Neobank reconciliation involves matching digital banking transactions with internal financial records to ensure accuracy and detect discrepancies in real-time. Vendor account reconciliation focuses on verifying supplier invoices against purchase orders and payments to maintain precise payable accounts and avoid billing errors. Explore the differences and benefits of each reconciliation method to optimize your financial management.

Why it is important

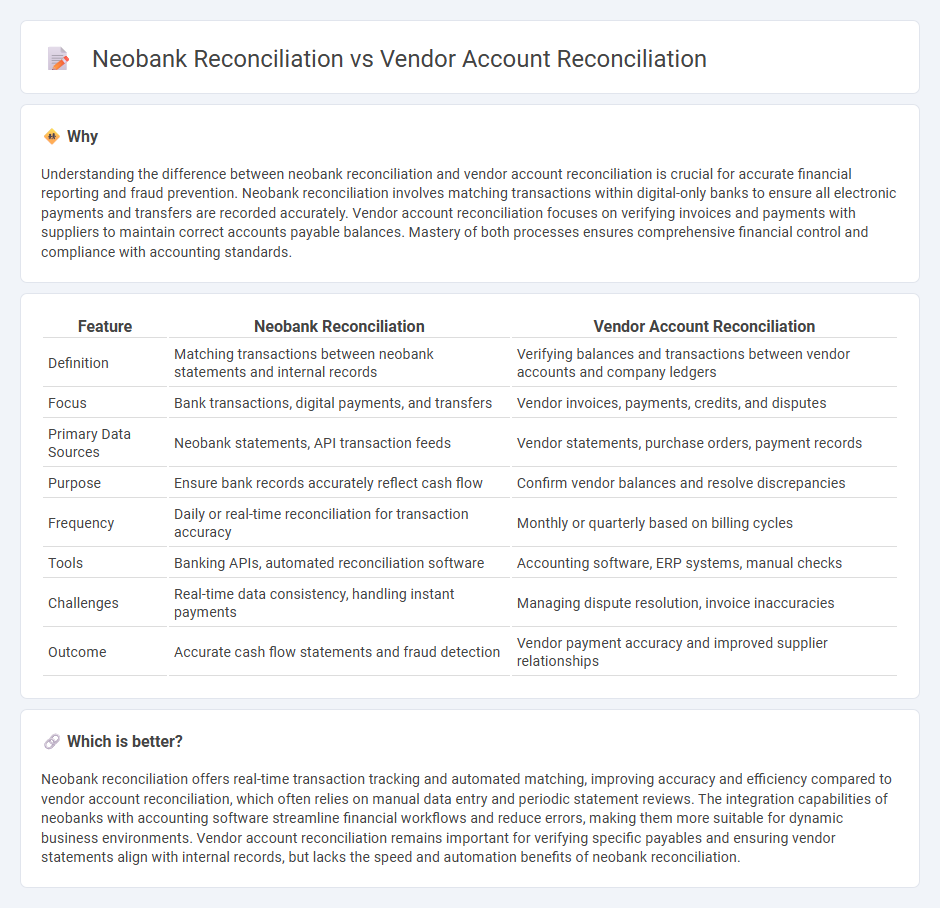

Understanding the difference between neobank reconciliation and vendor account reconciliation is crucial for accurate financial reporting and fraud prevention. Neobank reconciliation involves matching transactions within digital-only banks to ensure all electronic payments and transfers are recorded accurately. Vendor account reconciliation focuses on verifying invoices and payments with suppliers to maintain correct accounts payable balances. Mastery of both processes ensures comprehensive financial control and compliance with accounting standards.

Comparison Table

| Feature | Neobank Reconciliation | Vendor Account Reconciliation |

|---|---|---|

| Definition | Matching transactions between neobank statements and internal records | Verifying balances and transactions between vendor accounts and company ledgers |

| Focus | Bank transactions, digital payments, and transfers | Vendor invoices, payments, credits, and disputes |

| Primary Data Sources | Neobank statements, API transaction feeds | Vendor statements, purchase orders, payment records |

| Purpose | Ensure bank records accurately reflect cash flow | Confirm vendor balances and resolve discrepancies |

| Frequency | Daily or real-time reconciliation for transaction accuracy | Monthly or quarterly based on billing cycles |

| Tools | Banking APIs, automated reconciliation software | Accounting software, ERP systems, manual checks |

| Challenges | Real-time data consistency, handling instant payments | Managing dispute resolution, invoice inaccuracies |

| Outcome | Accurate cash flow statements and fraud detection | Vendor payment accuracy and improved supplier relationships |

Which is better?

Neobank reconciliation offers real-time transaction tracking and automated matching, improving accuracy and efficiency compared to vendor account reconciliation, which often relies on manual data entry and periodic statement reviews. The integration capabilities of neobanks with accounting software streamline financial workflows and reduce errors, making them more suitable for dynamic business environments. Vendor account reconciliation remains important for verifying specific payables and ensuring vendor statements align with internal records, but lacks the speed and automation benefits of neobank reconciliation.

Connection

Neobank reconciliation and vendor account reconciliation are interconnected processes that ensure accurate financial records by matching digital banking transactions with vendor invoices and payments. Neobanks provide real-time transaction data through APIs that streamline vendor account reconciliation, reducing discrepancies and improving cash flow management. Efficient synchronization between these reconciliations enhances financial transparency, audit readiness, and overall accounting accuracy.

Key Terms

**Vendor Account Reconciliation:**

Vendor Account Reconciliation involves matching and verifying transactions between a company and its vendors to ensure accuracy in payments and outstanding balances. This process helps identify discrepancies, prevent errors, and maintain healthy supplier relationships by confirming that invoices, purchase orders, and payments align correctly. Explore more to optimize your vendor reconciliation strategies for improved cash flow management.

Accounts Payable Ledger

Vendor account reconciliation involves matching purchase orders, invoices, and payment records within the Accounts Payable Ledger to ensure accuracy in liabilities and prevent discrepancies. Neobank reconciliation leverages digital banking platforms and real-time transaction data to streamline the matching of transactional records with the Accounts Payable Ledger, enhancing efficiency and reducing errors in payable accounts management. Explore detailed comparisons of reconciliation processes to optimize your Accounts Payable Ledger control.

Supplier Statements

Vendor account reconciliation involves matching purchase orders, invoices, and payment records against supplier statements to ensure accuracy and identify discrepancies. Neobank reconciliation automates this process by integrating supplier statements within digital banking platforms, offering real-time transaction verification and seamless supplier payment tracking. Explore how advanced automated solutions can transform your reconciliation process for improved financial accuracy.

Source and External Links

Vendor Reconciliation: Processes and Best Practices - Ramp - This webpage outlines the vendor reconciliation process, highlighting steps such as matching invoices, checking balances, and resolving discrepancies to ensure accurate financial records.

What is Vendor Reconciliation in Accounts Payable? - BILL - This article explains vendor reconciliation as a process to verify vendor account balances against internal records, focusing on matching invoices and resolving discrepancies.

Vendor Reconciliation Process in Accounts Payable - ClearTech - This blog post discusses the importance of vendor reconciliation in ensuring payment accuracy and compliance by matching invoices with vendor statements and correcting discrepancies.

dowidth.com

dowidth.com