Personal financial management tools offer users comprehensive budgeting, expense tracking, and goal-setting features to optimize everyday money management. Investment platforms focus on facilitating asset allocation, portfolio diversification, and real-time market analysis for wealth growth. Explore how each solution can enhance your financial strategy and meet your unique needs.

Why it is important

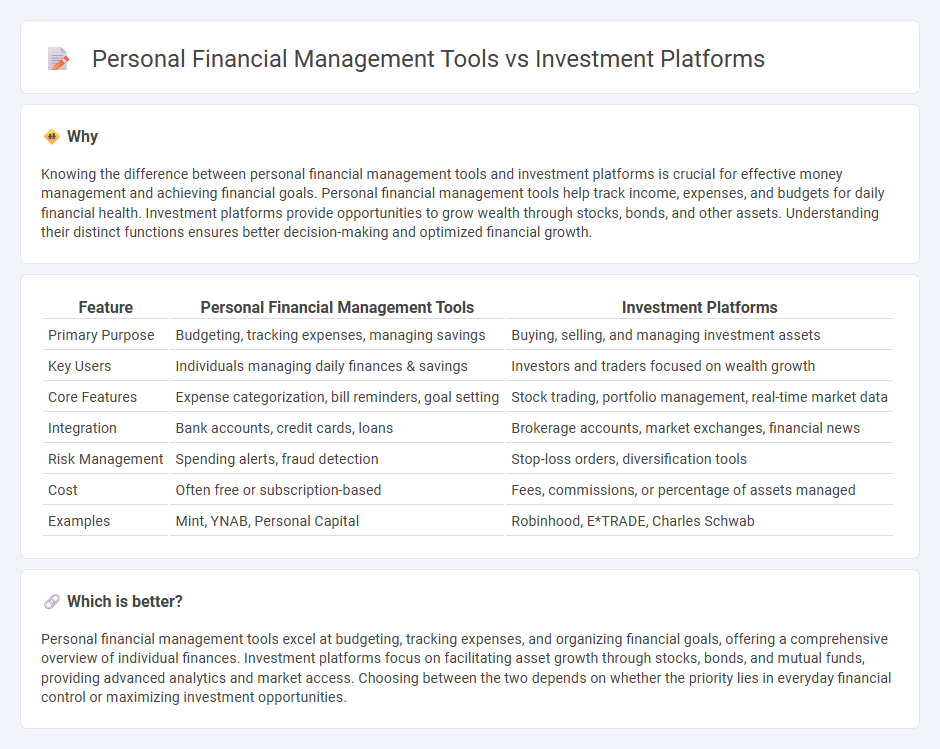

Knowing the difference between personal financial management tools and investment platforms is crucial for effective money management and achieving financial goals. Personal financial management tools help track income, expenses, and budgets for daily financial health. Investment platforms provide opportunities to grow wealth through stocks, bonds, and other assets. Understanding their distinct functions ensures better decision-making and optimized financial growth.

Comparison Table

| Feature | Personal Financial Management Tools | Investment Platforms |

|---|---|---|

| Primary Purpose | Budgeting, tracking expenses, managing savings | Buying, selling, and managing investment assets |

| Key Users | Individuals managing daily finances & savings | Investors and traders focused on wealth growth |

| Core Features | Expense categorization, bill reminders, goal setting | Stock trading, portfolio management, real-time market data |

| Integration | Bank accounts, credit cards, loans | Brokerage accounts, market exchanges, financial news |

| Risk Management | Spending alerts, fraud detection | Stop-loss orders, diversification tools |

| Cost | Often free or subscription-based | Fees, commissions, or percentage of assets managed |

| Examples | Mint, YNAB, Personal Capital | Robinhood, E*TRADE, Charles Schwab |

Which is better?

Personal financial management tools excel at budgeting, tracking expenses, and organizing financial goals, offering a comprehensive overview of individual finances. Investment platforms focus on facilitating asset growth through stocks, bonds, and mutual funds, providing advanced analytics and market access. Choosing between the two depends on whether the priority lies in everyday financial control or maximizing investment opportunities.

Connection

Personal financial management tools aggregate data from various bank accounts, credit cards, and loans to provide users with a comprehensive view of their financial health, enabling better budgeting and expense tracking. Investment platforms often integrate with these tools to offer tailored investment recommendations based on real-time cash flow and net worth analysis. This seamless connection allows users to optimize asset allocation and make informed decisions to grow their portfolios while maintaining financial discipline.

Key Terms

Asset Allocation

Investment platforms provide robust features for asset allocation by offering diversified portfolios, real-time market data, and automated rebalancing tailored to investor risk profiles. Personal financial management tools track net worth and spending habits but often lack sophisticated asset allocation strategies essential for portfolio optimization. Explore our detailed comparison to understand which solution better aligns with your financial goals.

Portfolio Tracking

Investment platforms provide advanced portfolio tracking features that offer real-time asset allocation, performance analytics, and automatic trade execution capabilities tailored for active investors. Personal financial management tools focus on aggregating overall financial data, including budgets, expenses, and net worth, while offering simplified portfolio tracking with less emphasis on trading functionalities. Explore the best portfolio tracking solutions to optimize your investment strategy.

Budgeting

Investment platforms primarily facilitate the buying, selling, and management of financial assets, while personal financial management tools emphasize budgeting by tracking income, expenses, and cash flow. Budgeting features in financial management apps provide users with real-time spending insights and customizable alerts to help control finances effectively. Explore comprehensive comparisons to understand which solution best fits your financial goals.

Source and External Links

9 best investing platforms for 2025: Low-cost options to put your ... - Offers a comparison of top investment platforms like Public and Fidelity, highlighting features such as commission-free trades, fractional shares, social investing, and research tools suitable for various investor types.

Trading platforms and research - Fidelity Investments - Details Fidelity's range of trading platforms from beginner to advanced users, including mobile apps, web-based tools, and the powerful Active Trader Pro, with extensive research and analytics.

Fundrise - Focuses on private market investment opportunities, including real estate, venture capital, and private credit, through a technology-driven platform aiming to democratize access to institutional-quality assets.

dowidth.com

dowidth.com