Banking as a Service (BaaS) provides third-party companies with licensed banking infrastructure to offer financial products directly to customers, streamlining the integration of banking services into non-bank platforms. Challenger banks operate independently with fully digital platforms, focusing on innovative user experiences and niche markets without relying on traditional banking systems. Explore how these models are transforming the financial landscape and redefining customer engagement.

Why it is important

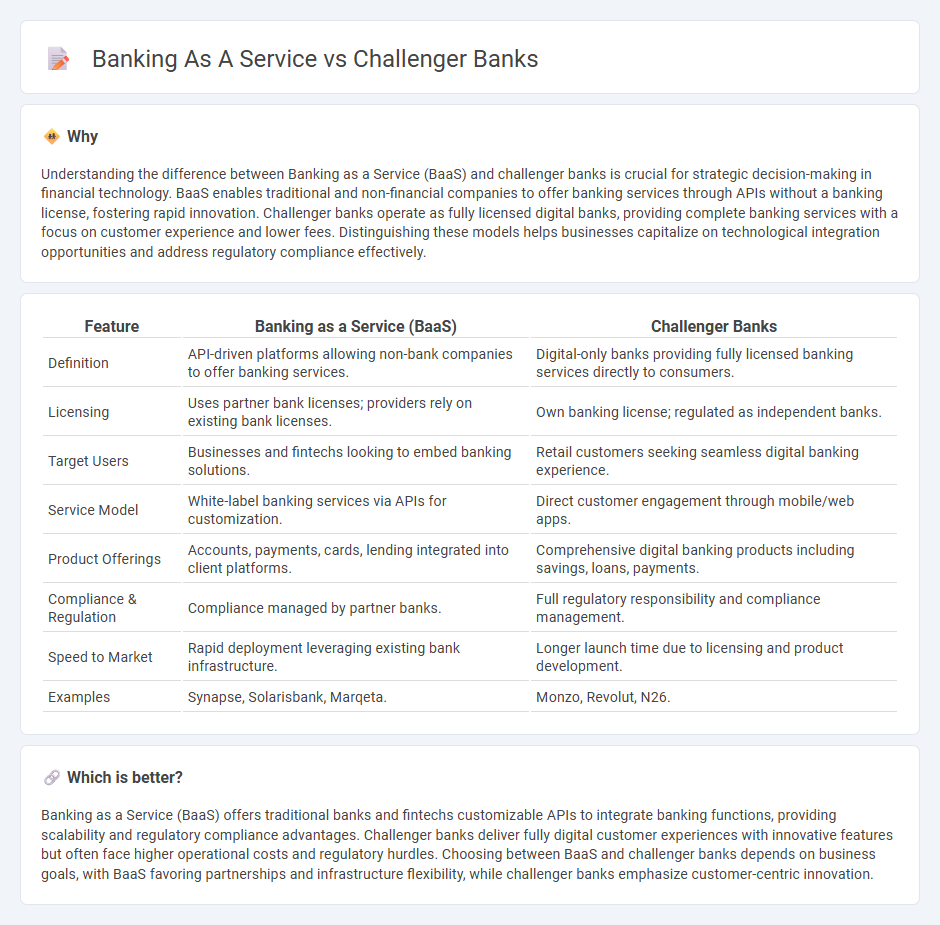

Understanding the difference between Banking as a Service (BaaS) and challenger banks is crucial for strategic decision-making in financial technology. BaaS enables traditional and non-financial companies to offer banking services through APIs without a banking license, fostering rapid innovation. Challenger banks operate as fully licensed digital banks, providing complete banking services with a focus on customer experience and lower fees. Distinguishing these models helps businesses capitalize on technological integration opportunities and address regulatory compliance effectively.

Comparison Table

| Feature | Banking as a Service (BaaS) | Challenger Banks |

|---|---|---|

| Definition | API-driven platforms allowing non-bank companies to offer banking services. | Digital-only banks providing fully licensed banking services directly to consumers. |

| Licensing | Uses partner bank licenses; providers rely on existing bank licenses. | Own banking license; regulated as independent banks. |

| Target Users | Businesses and fintechs looking to embed banking solutions. | Retail customers seeking seamless digital banking experience. |

| Service Model | White-label banking services via APIs for customization. | Direct customer engagement through mobile/web apps. |

| Product Offerings | Accounts, payments, cards, lending integrated into client platforms. | Comprehensive digital banking products including savings, loans, payments. |

| Compliance & Regulation | Compliance managed by partner banks. | Full regulatory responsibility and compliance management. |

| Speed to Market | Rapid deployment leveraging existing bank infrastructure. | Longer launch time due to licensing and product development. |

| Examples | Synapse, Solarisbank, Marqeta. | Monzo, Revolut, N26. |

Which is better?

Banking as a Service (BaaS) offers traditional banks and fintechs customizable APIs to integrate banking functions, providing scalability and regulatory compliance advantages. Challenger banks deliver fully digital customer experiences with innovative features but often face higher operational costs and regulatory hurdles. Choosing between BaaS and challenger banks depends on business goals, with BaaS favoring partnerships and infrastructure flexibility, while challenger banks emphasize customer-centric innovation.

Connection

Banking as a Service (BaaS) enables challenger banks to offer tailored digital financial solutions by leveraging third-party infrastructure and APIs, accelerating their market entry. Challenger banks utilize BaaS platforms to bypass traditional banking system constraints, providing seamless user experiences, enhanced scalability, and regulatory compliance. This synergy fosters innovation in the fintech ecosystem, driving customer-centric banking products and expanding financial inclusion.

Key Terms

Digital-Only Banks

Digital-only banks leverage challenger bank models by offering streamlined, tech-driven banking services without physical branches, maximizing user experience through mobile-first platforms and real-time financial management. Banking as a Service (BaaS) enables traditional and non-bank companies to integrate financial services via APIs, expanding the digital-only bank ecosystem with customizable products and faster market entry. Explore in-depth comparisons and growth trends in digital-only banking innovations to understand their impact on the financial landscape.

White-Label Banking

Challenger banks are fully licensed digital banks offering direct financial services, while Banking as a Service (BaaS) provides white-label banking infrastructure that allows third parties to offer customized financial products under their own brand. White-label banking in the BaaS model leverages APIs to enable rapid deployment of banking services without the need for full banking licenses, reducing costs and accelerating go-to-market timelines. Explore the key differences and strategic benefits to determine which solution aligns best with your fintech goals.

API Integration

Challenger banks leverage API integration to deliver seamless, user-centric financial services through fully digital platforms, prioritizing direct customer interaction and innovative banking features. Banking as a Service (BaaS) provides embedded financial services via APIs to third-party businesses, enabling them to offer banking functionalities without becoming licensed banks. Explore how API-driven models redefine modern banking and streamline financial product delivery.

Source and External Links

Challenger Banks Explained: Trends and Opportunities - Ulam Labs - Challenger banks are digital-first financial institutions that challenge traditional banks by offering innovative digital banking solutions, with the global market projected to grow rapidly from USD 118 billion in 2023 to over USD 2,597 billion by 2031, highlighted by major players like UK's Monzo and Brazil's Nubank expanding significantly.

The Rise of Challenger Banks: Are the Apps Taking Over? - FT Partners - Challenger banks are reshaping the global banking sector by competing strongly with traditional banks and blurring lines with other financial service providers, prompting incumbents to launch FinTech arms in response to this growing trend.

Challenger Bank Definition - FinTech Weekly - Challenger banks, often called neo banks, are typically smaller, technologically modern banks that focus on customer-centric digital financial services to compete against established banks, especially emerging after the UK regulatory changes starting in 2010.

dowidth.com

dowidth.com