Green financing focuses on funding projects that deliver clear environmental benefits, such as renewable energy or sustainable agriculture, by mobilizing capital specifically for eco-friendly initiatives. Blended finance combines public or philanthropic funds with private investment to mitigate risks and attract greater capital flow into sustainable development projects, enhancing financial viability. Explore how these innovative funding mechanisms transform the future of sustainable banking.

Why it is important

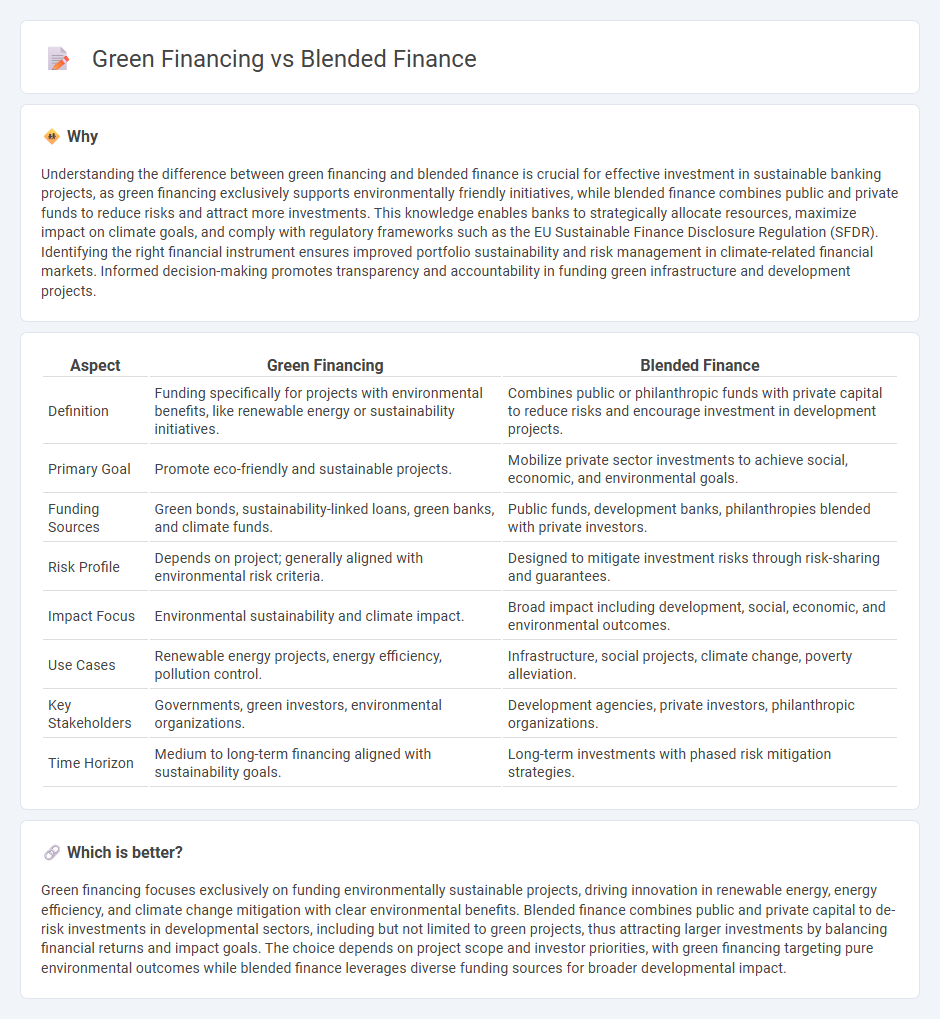

Understanding the difference between green financing and blended finance is crucial for effective investment in sustainable banking projects, as green financing exclusively supports environmentally friendly initiatives, while blended finance combines public and private funds to reduce risks and attract more investments. This knowledge enables banks to strategically allocate resources, maximize impact on climate goals, and comply with regulatory frameworks such as the EU Sustainable Finance Disclosure Regulation (SFDR). Identifying the right financial instrument ensures improved portfolio sustainability and risk management in climate-related financial markets. Informed decision-making promotes transparency and accountability in funding green infrastructure and development projects.

Comparison Table

| Aspect | Green Financing | Blended Finance |

|---|---|---|

| Definition | Funding specifically for projects with environmental benefits, like renewable energy or sustainability initiatives. | Combines public or philanthropic funds with private capital to reduce risks and encourage investment in development projects. |

| Primary Goal | Promote eco-friendly and sustainable projects. | Mobilize private sector investments to achieve social, economic, and environmental goals. |

| Funding Sources | Green bonds, sustainability-linked loans, green banks, and climate funds. | Public funds, development banks, philanthropies blended with private investors. |

| Risk Profile | Depends on project; generally aligned with environmental risk criteria. | Designed to mitigate investment risks through risk-sharing and guarantees. |

| Impact Focus | Environmental sustainability and climate impact. | Broad impact including development, social, economic, and environmental outcomes. |

| Use Cases | Renewable energy projects, energy efficiency, pollution control. | Infrastructure, social projects, climate change, poverty alleviation. |

| Key Stakeholders | Governments, green investors, environmental organizations. | Development agencies, private investors, philanthropic organizations. |

| Time Horizon | Medium to long-term financing aligned with sustainability goals. | Long-term investments with phased risk mitigation strategies. |

Which is better?

Green financing focuses exclusively on funding environmentally sustainable projects, driving innovation in renewable energy, energy efficiency, and climate change mitigation with clear environmental benefits. Blended finance combines public and private capital to de-risk investments in developmental sectors, including but not limited to green projects, thus attracting larger investments by balancing financial returns and impact goals. The choice depends on project scope and investor priorities, with green financing targeting pure environmental outcomes while blended finance leverages diverse funding sources for broader developmental impact.

Connection

Green financing and blended finance are interconnected through their shared goal of mobilizing capital for sustainable development projects, especially in the banking sector. Green financing involves directing funds toward environmentally friendly initiatives, while blended finance uses a combination of public and private investments to reduce risks and attract more funding for these projects. Banks leverage blended finance structures to enhance green financing by combining concessional funds with market-rate capital, enabling larger-scale investments in renewable energy, sustainable infrastructure, and climate resilience.

Key Terms

Blended Finance:

Blended finance leverages public or philanthropic capital to attract private investment for sustainable development projects, mitigating risks and improving financial returns. It enables underserved sectors to access funding by combining concessional and commercial resources, stimulating economic growth and social impact. Explore how blended finance can unlock capital for impactful green projects and transform sustainable investment strategies.

Concessional Capital

Blended finance leverages concessional capital as a strategic tool to de-risk investments and attract private sector funding by combining grants, concessional loans, or guarantees with commercial finance, aiming to scale impact in sectors like clean energy and infrastructure. Green financing primarily targets environmentally sustainable projects and can include both concessional and commercial components, but concessional capital in this context often subsidizes higher-risk or early-stage green innovations. Explore further to understand how concessional capital shapes the effectiveness and reach of blended finance versus green financing frameworks.

Risk Sharing

Blended finance combines public and private funds to share risks and mobilize capital for sustainable development, enhancing investment viability in emerging markets. Green financing specifically targets funding for environmentally sustainable projects, often with risk mitigation instruments to attract private investors. Explore how risk-sharing mechanisms differ between these approaches to optimize financial impact.

Source and External Links

Blended Finance Working Group - The GIIN - Blended finance combines capital from investors with different risk-return objectives, enabling market-rate seekers and impact-focused investors to co-invest and make high-impact projects financially viable by restructuring risk and return layers.

Blended Finance | Convergence - Blended finance uses catalytic public or philanthropic capital to attract private sector investment in sustainable development, addressing barriers like high risk and low returns to unlock new opportunities, especially in developing countries.

Blended Finance | Wikipedia - Blended finance strategically employs development and philanthropic funds to mobilize private capital into emerging markets, scaling up financing for projects that support the UN Sustainable Development Goals and help close global funding gaps.

dowidth.com

dowidth.com