Digital onboarding uses automated verification technologies to enable customers to open bank accounts quickly via smartphones or computers, increasing convenience and reducing operational costs. Agent-assisted onboarding provides personalized support through bank representatives, ensuring compliance and helping customers who may face difficulties with digital platforms. Explore the benefits and challenges of both onboarding methods to determine the best fit for your banking needs.

Why it is important

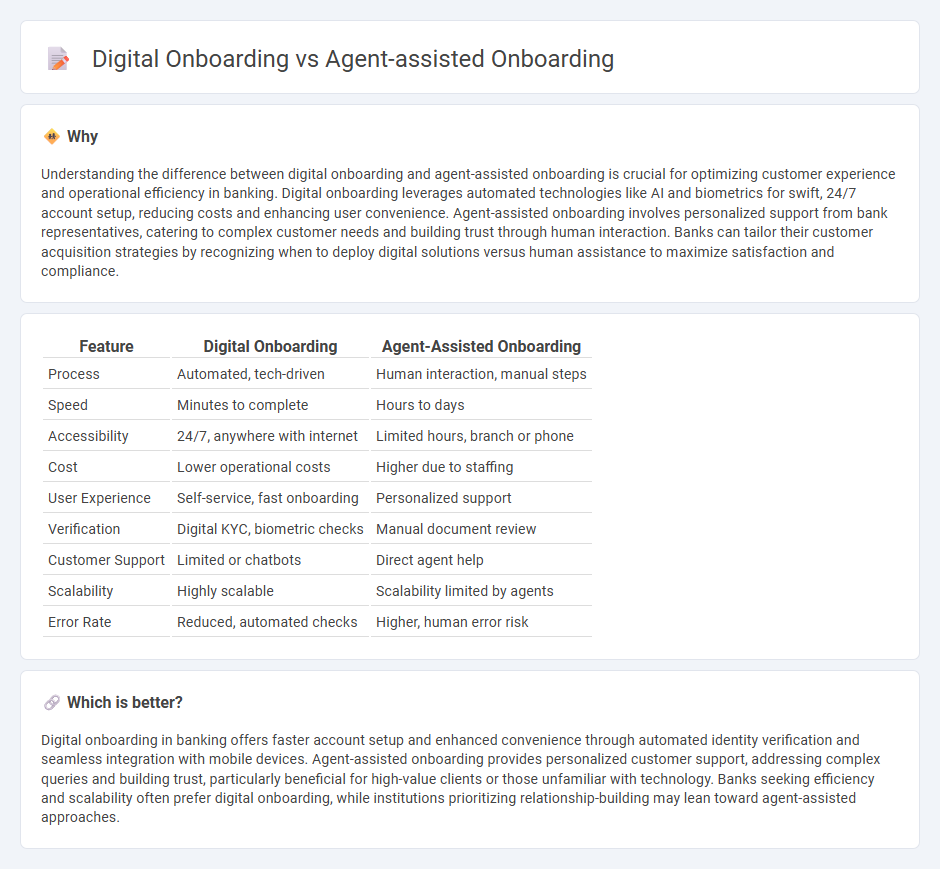

Understanding the difference between digital onboarding and agent-assisted onboarding is crucial for optimizing customer experience and operational efficiency in banking. Digital onboarding leverages automated technologies like AI and biometrics for swift, 24/7 account setup, reducing costs and enhancing user convenience. Agent-assisted onboarding involves personalized support from bank representatives, catering to complex customer needs and building trust through human interaction. Banks can tailor their customer acquisition strategies by recognizing when to deploy digital solutions versus human assistance to maximize satisfaction and compliance.

Comparison Table

| Feature | Digital Onboarding | Agent-Assisted Onboarding |

|---|---|---|

| Process | Automated, tech-driven | Human interaction, manual steps |

| Speed | Minutes to complete | Hours to days |

| Accessibility | 24/7, anywhere with internet | Limited hours, branch or phone |

| Cost | Lower operational costs | Higher due to staffing |

| User Experience | Self-service, fast onboarding | Personalized support |

| Verification | Digital KYC, biometric checks | Manual document review |

| Customer Support | Limited or chatbots | Direct agent help |

| Scalability | Highly scalable | Scalability limited by agents |

| Error Rate | Reduced, automated checks | Higher, human error risk |

Which is better?

Digital onboarding in banking offers faster account setup and enhanced convenience through automated identity verification and seamless integration with mobile devices. Agent-assisted onboarding provides personalized customer support, addressing complex queries and building trust, particularly beneficial for high-value clients or those unfamiliar with technology. Banks seeking efficiency and scalability often prefer digital onboarding, while institutions prioritizing relationship-building may lean toward agent-assisted approaches.

Connection

Digital onboarding streamlines customer account creation through automated processes, enhancing user experience with speed and convenience. Agent-assisted onboarding complements this by providing personalized support, addressing complex queries, and ensuring compliance with regulatory requirements. Together, these methods create a seamless, efficient banking onboarding ecosystem that balances technology with human expertise.

Key Terms

Customer Identification

Agent-assisted onboarding leverages human interaction to verify customer identity through document review and personalized questioning, ensuring higher accuracy and fraud prevention. Digital onboarding employs AI-driven biometric verification, automated document scanning, and database cross-referencing to quickly authenticate users with minimal human involvement. Explore the benefits and challenges of each method in optimizing customer identification for seamless onboarding.

Automation

Agent-assisted onboarding blends human interaction with automation tools to streamline client information collection and verification, enhancing accuracy and customer satisfaction. Digital onboarding leverages fully automated processes powered by AI and machine learning to minimize manual intervention, speed up identity verification, and reduce onboarding time. Explore the latest advancements and benefits of these onboarding approaches to determine the best fit for your organization's automation goals.

KYC Compliance

Agent-assisted onboarding integrates human interaction to enhance KYC compliance by verifying identity documents and ensuring personalized risk assessment, reducing fraud and regulatory risks. Digital onboarding leverages automated identity verification tools, biometrics, and AI-driven analytics, enabling rapid, scalable KYC compliance with minimized manual errors. Explore how each method impacts efficiency and security in your compliance strategy.

Source and External Links

Employee Onboarding AI Agents - AI agents personalize and streamline onboarding by automating administrative tasks, providing cultural integration, tracking progress, and supporting remote workforces to deliver an engaging, seamless new hire experience.

Onboarding AI Agent - This AI agent automates paperwork, schedules training, shares resources, and improves onboarding accuracy and new hire engagement, reducing employee training time by 40%.

Streamlining the agent onboarding process - Effective agent-assisted onboarding uses technology like LMS, AI simulators, and personalized learning paths to create inclusive, efficient training tailored to new support agents' backgrounds and skills.

dowidth.com

dowidth.com