Cloud core banking leverages scalable cloud infrastructure to deliver flexible, real-time banking services with enhanced security and reduced operational costs. Core banking SaaS offers subscription-based access to essential banking functions via the cloud, enabling rapid deployment and seamless updates without heavy upfront investments. Explore how these innovative core banking models transform financial institutions' agility and customer experience.

Why it is important

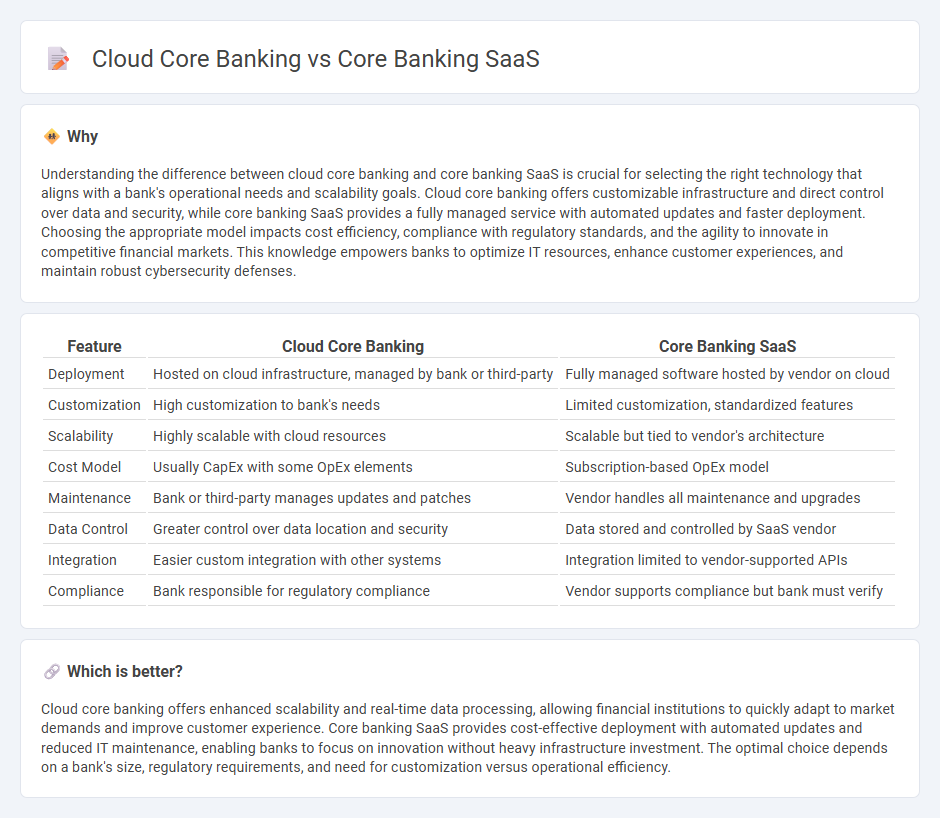

Understanding the difference between cloud core banking and core banking SaaS is crucial for selecting the right technology that aligns with a bank's operational needs and scalability goals. Cloud core banking offers customizable infrastructure and direct control over data and security, while core banking SaaS provides a fully managed service with automated updates and faster deployment. Choosing the appropriate model impacts cost efficiency, compliance with regulatory standards, and the agility to innovate in competitive financial markets. This knowledge empowers banks to optimize IT resources, enhance customer experiences, and maintain robust cybersecurity defenses.

Comparison Table

| Feature | Cloud Core Banking | Core Banking SaaS |

|---|---|---|

| Deployment | Hosted on cloud infrastructure, managed by bank or third-party | Fully managed software hosted by vendor on cloud |

| Customization | High customization to bank's needs | Limited customization, standardized features |

| Scalability | Highly scalable with cloud resources | Scalable but tied to vendor's architecture |

| Cost Model | Usually CapEx with some OpEx elements | Subscription-based OpEx model |

| Maintenance | Bank or third-party manages updates and patches | Vendor handles all maintenance and upgrades |

| Data Control | Greater control over data location and security | Data stored and controlled by SaaS vendor |

| Integration | Easier custom integration with other systems | Integration limited to vendor-supported APIs |

| Compliance | Bank responsible for regulatory compliance | Vendor supports compliance but bank must verify |

Which is better?

Cloud core banking offers enhanced scalability and real-time data processing, allowing financial institutions to quickly adapt to market demands and improve customer experience. Core banking SaaS provides cost-effective deployment with automated updates and reduced IT maintenance, enabling banks to focus on innovation without heavy infrastructure investment. The optimal choice depends on a bank's size, regulatory requirements, and need for customization versus operational efficiency.

Connection

Cloud core banking leverages cloud technology to deliver core banking services, enabling scalable, flexible, and cost-effective operations. Core banking SaaS (Software as a Service) platforms provide these essential banking functions through cloud-based applications, allowing banks to access and manage accounts, transactions, and customer data remotely. Together, cloud core banking and core banking SaaS facilitate enhanced digital transformation, real-time processing, and seamless integration of banking services.

Key Terms

Multi-tenancy

Core banking SaaS platforms inherently support multi-tenancy, enabling multiple banks to securely share a single instance of software while maintaining data isolation and customization through configurable modules. Cloud core banking solutions leverage distributed cloud infrastructure to enhance scalability, uptime, and performance but may offer both single-tenant and multi-tenant deployments depending on business needs. Explore the nuances of multi-tenancy in core banking to optimize operational efficiency and cost-effectiveness.

On-premises integration

Core banking SaaS offers cloud-based solutions with flexible on-premises integration through APIs and middleware, enabling seamless connectivity with existing local systems. Cloud core banking platforms provide fully managed environments that simplify scalability and maintenance but may pose challenges in deeply embedding with complex on-premises infrastructure. Explore detailed comparisons to determine which approach best supports your organization's integration needs.

Scalability

Core banking SaaS solutions offer scalable infrastructure through multi-tenant architecture, enabling banks to quickly adapt to changing workloads without significant hardware investments. Cloud core banking platforms provide elasticity by dynamically allocating resources across distributed networks, ensuring optimal performance during peak demand. Discover how these scalable technologies can transform your banking operations for future growth.

Source and External Links

Temenos SaaS | Core, Digital & AI as-a-Service - Temenos SaaS delivers cloud-based core banking, digital banking, and AI services, enabling banks to accelerate digital transformation, rapidly launch new products, and reduce IT management overhead while focusing on customer experience.

SaaScada: Data Driven SaaS Core Banking Software - SaaScada offers a data-driven, cloud-native core banking platform that emphasizes real-time insights, rapid product configuration, and fast deployment, allowing financial institutions to innovate and adapt quickly to changing market needs.

Core Banking Software and Solutions | Oracle - Oracle provides modular, cloud-native core banking SaaS solutions designed for scalability, automation, and seamless integration across front, middle, and back offices to support modern digital banks and evolving business models.

dowidth.com

dowidth.com