Smart contracts accounting automates financial transactions using blockchain technology, ensuring enhanced transparency, real-time verification, and reduced human errors compared to Traditional accounting, which relies on manual processes and periodic reconciliations. By leveraging cryptographic validation and decentralized ledgers, smart contracts streamline audit trails and minimize fraud risks, while Traditional accounting still depends heavily on paper-based records and intermediary oversight. Discover how integrating smart contracts can revolutionize your accounting practices and improve financial accuracy.

Why it is important

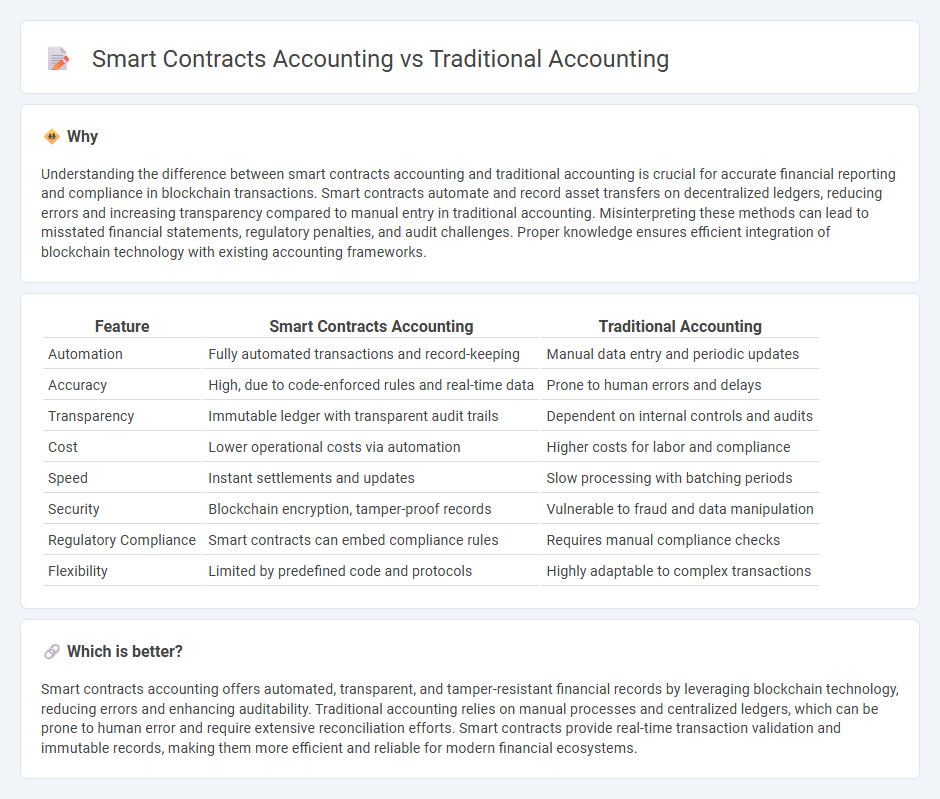

Understanding the difference between smart contracts accounting and traditional accounting is crucial for accurate financial reporting and compliance in blockchain transactions. Smart contracts automate and record asset transfers on decentralized ledgers, reducing errors and increasing transparency compared to manual entry in traditional accounting. Misinterpreting these methods can lead to misstated financial statements, regulatory penalties, and audit challenges. Proper knowledge ensures efficient integration of blockchain technology with existing accounting frameworks.

Comparison Table

| Feature | Smart Contracts Accounting | Traditional Accounting |

|---|---|---|

| Automation | Fully automated transactions and record-keeping | Manual data entry and periodic updates |

| Accuracy | High, due to code-enforced rules and real-time data | Prone to human errors and delays |

| Transparency | Immutable ledger with transparent audit trails | Dependent on internal controls and audits |

| Cost | Lower operational costs via automation | Higher costs for labor and compliance |

| Speed | Instant settlements and updates | Slow processing with batching periods |

| Security | Blockchain encryption, tamper-proof records | Vulnerable to fraud and data manipulation |

| Regulatory Compliance | Smart contracts can embed compliance rules | Requires manual compliance checks |

| Flexibility | Limited by predefined code and protocols | Highly adaptable to complex transactions |

Which is better?

Smart contracts accounting offers automated, transparent, and tamper-resistant financial records by leveraging blockchain technology, reducing errors and enhancing auditability. Traditional accounting relies on manual processes and centralized ledgers, which can be prone to human error and require extensive reconciliation efforts. Smart contracts provide real-time transaction validation and immutable records, making them more efficient and reliable for modern financial ecosystems.

Connection

Smart contracts accounting automates transaction recording by embedding financial rules directly into blockchain protocols, ensuring real-time, immutable ledger updates. Traditional accounting relies on manual entry and periodic reconciliation, but it benefits from integrating smart contracts through enhanced transparency, accuracy, and reduced errors in verifying contract fulfillment. This connection improves audit trails and compliance by merging automated digital contracts with established financial reporting standards.

Key Terms

Manual Ledger

Traditional accounting relies heavily on manual ledger entries, requiring extensive human intervention to record, verify, and reconcile financial transactions, often leading to increased errors and slower processing times. Smart contracts accounting automates these processes by using blockchain technology to automatically execute and record transactions in a decentralized ledger, enhancing transparency, accuracy, and efficiency. Explore how integrating smart contracts can revolutionize manual ledger management and improve financial accountability.

Automation

Traditional accounting relies heavily on manual data entry and periodic reconciliations, which often lead to delays and human errors. Smart contracts accounting automates transactions using blockchain technology, enabling real-time, accurate record-keeping without intermediaries. Explore the advantages of smart contracts to transform your financial processes with enhanced automation.

Real-time Reconciliation

Traditional accounting relies on periodic manual reconciliation processes that often lead to delays and human errors, affecting financial accuracy and decision-making. Smart contracts accounting utilizes blockchain technology to enable real-time reconciliation by automatically validating and recording transactions, ensuring transparency and minimizing discrepancies. Discover how smart contracts revolutionize accounting efficiency and accuracy with real-time reconciliation.

Source and External Links

Cash Basis vs Traditional Accounting for Inventory - Traditional accounting, also known as accrual accounting, records revenue when earned and expenses when incurred, offering a more accurate financial picture but is complex and often required for larger businesses under GAAP.

The Pros and Cons of Traditional vs. Digital Accounting for Event Companies - Traditional accounting involves manually using physical ledgers, journals, and spreadsheets for double-entry bookkeeping, while digital accounting automates these processes with software and cloud platforms.

What is Traditional Accounting? And Why It's Failing You - Outmin - Traditional accounting is described as an outdated, fragmented process relying heavily on manual tasks and multiple professionals handling different accounting functions, leading to inefficiencies and high costs.

dowidth.com

dowidth.com