Blockchain bookkeeping enhances accuracy and transparency by recording transactions in an immutable digital ledger, reducing errors and fraud compared to traditional paper-based bookkeeping. Paper-based systems rely on manual entries and physical documents, which are prone to loss, damage, and manipulation. Explore the advantages and limitations of both methods to understand how blockchain is transforming accounting practices.

Why it is important

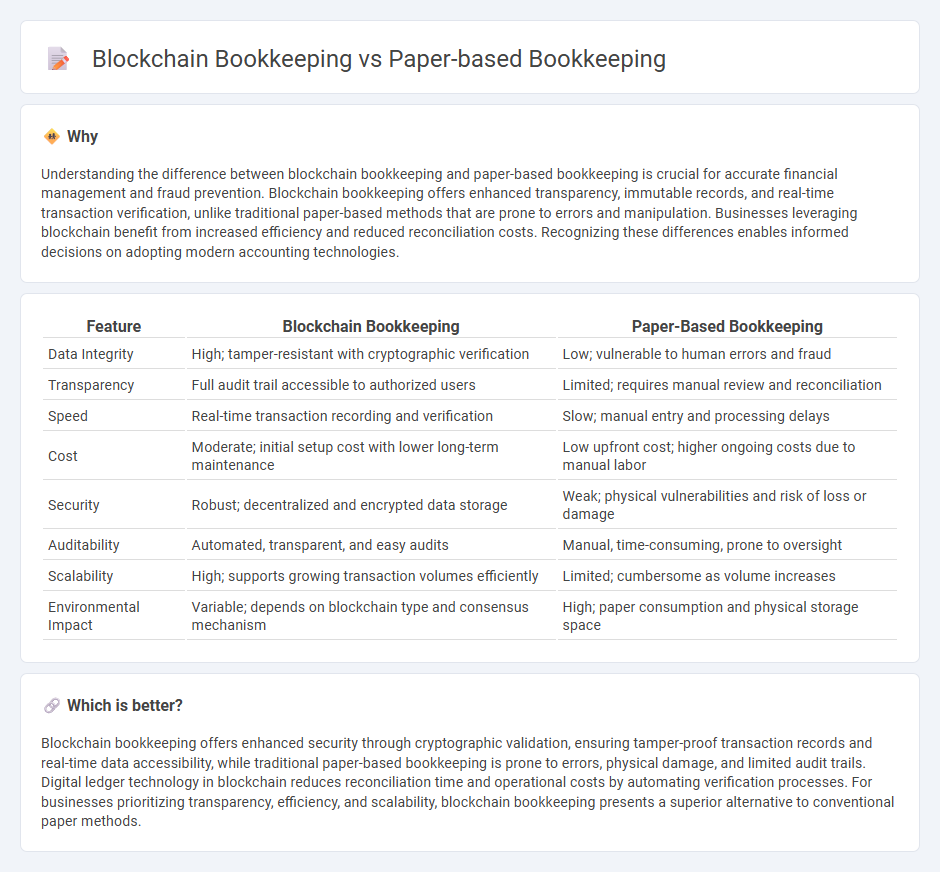

Understanding the difference between blockchain bookkeeping and paper-based bookkeeping is crucial for accurate financial management and fraud prevention. Blockchain bookkeeping offers enhanced transparency, immutable records, and real-time transaction verification, unlike traditional paper-based methods that are prone to errors and manipulation. Businesses leveraging blockchain benefit from increased efficiency and reduced reconciliation costs. Recognizing these differences enables informed decisions on adopting modern accounting technologies.

Comparison Table

| Feature | Blockchain Bookkeeping | Paper-Based Bookkeeping |

|---|---|---|

| Data Integrity | High; tamper-resistant with cryptographic verification | Low; vulnerable to human errors and fraud |

| Transparency | Full audit trail accessible to authorized users | Limited; requires manual review and reconciliation |

| Speed | Real-time transaction recording and verification | Slow; manual entry and processing delays |

| Cost | Moderate; initial setup cost with lower long-term maintenance | Low upfront cost; higher ongoing costs due to manual labor |

| Security | Robust; decentralized and encrypted data storage | Weak; physical vulnerabilities and risk of loss or damage |

| Auditability | Automated, transparent, and easy audits | Manual, time-consuming, prone to oversight |

| Scalability | High; supports growing transaction volumes efficiently | Limited; cumbersome as volume increases |

| Environmental Impact | Variable; depends on blockchain type and consensus mechanism | High; paper consumption and physical storage space |

Which is better?

Blockchain bookkeeping offers enhanced security through cryptographic validation, ensuring tamper-proof transaction records and real-time data accessibility, while traditional paper-based bookkeeping is prone to errors, physical damage, and limited audit trails. Digital ledger technology in blockchain reduces reconciliation time and operational costs by automating verification processes. For businesses prioritizing transparency, efficiency, and scalability, blockchain bookkeeping presents a superior alternative to conventional paper methods.

Connection

Blockchain bookkeeping and paper-based bookkeeping are connected through their fundamental role in recording financial transactions and maintaining accurate ledgers. While paper-based bookkeeping relies on manual entries and physical records, blockchain bookkeeping uses decentralized digital ledgers that enhance transparency and security. Both methods aim to ensure data integrity, but blockchain technology reduces errors and fraud by providing immutable, time-stamped transaction histories.

Key Terms

Ledger

Paper-based bookkeeping relies on physical ledgers, which can be prone to human error, fraud, and loss, while blockchain bookkeeping utilizes decentralized, immutable digital ledgers that enhance transparency and security. Blockchain ledgers record transactions across multiple nodes, ensuring real-time updates and tamper-proof records, which significantly reduces reconciliation time and increases audit accuracy. Discover more about how blockchain technology is revolutionizing ledger management and transforming financial record-keeping.

Audit Trail

Paper-based bookkeeping relies on physical ledgers that can be prone to errors, tampering, and loss, making audit trails difficult to verify and maintain over time. Blockchain bookkeeping leverages a decentralized, immutable ledger that records transactions chronologically with cryptographic security, ensuring transparency and a robust audit trail. Explore how blockchain innovation can transform audit trail reliability and integrity in financial reporting.

Immutability

Paper-based bookkeeping relies on physical documents susceptible to damage, loss, and unauthorized alterations, undermining data integrity. Blockchain bookkeeping ensures immutability through cryptographic hashing and distributed consensus, providing tamper-proof and verifiable transaction records. Explore the transformative impact of blockchain's immutable ledger on modern financial practices.

Source and External Links

Digital vs. Paper: Which Bookkeeping Ledger Book is Right for You? - Paper-based bookkeeping involves manually recording transactions in physical ledger books, offering tangible records and ease of use without technology, but can be time-consuming, error-prone, and susceptible to damage.

Cloud-Based Bookkeeping Software vs. Traditional Paper-Based Systems - Traditional paper bookkeeping relies on physical documents and manual entry, providing a tactile experience but lacking accessibility and being vulnerable to damage and disorganization in the digital age.

Big E-Z Bookkeeping Paper Ledger System - This paper-based ledger system helps track a full year of business income and expenses with customizable forms and reconciliation tools, supporting straightforward manual financial record-keeping without digital tools.

dowidth.com

dowidth.com