Super apps integrate a wide range of financial services such as payments, lending, and insurance into a single platform, streamlining customer experiences and enhancing accessibility. RegTech solutions focus on regulatory compliance by leveraging advanced technologies like AI and blockchain to monitor transactions, reduce fraud, and ensure adherence to legal standards in real time. Explore how the convergence of super apps and RegTech is reshaping the future of banking innovation and security.

Why it is important

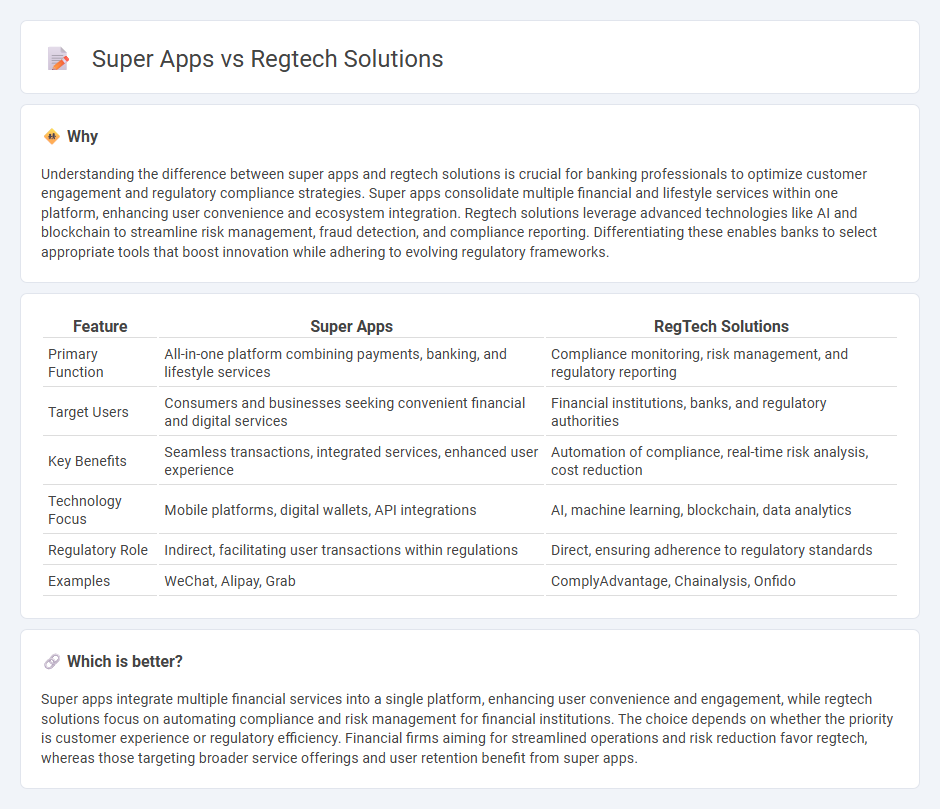

Understanding the difference between super apps and regtech solutions is crucial for banking professionals to optimize customer engagement and regulatory compliance strategies. Super apps consolidate multiple financial and lifestyle services within one platform, enhancing user convenience and ecosystem integration. Regtech solutions leverage advanced technologies like AI and blockchain to streamline risk management, fraud detection, and compliance reporting. Differentiating these enables banks to select appropriate tools that boost innovation while adhering to evolving regulatory frameworks.

Comparison Table

| Feature | Super Apps | RegTech Solutions |

|---|---|---|

| Primary Function | All-in-one platform combining payments, banking, and lifestyle services | Compliance monitoring, risk management, and regulatory reporting |

| Target Users | Consumers and businesses seeking convenient financial and digital services | Financial institutions, banks, and regulatory authorities |

| Key Benefits | Seamless transactions, integrated services, enhanced user experience | Automation of compliance, real-time risk analysis, cost reduction |

| Technology Focus | Mobile platforms, digital wallets, API integrations | AI, machine learning, blockchain, data analytics |

| Regulatory Role | Indirect, facilitating user transactions within regulations | Direct, ensuring adherence to regulatory standards |

| Examples | WeChat, Alipay, Grab | ComplyAdvantage, Chainalysis, Onfido |

Which is better?

Super apps integrate multiple financial services into a single platform, enhancing user convenience and engagement, while regtech solutions focus on automating compliance and risk management for financial institutions. The choice depends on whether the priority is customer experience or regulatory efficiency. Financial firms aiming for streamlined operations and risk reduction favor regtech, whereas those targeting broader service offerings and user retention benefit from super apps.

Connection

Super apps integrate multiple financial services within a single platform, leveraging regtech solutions to ensure regulatory compliance and enhance security. Regtech technologies use AI, machine learning, and real-time data analytics to monitor transactions and detect fraud, streamlining risk management for super apps. This synergy helps banks and fintechs deliver seamless, compliant, and secure user experiences in the evolving digital banking ecosystem.

Key Terms

**Regtech Solutions:**

Regtech solutions leverage advanced technologies like AI, blockchain, and big data analytics to enhance regulatory compliance, risk management, and reporting efficiency across financial services. These solutions enable real-time monitoring and automation of complex regulatory processes, reducing operational costs and minimizing regulatory breaches. Explore in-depth how regtech solutions transform compliance frameworks and drive innovation in financial ecosystems.

Compliance Automation

RegTech solutions streamline compliance automation by leveraging AI and machine learning to monitor regulatory changes and ensure real-time adherence to legal standards. Super apps integrate multiple services, including compliance tools, but often lack the specialized focus and depth offered by dedicated RegTech platforms. Explore in-depth comparisons to understand how each approach optimizes regulatory compliance processes.

Risk Management

Regtech solutions leverage advanced AI and machine learning algorithms to provide real-time risk assessment, regulatory compliance monitoring, and fraud detection tailored for financial institutions. Super apps integrate multiple services, including payments, investments, and insurance, offering users a unified interface but often rely on third-party regtech tools for specialized risk management. Discover how these technologies transform risk management strategies in evolving financial ecosystems.

Source and External Links

RegTech Universe 2024 - Offers a comprehensive overview of RegTech solutions, including regulatory reporting, risk management, identity management, and compliance.

RegTech: What Is It and Why Use It? - Explains RegTech's role in monitoring transactions, detecting suspicious activities, and generating regulatory reports.

The Future of Compliance: Emerging RegTech Trends - Discusses trends like RegTech-as-a-Service, simplifying compliance through cloud-based solutions.

dowidth.com

dowidth.com