Transfer pricing analytics focuses on evaluating intercompany transaction prices to ensure compliance with tax regulations and optimize tax liabilities, leveraging data on market conditions and comparable transactions. Cash flow analysis examines the timing and amounts of cash inflows and outflows to assess liquidity, operational efficiency, and financial stability. Discover how mastering both transfer pricing analytics and cash flow analysis can enhance strategic financial decision-making.

Why it is important

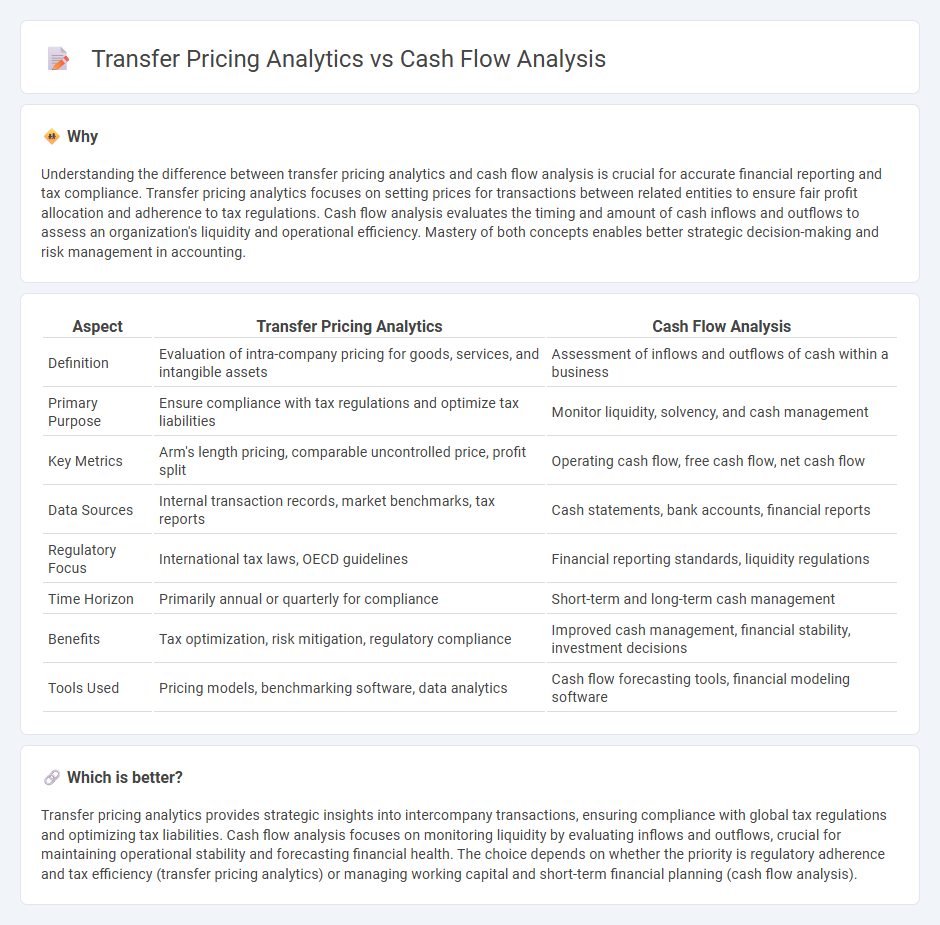

Understanding the difference between transfer pricing analytics and cash flow analysis is crucial for accurate financial reporting and tax compliance. Transfer pricing analytics focuses on setting prices for transactions between related entities to ensure fair profit allocation and adherence to tax regulations. Cash flow analysis evaluates the timing and amount of cash inflows and outflows to assess an organization's liquidity and operational efficiency. Mastery of both concepts enables better strategic decision-making and risk management in accounting.

Comparison Table

| Aspect | Transfer Pricing Analytics | Cash Flow Analysis |

|---|---|---|

| Definition | Evaluation of intra-company pricing for goods, services, and intangible assets | Assessment of inflows and outflows of cash within a business |

| Primary Purpose | Ensure compliance with tax regulations and optimize tax liabilities | Monitor liquidity, solvency, and cash management |

| Key Metrics | Arm's length pricing, comparable uncontrolled price, profit split | Operating cash flow, free cash flow, net cash flow |

| Data Sources | Internal transaction records, market benchmarks, tax reports | Cash statements, bank accounts, financial reports |

| Regulatory Focus | International tax laws, OECD guidelines | Financial reporting standards, liquidity regulations |

| Time Horizon | Primarily annual or quarterly for compliance | Short-term and long-term cash management |

| Benefits | Tax optimization, risk mitigation, regulatory compliance | Improved cash management, financial stability, investment decisions |

| Tools Used | Pricing models, benchmarking software, data analytics | Cash flow forecasting tools, financial modeling software |

Which is better?

Transfer pricing analytics provides strategic insights into intercompany transactions, ensuring compliance with global tax regulations and optimizing tax liabilities. Cash flow analysis focuses on monitoring liquidity by evaluating inflows and outflows, crucial for maintaining operational stability and forecasting financial health. The choice depends on whether the priority is regulatory adherence and tax efficiency (transfer pricing analytics) or managing working capital and short-term financial planning (cash flow analysis).

Connection

Transfer pricing analytics and cash flow analysis are interconnected through their role in optimizing internal financial transactions and ensuring compliance with tax regulations. Accurate transfer pricing analytics helps allocate revenues and expenses among subsidiaries, directly impacting cash flow projections and liquidity management. Effective integration of these analyses enhances strategic decision-making by improving profitability assessment and cash resource allocation across multinational enterprises.

Key Terms

**Cash Flow Analysis:**

Cash flow analysis evaluates the inflows and outflows of cash within a business to assess liquidity, operational efficiency, and financial stability. It involves detailed tracking of cash receipts from sales, payments for expenses, and investments to ensure the company maintains sufficient cash to meet obligations. Explore comprehensive strategies to optimize cash flow and enhance financial decision-making.

Operating Activities

Cash flow analysis of operating activities provides insights into the actual cash generated or used by a company's core business operations, highlighting liquidity and operational efficiency. Transfer pricing analytics, focused on operating activities, evaluates intercompany transactions to ensure compliance with regulatory standards and optimize tax positioning within multinational corporations. Explore more to understand how integrating both approaches enhances strategic financial management and regulatory adherence.

Free Cash Flow

Free cash flow analysis evaluates a company's liquidity by measuring the cash generated after capital expenditures, offering insights into operational efficiency and financial health. Transfer pricing analytics examines intercompany transaction prices to ensure compliance with tax regulations and optimize profit allocation, indirectly impacting free cash flow through taxation and cash repatriation strategies. Explore detailed methodologies to understand how aligning free cash flow management with transfer pricing strategies enhances corporate financial planning.

Source and External Links

What Is Cash Flow Analysis? How to Do One (+ Examples) - This article provides a comprehensive guide on how to perform a cash flow analysis, including preparing a cash flow statement and determining the cash flow ratio.

Cash Flow Analysis: Basics, Benefits and How to Do It - This resource outlines the basics of cash flow analysis, its benefits, and a step-by-step approach to conducting it effectively within a business.

How to Do a Cash Flow Analysis with Examples - This guide offers practical steps for conducting a cash flow analysis, including identifying net income and other cash inflows and outflows.

dowidth.com

dowidth.com