Virtual cards offer enhanced security features and convenience compared to cash, reducing the risk of theft and fraud in digital transactions. These cards allow users to generate unique card numbers for online purchases, providing greater control over spending and protecting sensitive financial information. Explore the benefits of virtual cards and how they are transforming modern banking.

Why it is important

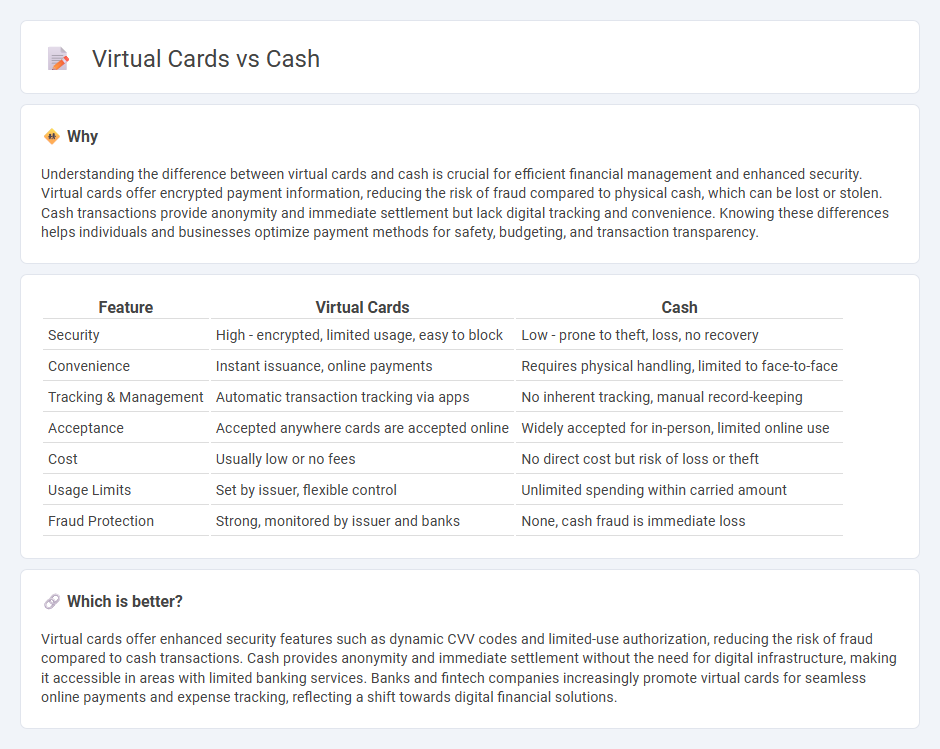

Understanding the difference between virtual cards and cash is crucial for efficient financial management and enhanced security. Virtual cards offer encrypted payment information, reducing the risk of fraud compared to physical cash, which can be lost or stolen. Cash transactions provide anonymity and immediate settlement but lack digital tracking and convenience. Knowing these differences helps individuals and businesses optimize payment methods for safety, budgeting, and transaction transparency.

Comparison Table

| Feature | Virtual Cards | Cash |

|---|---|---|

| Security | High - encrypted, limited usage, easy to block | Low - prone to theft, loss, no recovery |

| Convenience | Instant issuance, online payments | Requires physical handling, limited to face-to-face |

| Tracking & Management | Automatic transaction tracking via apps | No inherent tracking, manual record-keeping |

| Acceptance | Accepted anywhere cards are accepted online | Widely accepted for in-person, limited online use |

| Cost | Usually low or no fees | No direct cost but risk of loss or theft |

| Usage Limits | Set by issuer, flexible control | Unlimited spending within carried amount |

| Fraud Protection | Strong, monitored by issuer and banks | None, cash fraud is immediate loss |

Which is better?

Virtual cards offer enhanced security features such as dynamic CVV codes and limited-use authorization, reducing the risk of fraud compared to cash transactions. Cash provides anonymity and immediate settlement without the need for digital infrastructure, making it accessible in areas with limited banking services. Banks and fintech companies increasingly promote virtual cards for seamless online payments and expense tracking, reflecting a shift towards digital financial solutions.

Connection

Virtual cards provide a secure digital alternative to cash by allowing users to make online and in-store payments without physical currency. These cards link directly to bank accounts or digital wallets, facilitating instant transactions that mimic the convenience and liquidity of cash. The integration of virtual cards with mobile banking apps enhances financial flexibility while reducing risks associated with carrying or handling cash.

Key Terms

Physical Card

Physical cards offer tangible benefits like immediate access to funds and widespread acceptance at retail locations and ATMs, providing convenience for everyday purchases and cash withdrawals. These cards reduce the risk of fraud through EMV chip technology and offer a clear spending limit, making budgeting easier. Explore the advantages of physical cards to understand their role in your financial management.

Digital Wallet

Digital wallets seamlessly store virtual cards, enabling instant, contactless payments without the need for physical cash or cards. Virtual cards offer enhanced security features such as tokenization and temporary card numbers, reducing fraud risks compared to traditional cash transactions. Explore the benefits of digital wallets and virtual cards to revolutionize your payment experience.

Tokenization

Tokenization enhances security by replacing sensitive card information with unique tokens, minimizing fraud risks for both cash and virtual card transactions. Virtual cards leverage tokenization more effectively, enabling dynamic, single-use tokens for online payments, unlike traditional cash which relies on physical presence and lacks tokenization benefits. Explore how tokenization transforms payment security in cash and virtual card use.

Source and External Links

Cash - Wikipedia - Cash is physical currency like banknotes and coins, held for transactions, precautionary, or speculative motives, and used for anonymous payments, value preservation, and other social and economic functions.

Cash App - Wikipedia - Cash App is a digital wallet launched by Block, Inc., allowing U.S. users to send/receive money, access debit cards, invest, and file taxes, with over 57 million users as of 2024.

Make Money Fast The Ultimate Guide to Getting Free Cash App Money - This guide explains Cash App as a mobile payment service and warns against scams like "free Cash App money generators," emphasizing safe ways to use the platform for payments, debit cards, and bitcoin transactions.

dowidth.com

dowidth.com