Invisible payments leverage technologies like biometric authentication and tokenization to enable seamless transactions without physical interaction, enhancing security and convenience. Contactless cards use NFC technology to allow quick tap-to-pay functionality while maintaining encryption standards to protect user data. Explore how these payment methods are transforming the future of cashless transactions.

Why it is important

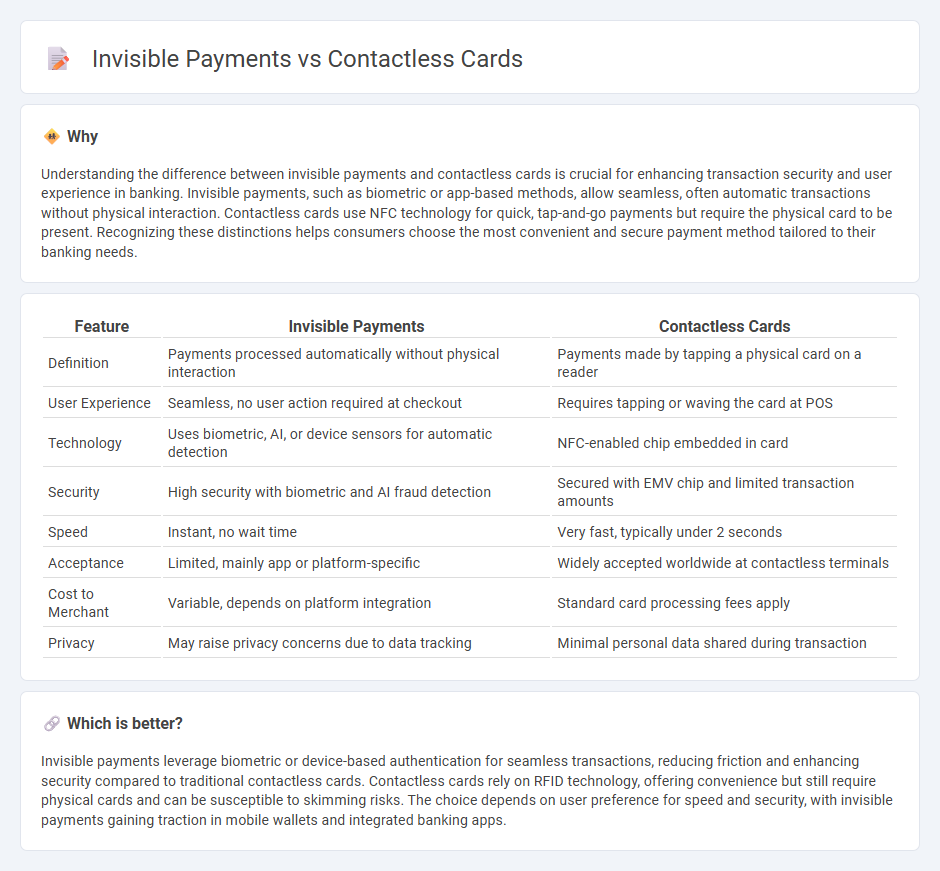

Understanding the difference between invisible payments and contactless cards is crucial for enhancing transaction security and user experience in banking. Invisible payments, such as biometric or app-based methods, allow seamless, often automatic transactions without physical interaction. Contactless cards use NFC technology for quick, tap-and-go payments but require the physical card to be present. Recognizing these distinctions helps consumers choose the most convenient and secure payment method tailored to their banking needs.

Comparison Table

| Feature | Invisible Payments | Contactless Cards |

|---|---|---|

| Definition | Payments processed automatically without physical interaction | Payments made by tapping a physical card on a reader |

| User Experience | Seamless, no user action required at checkout | Requires tapping or waving the card at POS |

| Technology | Uses biometric, AI, or device sensors for automatic detection | NFC-enabled chip embedded in card |

| Security | High security with biometric and AI fraud detection | Secured with EMV chip and limited transaction amounts |

| Speed | Instant, no wait time | Very fast, typically under 2 seconds |

| Acceptance | Limited, mainly app or platform-specific | Widely accepted worldwide at contactless terminals |

| Cost to Merchant | Variable, depends on platform integration | Standard card processing fees apply |

| Privacy | May raise privacy concerns due to data tracking | Minimal personal data shared during transaction |

Which is better?

Invisible payments leverage biometric or device-based authentication for seamless transactions, reducing friction and enhancing security compared to traditional contactless cards. Contactless cards rely on RFID technology, offering convenience but still require physical cards and can be susceptible to skimming risks. The choice depends on user preference for speed and security, with invisible payments gaining traction in mobile wallets and integrated banking apps.

Connection

Invisible payments rely on contactless card technology, enabling seamless transactions without physical cash or card swipes. These payments use near field communication (NFC) and tokenization to enhance security and speed at retail points of sale. Contactless cards serve as the primary instrument for invisible payments, promoting convenience in modern banking.

Key Terms

Near Field Communication (NFC)

Near Field Communication (NFC) technology enables secure and quick transactions in both contactless cards and invisible payments, with contactless cards requiring a physical tap while invisible payments operate seamlessly in the background through devices like smartphones and wearables. Contactless cards offer familiarity and widespread acceptance, whereas invisible payments emphasize convenience and speed by eliminating the need for direct user interaction. Explore the detailed nuances and future trends of NFC-powered payment systems to understand their impact on modern financial transactions.

Tokenization

Tokenization plays a crucial role in both contactless cards and invisible payments by replacing sensitive account information with unique digital tokens, enhancing security and reducing fraud. Contactless cards utilize tokenization to protect card data during tap-to-pay transactions, while invisible payments embed tokenization within background processes for seamless and secure purchases without user interaction. Explore how tokenization is revolutionizing payment security and convenience across these technologies.

Biometric Authentication

Biometric authentication enhances contactless cards by integrating fingerprint or facial recognition, ensuring secure and seamless transactions. Invisible payments leverage biometrics paired with AI for frictionless, behind-the-scenes processing in retail and mobile environments. Explore how biometric solutions are revolutionizing payment security and convenience today.

Source and External Links

What Is a Contactless Card & How Does It Work? | Capital One - Contactless cards enable fast payments by tapping or holding the card over a reader using wireless technology and are safer and faster than swiping or inserting the card.

What is a Contactless Credit Card - Chase.com - Contactless cards use near-field communication (NFC) to securely transmit payment data when tapped near a compatible terminal, making payments faster and more convenient globally.

Contactless payment - Wikipedia - Contactless payment systems use RFID or NFC technology to allow cardholders and devices to wave their cards or phones near a reader for secure, close proximity payments without physical contact.

dowidth.com

dowidth.com