Continuous auditing utilizes automated data analysis and real-time monitoring to enhance accuracy and efficiency, while manual auditing relies on periodic, human-led examination of financial records. This approach reduces the risk of errors and fraud by providing ongoing assurance and immediate anomaly detection. Explore further to understand how continuous auditing transforms financial oversight in modern organizations.

Why it is important

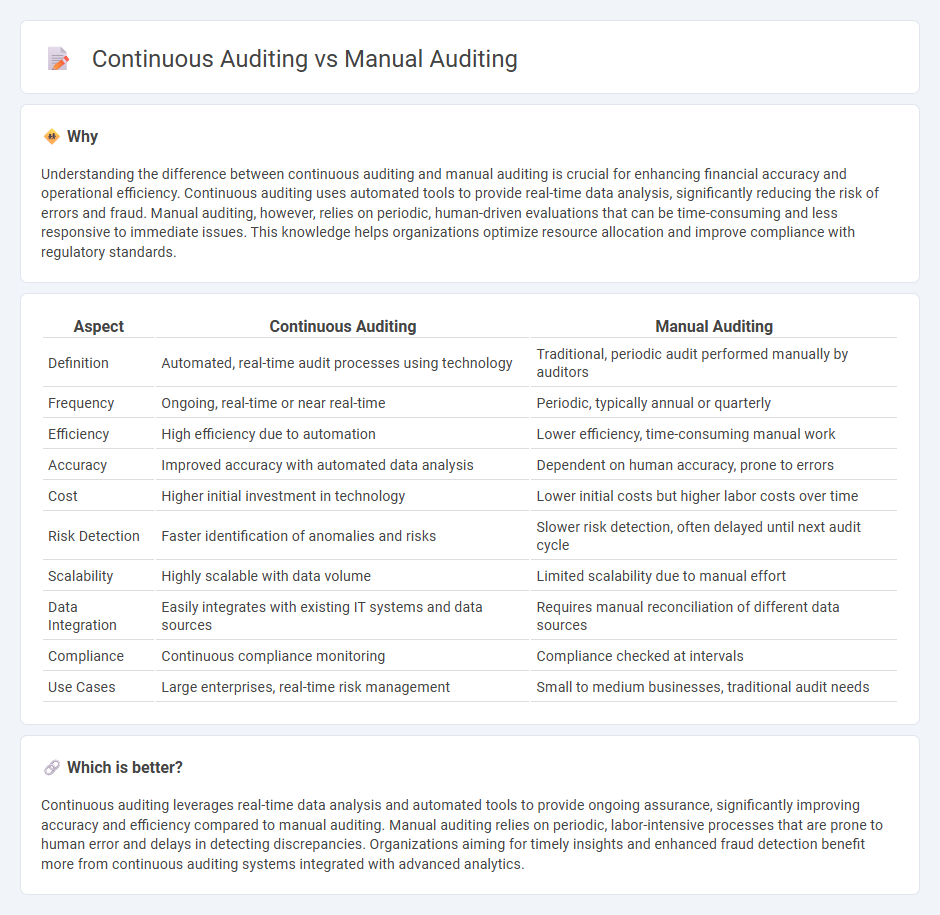

Understanding the difference between continuous auditing and manual auditing is crucial for enhancing financial accuracy and operational efficiency. Continuous auditing uses automated tools to provide real-time data analysis, significantly reducing the risk of errors and fraud. Manual auditing, however, relies on periodic, human-driven evaluations that can be time-consuming and less responsive to immediate issues. This knowledge helps organizations optimize resource allocation and improve compliance with regulatory standards.

Comparison Table

| Aspect | Continuous Auditing | Manual Auditing |

|---|---|---|

| Definition | Automated, real-time audit processes using technology | Traditional, periodic audit performed manually by auditors |

| Frequency | Ongoing, real-time or near real-time | Periodic, typically annual or quarterly |

| Efficiency | High efficiency due to automation | Lower efficiency, time-consuming manual work |

| Accuracy | Improved accuracy with automated data analysis | Dependent on human accuracy, prone to errors |

| Cost | Higher initial investment in technology | Lower initial costs but higher labor costs over time |

| Risk Detection | Faster identification of anomalies and risks | Slower risk detection, often delayed until next audit cycle |

| Scalability | Highly scalable with data volume | Limited scalability due to manual effort |

| Data Integration | Easily integrates with existing IT systems and data sources | Requires manual reconciliation of different data sources |

| Compliance | Continuous compliance monitoring | Compliance checked at intervals |

| Use Cases | Large enterprises, real-time risk management | Small to medium businesses, traditional audit needs |

Which is better?

Continuous auditing leverages real-time data analysis and automated tools to provide ongoing assurance, significantly improving accuracy and efficiency compared to manual auditing. Manual auditing relies on periodic, labor-intensive processes that are prone to human error and delays in detecting discrepancies. Organizations aiming for timely insights and enhanced fraud detection benefit more from continuous auditing systems integrated with advanced analytics.

Connection

Continuous auditing enhances traditional manual auditing by providing real-time data analysis and monitoring, enabling auditors to identify discrepancies promptly. Manual auditing relies on periodic sampling and detailed examination of financial records, while continuous auditing leverages automated tools and data analytics to support ongoing evaluation. The integration of both methods improves accuracy, reduces risks, and ensures regulatory compliance in financial reporting.

Key Terms

Sampling

Manual auditing relies heavily on statistical sampling methods to test a subset of transactions, which can introduce sampling risk and limit the scope of audit coverage. Continuous auditing employs real-time data analytics and automated monitoring tools to examine entire populations of data, significantly reducing sampling errors and enhancing detection capabilities. Explore deeper insights into how sampling approaches impact audit accuracy and efficiency.

Real-time Monitoring

Manual auditing relies on periodic sampling and human review, which can delay the identification of discrepancies and risks. Continuous auditing employs automated tools and real-time monitoring systems, enabling organizations to detect anomalies and compliance issues instantly. Explore how continuous auditing transforms risk management with immediate insights and improved accuracy.

Audit Trail

Manual auditing relies on periodic reviews of audit trails, which can be time-consuming and prone to human error, limiting the ability to detect irregularities promptly. Continuous auditing leverages automated tools to monitor and analyze audit trails in real time, ensuring enhanced accuracy, timely detection of anomalies, and improved compliance. Explore more to understand how integrating continuous audit trails can revolutionize your auditing processes.

Source and External Links

Audit Manual - This manual provides guidance on conducting audits, ensuring efficient use of resources, and achieving audit objectives through proper documentation and communication.

Michigan Pupil Membership Auditing Manual - This manual outlines procedures for conducting pupil membership audits, including review of specific membership requirements and use of audit checklists.

Audit Manual - CDTFA - This manual provides direction to staff administering the Sales and Use Tax Law and Regulations, offering guidance on audit policies and procedures.

dowidth.com

dowidth.com