Dynamic discounting offers early payment incentives by allowing buyers to pay suppliers ahead of the net payment terms, improving cash flow management and reducing supply chain risk. Net payment terms specify a fixed period within which the buyer must pay the full invoice amount, typically 30, 60, or 90 days, providing predictable payment schedules but less flexibility. Discover how mastering dynamic discounting and net payment strategies can optimize your accounting practices and financial performance.

Why it is important

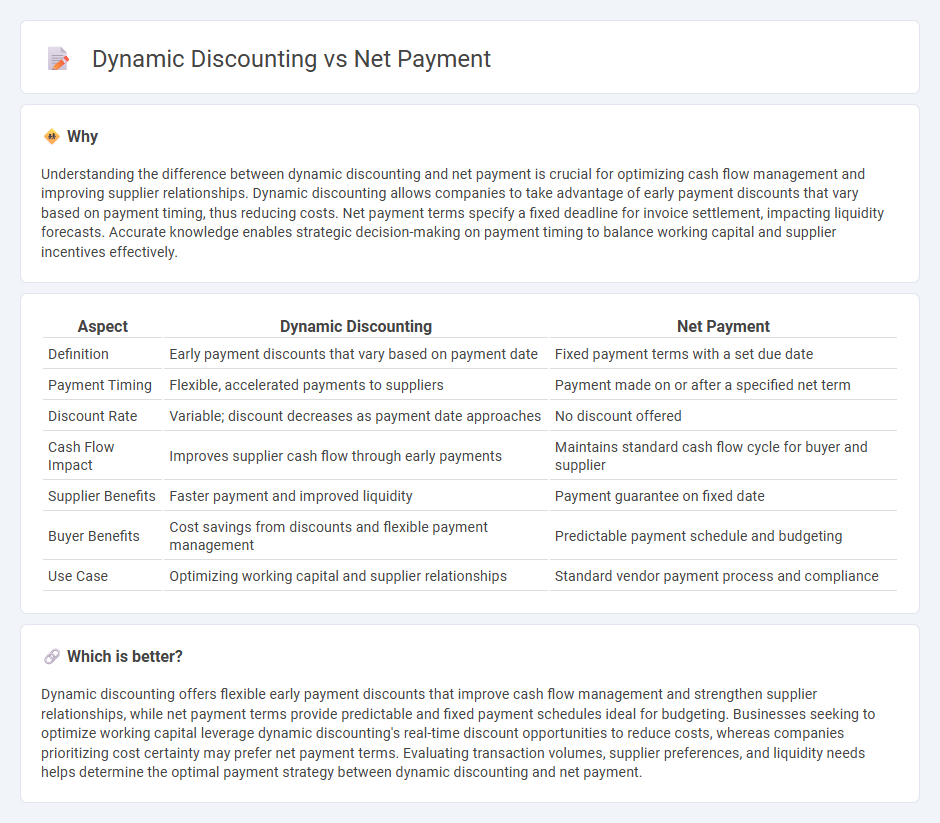

Understanding the difference between dynamic discounting and net payment is crucial for optimizing cash flow management and improving supplier relationships. Dynamic discounting allows companies to take advantage of early payment discounts that vary based on payment timing, thus reducing costs. Net payment terms specify a fixed deadline for invoice settlement, impacting liquidity forecasts. Accurate knowledge enables strategic decision-making on payment timing to balance working capital and supplier incentives effectively.

Comparison Table

| Aspect | Dynamic Discounting | Net Payment |

|---|---|---|

| Definition | Early payment discounts that vary based on payment date | Fixed payment terms with a set due date |

| Payment Timing | Flexible, accelerated payments to suppliers | Payment made on or after a specified net term |

| Discount Rate | Variable; discount decreases as payment date approaches | No discount offered |

| Cash Flow Impact | Improves supplier cash flow through early payments | Maintains standard cash flow cycle for buyer and supplier |

| Supplier Benefits | Faster payment and improved liquidity | Payment guarantee on fixed date |

| Buyer Benefits | Cost savings from discounts and flexible payment management | Predictable payment schedule and budgeting |

| Use Case | Optimizing working capital and supplier relationships | Standard vendor payment process and compliance |

Which is better?

Dynamic discounting offers flexible early payment discounts that improve cash flow management and strengthen supplier relationships, while net payment terms provide predictable and fixed payment schedules ideal for budgeting. Businesses seeking to optimize working capital leverage dynamic discounting's real-time discount opportunities to reduce costs, whereas companies prioritizing cost certainty may prefer net payment terms. Evaluating transaction volumes, supplier preferences, and liquidity needs helps determine the optimal payment strategy between dynamic discounting and net payment.

Connection

Dynamic discounting directly influences net payment terms by enabling buyers to pay invoices early in exchange for discounts, which accelerates cash flow for suppliers and reduces costs for purchasers. This connection optimizes working capital management by adjusting payment dates based on real-time financial strategies. Efficient implementation of dynamic discounting transforms static net payment schedules into flexible, mutually beneficial financial arrangements.

Key Terms

Payment Terms

Net payment terms specify a fixed period within which the full invoice amount is due, typically 30, 60, or 90 days, ensuring predictable cash flow for both buyers and suppliers. Dynamic discounting allows suppliers to offer early payment discounts that vary based on the actual payment date, incentivizing accelerated payments and optimizing working capital. Explore how combining net payment terms with dynamic discounting strategies can enhance financial efficiency and supplier relationships.

Discount Rate

Dynamic discounting offers businesses the advantage of flexible discount rates that increase as invoices are paid earlier, optimizing cash flow and maximizing savings. In contrast, net payment terms typically specify a fixed payment deadline with no opportunity to adjust the discount rate based on payment timing. Explore more to understand how dynamic discounting can strategically enhance your working capital management.

Cash Flow

Net payment terms define the fixed period within which buyers must settle invoices, directly impacting cash flow predictability by establishing clear outflow schedules. Dynamic discounting introduces flexible early payment options where buyers can avail discounts based on payment timing, enhancing cash flow optimization by accelerating receivables for suppliers and reducing financing costs for buyers. Explore in-depth insights on how net payment and dynamic discounting strategies drive cash flow efficiency and financial health.

Source and External Links

What are net payment terms? - Net payment terms are conditions on invoices specifying when a payment must be made, often including options like Net 30, Net 60, or Net 90 days.

What is net pay? - Net pay is the amount of money an employee takes home after deductions such as taxes and insurance premiums are subtracted from their gross income.

What is Net Pay? - Net pay is the total amount an employee receives after taxes and other deductions are taken out of their gross pay.

dowidth.com

dowidth.com