Invisible payments use advanced technology to process transactions seamlessly without customer interaction, enhancing user convenience and reducing payment friction. Direct debit allows automatic withdrawal from a payer's bank account, ensuring timely bill payments and predictable cash flow for businesses. Discover how these innovative banking methods are transforming financial management and customer experience.

Why it is important

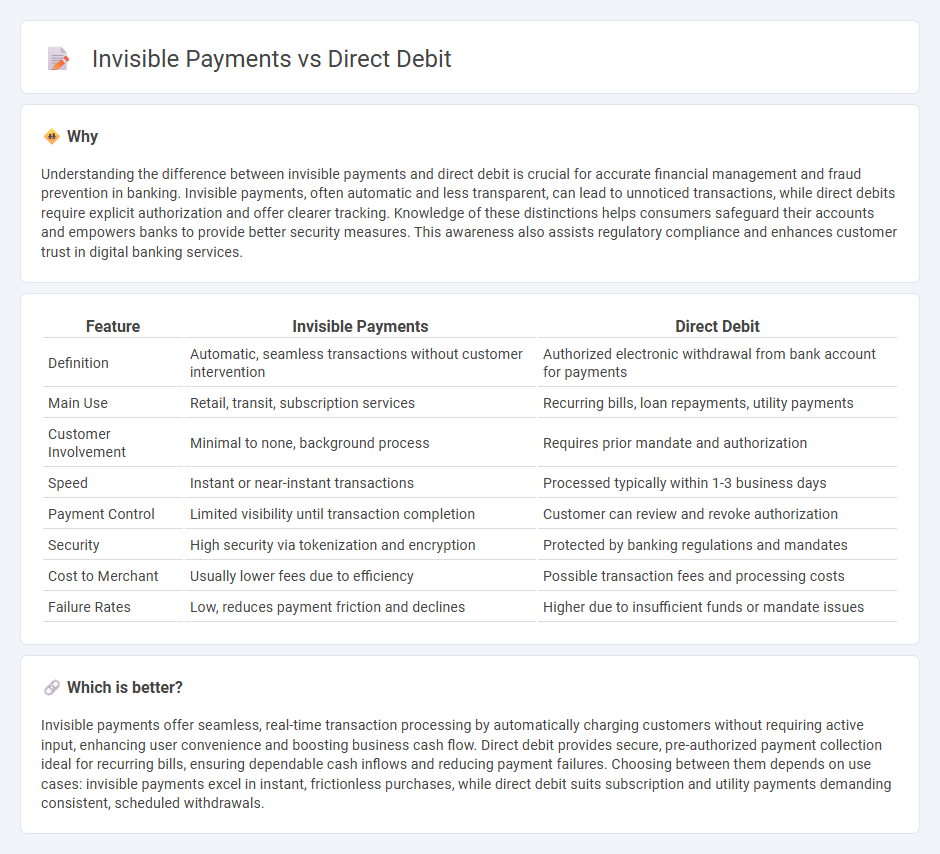

Understanding the difference between invisible payments and direct debit is crucial for accurate financial management and fraud prevention in banking. Invisible payments, often automatic and less transparent, can lead to unnoticed transactions, while direct debits require explicit authorization and offer clearer tracking. Knowledge of these distinctions helps consumers safeguard their accounts and empowers banks to provide better security measures. This awareness also assists regulatory compliance and enhances customer trust in digital banking services.

Comparison Table

| Feature | Invisible Payments | Direct Debit |

|---|---|---|

| Definition | Automatic, seamless transactions without customer intervention | Authorized electronic withdrawal from bank account for payments |

| Main Use | Retail, transit, subscription services | Recurring bills, loan repayments, utility payments |

| Customer Involvement | Minimal to none, background process | Requires prior mandate and authorization |

| Speed | Instant or near-instant transactions | Processed typically within 1-3 business days |

| Payment Control | Limited visibility until transaction completion | Customer can review and revoke authorization |

| Security | High security via tokenization and encryption | Protected by banking regulations and mandates |

| Cost to Merchant | Usually lower fees due to efficiency | Possible transaction fees and processing costs |

| Failure Rates | Low, reduces payment friction and declines | Higher due to insufficient funds or mandate issues |

Which is better?

Invisible payments offer seamless, real-time transaction processing by automatically charging customers without requiring active input, enhancing user convenience and boosting business cash flow. Direct debit provides secure, pre-authorized payment collection ideal for recurring bills, ensuring dependable cash inflows and reducing payment failures. Choosing between them depends on use cases: invisible payments excel in instant, frictionless purchases, while direct debit suits subscription and utility payments demanding consistent, scheduled withdrawals.

Connection

Invisible payments leverage direct debit systems to enable seamless, automatic transactions without requiring active user input. By utilizing bank authorization and pre-approved agreements, invisible payments process funds directly from customers' accounts, enhancing convenience and reducing transaction friction. This integration supports real-time purchase experiences in sectors like transportation, utilities, and subscription services, driving increased adoption of cashless payment methods.

Key Terms

Authorization

Direct debit authorization requires explicit consent from the payer, typically through a signed mandate, ensuring clear approval for scheduled bank withdrawals. Invisible payments, often powered by tokenization and biometric authentication, enable seamless, real-time transactions without direct payer intervention. Discover how evolving authorization methods redefine payment security and user experience.

Settlement

Direct debit offers a predictable and secure settlement process with funds debited directly from the payer's bank account, ensuring timely and guaranteed transactions for businesses. Invisible payments streamline settlement by enabling frictionless, behind-the-scenes payment authorizations often linked to digital wallets or biometrics, reducing manual intervention and settlement delays. Explore the evolving landscape of settlement methods in payment systems to enhance transaction efficiency and security.

Payment Initiation

Payment initiation in direct debit involves the payer authorizing a recurring transaction directly from their bank account, offering secure and predictable cash flow management. Invisible payments utilize payment initiation service providers (PISPs) to execute transactions without visible customer action, enhancing seamless user experience through faster transaction processing. Discover how these payment initiation methods can optimize your business's cash flow efficiency and customer convenience.

Source and External Links

Direct Debit: How It Works, Key Benefits & More - Invoiced - Direct debit is a payment method where a buyer authorizes a seller to collect recurring payments directly from their bank account, offering sellers predictable payments and reduced risk of non-payment along with better cash flow control.

Direct debit - Wikipedia - A direct debit is a mandated financial transaction where the payer authorizes the payee to draw varying recurring amounts directly from the payer's bank account, commonly used for bills and subscriptions.

What is Direct Debit? ACH Debit Bank Payment Collection - Direct Debit is a simple, safe, and convenient method to make regular or one-off payments, typically used for bills or subscriptions, requiring prior authorization and offering consumer protections like refund rights.

dowidth.com

dowidth.com