Deep learning forecasting models leverage neural networks to capture complex patterns and nonlinear relationships in large accounting datasets, improving prediction accuracy over traditional methods. The ARIMA model, widely used in accounting time series analysis, excels at modeling linear trends and seasonal effects but may struggle with intricate data structures. Explore the comparative strengths of deep learning and ARIMA to enhance forecasting precision in accounting applications.

Why it is important

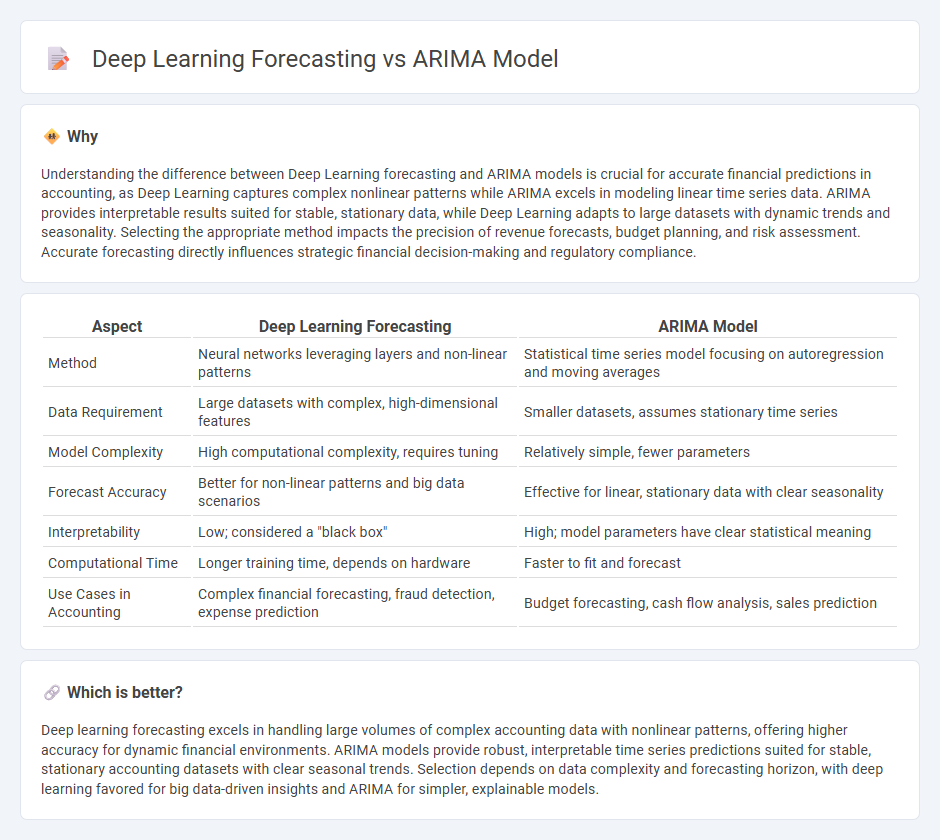

Understanding the difference between Deep Learning forecasting and ARIMA models is crucial for accurate financial predictions in accounting, as Deep Learning captures complex nonlinear patterns while ARIMA excels in modeling linear time series data. ARIMA provides interpretable results suited for stable, stationary data, while Deep Learning adapts to large datasets with dynamic trends and seasonality. Selecting the appropriate method impacts the precision of revenue forecasts, budget planning, and risk assessment. Accurate forecasting directly influences strategic financial decision-making and regulatory compliance.

Comparison Table

| Aspect | Deep Learning Forecasting | ARIMA Model |

|---|---|---|

| Method | Neural networks leveraging layers and non-linear patterns | Statistical time series model focusing on autoregression and moving averages |

| Data Requirement | Large datasets with complex, high-dimensional features | Smaller datasets, assumes stationary time series |

| Model Complexity | High computational complexity, requires tuning | Relatively simple, fewer parameters |

| Forecast Accuracy | Better for non-linear patterns and big data scenarios | Effective for linear, stationary data with clear seasonality |

| Interpretability | Low; considered a "black box" | High; model parameters have clear statistical meaning |

| Computational Time | Longer training time, depends on hardware | Faster to fit and forecast |

| Use Cases in Accounting | Complex financial forecasting, fraud detection, expense prediction | Budget forecasting, cash flow analysis, sales prediction |

Which is better?

Deep learning forecasting excels in handling large volumes of complex accounting data with nonlinear patterns, offering higher accuracy for dynamic financial environments. ARIMA models provide robust, interpretable time series predictions suited for stable, stationary accounting datasets with clear seasonal trends. Selection depends on data complexity and forecasting horizon, with deep learning favored for big data-driven insights and ARIMA for simpler, explainable models.

Connection

Deep learning forecasting and the ARIMA model are both essential tools in accounting for time series analysis and financial prediction. Deep learning leverages neural networks to capture complex, nonlinear patterns in financial data, while ARIMA focuses on linear relationships and seasonality in accounting time series. Integrating ARIMA's statistical rigor with deep learning's adaptive capabilities enhances accuracy in forecasting financial metrics such as revenue, expenses, and cash flow.

Key Terms

Time Series

ARIMA models excel in time series forecasting by capturing linear patterns and seasonality through autoregressive and moving average components, making them effective for stationary data with clear trends. Deep learning models, such as LSTM and GRU networks, handle complex nonlinear relationships and long-term dependencies, providing superior accuracy in high-dimensional and irregular time series data. Explore detailed comparisons and case studies to understand the strengths and limitations of ARIMA versus deep learning in time series forecasting.

Prediction Accuracy

The ARIMA model excels in time series forecasting when data exhibits linear patterns and seasonality, providing interpretable results and robust prediction accuracy in stable environments. Deep learning forecasting models, such as LSTM and GRU, capture complex nonlinear relationships and adapt well to large datasets with dynamic patterns, often outperforming ARIMA in accuracy for intricate time series. Explore detailed comparisons and performance benchmarks to understand which method suits specific forecasting needs best.

Model Complexity

ARIMA models feature a relatively low model complexity, relying on autoregressive and moving average components to capture time series patterns with interpretable parameters. Deep learning forecasting models, such as LSTM or Transformer-based architectures, exhibit high model complexity that can capture nonlinear relationships and long-term dependencies but often require extensive computational resources and large datasets. Explore deeper insights into model complexity trade-offs and practical applications in forecasting accuracy.

Source and External Links

ARIMA for Time Series Forecasting: A Complete Guide - The ARIMA (Autoregressive Integrated Moving Average) model is a popular statistical method for time series forecasting that combines past values (AR), differencing to achieve stationarity (I), and modeling errors via moving averages (MA) to predict future data points accurately.

What are ARIMA Models? | IBM - ARIMA stands for Autoregressive Integrated Moving Average and is widely used for time series analysis and forecasting, integrating both autoregressive and moving average approaches, with applications to seasonal and non-seasonal data.

ARIMA - GeeksforGeeks - ARIMA is instrumental in forecasting future values by modeling the relationship between current and past observations (autoregression), ensuring stationarity through differencing, and correcting for errors via moving average components, with careful parameter selection key for accuracy.

dowidth.com

dowidth.com