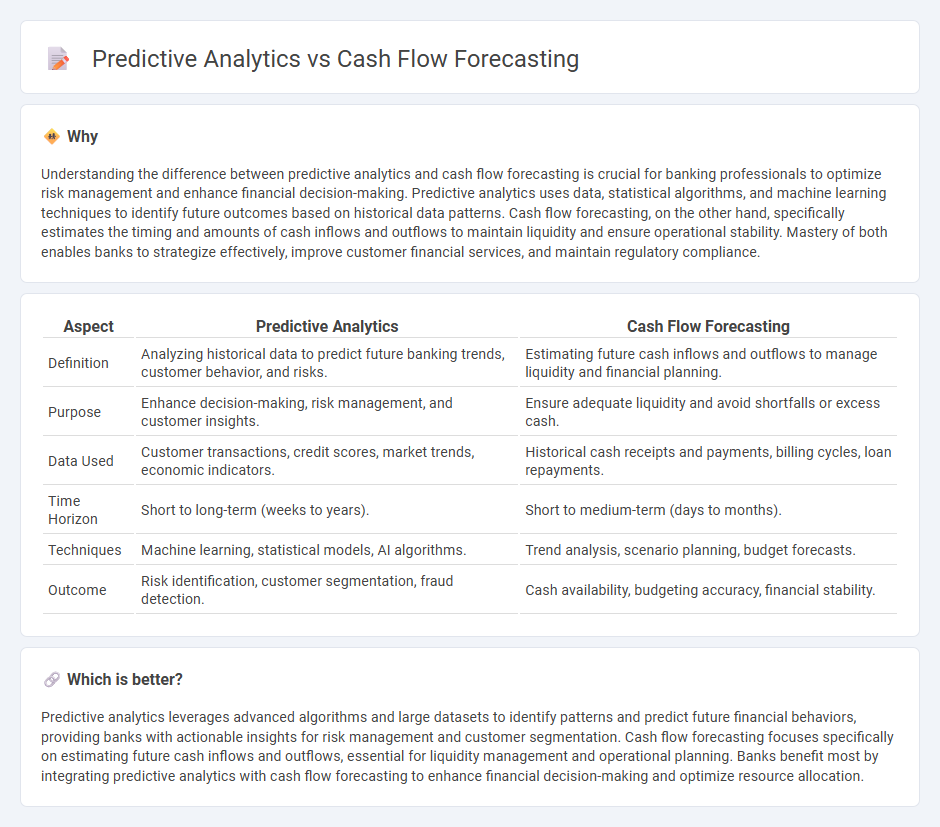

Understanding the difference between predictive analytics and cash flow forecasting is crucial for banking professionals to optimize risk management and enhance financial decision-making. Predictive analytics uses data, statistical algorithms, and machine learning techniques to identify future outcomes based on historical data patterns. Cash flow forecasting, on the other hand, specifically estimates the timing and amounts of cash inflows and outflows to maintain liquidity and ensure operational stability. Mastery of both enables banks to strategize effectively, improve customer financial services, and maintain regulatory compliance.

Comparison Table

| Aspect | Predictive Analytics | Cash Flow Forecasting |

|---|---|---|

| Definition | Analyzing historical data to predict future banking trends, customer behavior, and risks. | Estimating future cash inflows and outflows to manage liquidity and financial planning. |

| Purpose | Enhance decision-making, risk management, and customer insights. | Ensure adequate liquidity and avoid shortfalls or excess cash. |

| Data Used | Customer transactions, credit scores, market trends, economic indicators. | Historical cash receipts and payments, billing cycles, loan repayments. |

| Time Horizon | Short to long-term (weeks to years). | Short to medium-term (days to months). |

| Techniques | Machine learning, statistical models, AI algorithms. | Trend analysis, scenario planning, budget forecasts. |

| Outcome | Risk identification, customer segmentation, fraud detection. | Cash availability, budgeting accuracy, financial stability. |

Which is better?

Predictive analytics leverages advanced algorithms and large datasets to identify patterns and predict future financial behaviors, providing banks with actionable insights for risk management and customer segmentation. Cash flow forecasting focuses specifically on estimating future cash inflows and outflows, essential for liquidity management and operational planning. Banks benefit most by integrating predictive analytics with cash flow forecasting to enhance financial decision-making and optimize resource allocation.

Connection

Predictive analytics enhances cash flow forecasting by analyzing historical financial data and market trends to anticipate future cash inflows and outflows accurately. This integration enables banks to optimize liquidity management, reduce financial risks, and improve decision-making processes. Leveraging machine learning algorithms, predictive analytics provides real-time insights that refine the precision of cash flow projections.

Key Terms

Liquidity Management

Cash flow forecasting and predictive analytics both enhance liquidity management by providing insights into future cash positions and financial health. Cash flow forecasting relies on historical data and known commitments to estimate inflows and outflows, enabling businesses to plan for short-term liquidity needs. Explore how integrating predictive analytics can refine cash flow forecasts for more dynamic liquidity strategies.

Historical Data Analysis

Cash flow forecasting relies heavily on historical data analysis to predict future cash inflows and outflows, using past financial statements and transaction records to identify trends and seasonal patterns. Predictive analytics incorporates historical data but also integrates advanced statistical models and machine learning algorithms to uncover deeper insights and anticipate potential financial risks and opportunities. Explore more about how historical data drives accuracy in cash flow forecasting versus predictive analytics.

Machine Learning Algorithms

Cash flow forecasting leverages historical financial data and time series analysis to estimate future cash inflows and outflows, while predictive analytics employs advanced Machine Learning algorithms such as regression models, random forests, and neural networks to identify complex patterns and enhance forecasting accuracy. Machine Learning algorithms dynamically adapt to new data, improving the precision of cash flow predictions by analyzing a wide range of variables including seasonality, customer payment behaviors, and market trends. Explore more about how cutting-edge Machine Learning techniques revolutionize cash flow forecasting in modern financial management.

Source and External Links

Cash Flow Forecasting: A Comprehensive Guide | GTreasury - Cash flow forecasting estimates a business's financial position over time using direct methods for short-term and indirect methods for long-term projections, helping with strategic planning, risk mitigation, and working capital management.

Cash flow forecasting - Finance | Dynamics 365 - Learn Microsoft - Cash flow forecasting tools analyze upcoming cash flow and liquidity needs by integrating sales orders, purchase orders, accounts payable/receivable, budgets, and external data to produce detailed forecasts of cash requirements.

Cash flow forecasting - Business Victoria - A cash flow forecast estimates future cash inflows and outflows based on past performance and trends, helping businesses determine if they have enough cash to operate or grow by carefully forecasting income and expenses over a chosen period.

dowidth.com

dowidth.com