Digital KYC transforms customer verification by leveraging biometric authentication, AI-driven identity checks, and blockchain technology to enhance security and speed. Centralized KYC relies on a single entity managing customer data, often resulting in slower processes and increased risk of data breaches. Explore how digital KYC is revolutionizing banking compliance and customer experience.

Why it is important

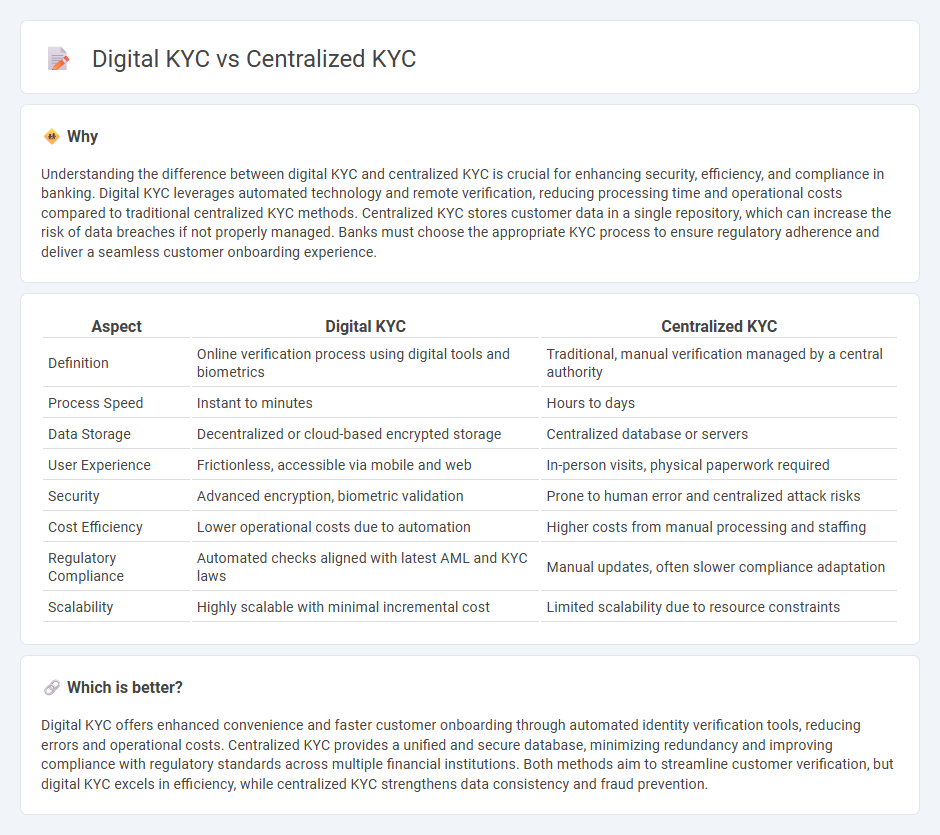

Understanding the difference between digital KYC and centralized KYC is crucial for enhancing security, efficiency, and compliance in banking. Digital KYC leverages automated technology and remote verification, reducing processing time and operational costs compared to traditional centralized KYC methods. Centralized KYC stores customer data in a single repository, which can increase the risk of data breaches if not properly managed. Banks must choose the appropriate KYC process to ensure regulatory adherence and deliver a seamless customer onboarding experience.

Comparison Table

| Aspect | Digital KYC | Centralized KYC |

|---|---|---|

| Definition | Online verification process using digital tools and biometrics | Traditional, manual verification managed by a central authority |

| Process Speed | Instant to minutes | Hours to days |

| Data Storage | Decentralized or cloud-based encrypted storage | Centralized database or servers |

| User Experience | Frictionless, accessible via mobile and web | In-person visits, physical paperwork required |

| Security | Advanced encryption, biometric validation | Prone to human error and centralized attack risks |

| Cost Efficiency | Lower operational costs due to automation | Higher costs from manual processing and staffing |

| Regulatory Compliance | Automated checks aligned with latest AML and KYC laws | Manual updates, often slower compliance adaptation |

| Scalability | Highly scalable with minimal incremental cost | Limited scalability due to resource constraints |

Which is better?

Digital KYC offers enhanced convenience and faster customer onboarding through automated identity verification tools, reducing errors and operational costs. Centralized KYC provides a unified and secure database, minimizing redundancy and improving compliance with regulatory standards across multiple financial institutions. Both methods aim to streamline customer verification, but digital KYC excels in efficiency, while centralized KYC strengthens data consistency and fraud prevention.

Connection

Digital KYC and centralized KYC are interconnected processes that streamline customer identity verification by leveraging technology and centralized databases. Digital KYC enables online submission and validation of KYC documents, while centralized KYC consolidates this information in a unified platform accessible by multiple financial institutions. This integration reduces duplication, enhances compliance with anti-money laundering regulations, and accelerates customer onboarding in the banking sector.

Key Terms

Data Repository

Centralized KYC systems rely on a single, secure data repository to store and manage customer identity information, enhancing data consistency and regulatory compliance. Digital KYC leverages advanced technologies like biometrics and blockchain to create decentralized or distributed data repositories, improving data security and real-time verification. Explore the advantages and challenges of these KYC data management approaches to optimize compliance and user experience.

Remote Verification

Centralized KYC systems rely on a single authority to verify customer identities, often causing delays and increased risk of data breaches. Digital KYC leverages remote verification technologies like biometric authentication, video calls, and AI-driven identity checks to expedite onboarding and enhance security. Explore the benefits and implementation strategies of remote digital KYC to revolutionize your compliance processes.

Customer Consent

Centralized KYC systems typically store customer data in a unified database controlled by a single authority, which can raise concerns about data privacy and consent management. Digital KYC emphasizes real-time, customer-driven consent mechanisms using blockchain or secure digital signatures to ensure transparency and control over personal information sharing. Explore how these approaches impact compliance and user trust in financial services.

Source and External Links

Central KYC (C-KYC) - PwC - C-KYC is a centralized registry for storing and verifying customer KYC information, enabling financial institutions to access and share verified customer data, improving onboarding efficiency and compliance oversight.

How to Complete Central KYC and Check CKYC Number - ClearTax - The CKYC system in India, managed by CERSAI, allows individuals to complete KYC once for all financial services, eliminating the need for repeated document submission across different institutions.

Central Know Your Customers (CKYC) FAQs | ICICI Prulife - Customers submit standard documents to their financial institution, which registers the details with the central CKYC registry, and receive a unique 14-digit KYC Identifier Number (KIN) for future transactions.

dowidth.com

dowidth.com