Debt recycling enhances wealth-building potential by converting non-deductible home loan debt into tax-deductible investment debt, optimizing loan structures for financial growth. Loan portability simplifies transferring an existing mortgage to a new property without incurring early repayment penalties, maintaining original loan terms and interest rates. Discover how these financial strategies can maximize your borrowing efficiency and investment returns.

Why it is important

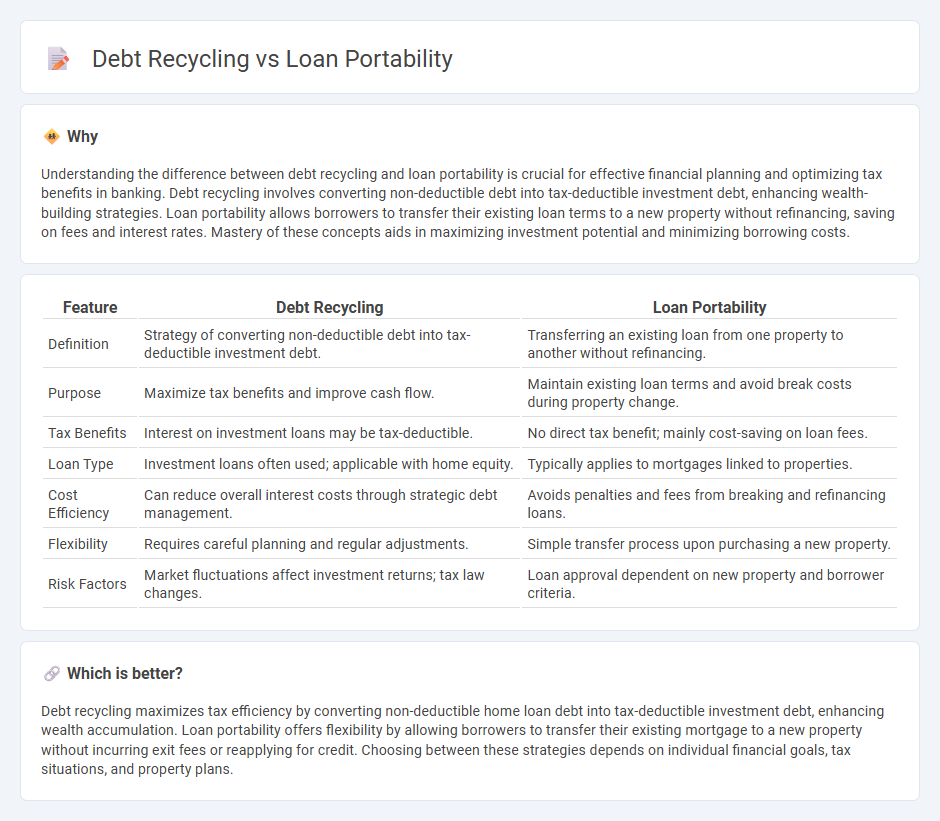

Understanding the difference between debt recycling and loan portability is crucial for effective financial planning and optimizing tax benefits in banking. Debt recycling involves converting non-deductible debt into tax-deductible investment debt, enhancing wealth-building strategies. Loan portability allows borrowers to transfer their existing loan terms to a new property without refinancing, saving on fees and interest rates. Mastery of these concepts aids in maximizing investment potential and minimizing borrowing costs.

Comparison Table

| Feature | Debt Recycling | Loan Portability |

|---|---|---|

| Definition | Strategy of converting non-deductible debt into tax-deductible investment debt. | Transferring an existing loan from one property to another without refinancing. |

| Purpose | Maximize tax benefits and improve cash flow. | Maintain existing loan terms and avoid break costs during property change. |

| Tax Benefits | Interest on investment loans may be tax-deductible. | No direct tax benefit; mainly cost-saving on loan fees. |

| Loan Type | Investment loans often used; applicable with home equity. | Typically applies to mortgages linked to properties. |

| Cost Efficiency | Can reduce overall interest costs through strategic debt management. | Avoids penalties and fees from breaking and refinancing loans. |

| Flexibility | Requires careful planning and regular adjustments. | Simple transfer process upon purchasing a new property. |

| Risk Factors | Market fluctuations affect investment returns; tax law changes. | Loan approval dependent on new property and borrower criteria. |

Which is better?

Debt recycling maximizes tax efficiency by converting non-deductible home loan debt into tax-deductible investment debt, enhancing wealth accumulation. Loan portability offers flexibility by allowing borrowers to transfer their existing mortgage to a new property without incurring exit fees or reapplying for credit. Choosing between these strategies depends on individual financial goals, tax situations, and property plans.

Connection

Debt recycling leverages existing home equity to convert non-deductible debt into tax-deductible investment loans, enhancing wealth creation. Loan portability allows borrowers to transfer their home loan balance and terms to a new property without refinancing, preserving benefits like interest rates and terms. Together, these strategies optimize borrowing efficiency and financial flexibility within the banking sector.

Key Terms

Loan Transfer

Loan portability allows borrowers to transfer their existing loan balance to a new lender without incurring break costs, facilitating better interest rates or loan terms. Debt recycling involves converting non-deductible home loan debt into tax-deductible investment debt by strategically refinancing, which may include a loan transfer as part of the process. Discover how loan transfer can optimize your financial strategy by exploring the differences between loan portability and debt recycling.

Equity Release

Loan portability allows homeowners to transfer their existing mortgage to a new property, preserving favorable interest rates and loan terms without incurring early repayment penalties. Debt recycling, particularly through equity release strategies, involves converting non-deductible debt into tax-deductible investment debt by using the home's equity to invest, aiming to build wealth over time. Explore comprehensive guides and financial advice to understand which strategy best leverages your home equity for optimal financial growth.

Tax Efficiency

Loan portability allows borrowers to transfer their existing mortgage balance to a new property without incurring penalties, optimizing mortgage interest deductions and maintaining tax efficiency. Debt recycling, on the other hand, leverages home loan funds to invest in income-producing assets, converting non-deductible debt into tax-deductible investment debt and enhancing after-tax returns. Explore more to understand how combining these strategies can maximize your financial and tax benefits.

Source and External Links

How does home loan portability work? - NerdWallet Australia - Home loan portability allows you to transfer your existing mortgage--including balance, interest rate, and features--to a new property when you sell your old home, provided you meet your lender's eligibility criteria.

What Is Loan Portability? - Mortgage Choice - Loan portability is a feature that lets you keep your current home loan product while changing the property that secures the mortgage, simplifying the process of moving homes.

Debt Portability Provisions in Loan Agreements | CLE Webinar - Debt portability in corporate finance allows companies to maintain existing debt facilities during ownership changes, offering an exception to standard "change of control" clauses and reducing transaction costs for M&A deals.

dowidth.com

dowidth.com