Predictive close leverages advanced analytics and historical data to estimate financial outcomes before the period ends, enabling faster decision-making. Rolling close continuously updates financial records in real time throughout the accounting period, ensuring ongoing accuracy and minimizing month-end adjustments. Explore these methodologies further to enhance your accounting efficiency and accuracy.

Why it is important

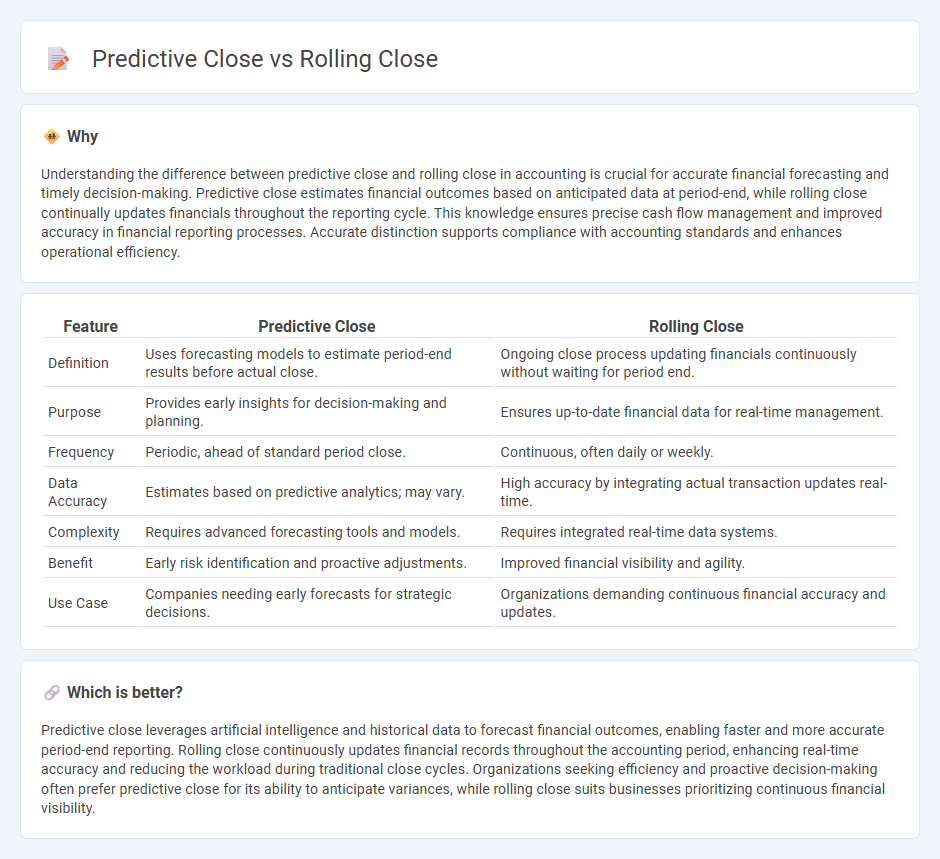

Understanding the difference between predictive close and rolling close in accounting is crucial for accurate financial forecasting and timely decision-making. Predictive close estimates financial outcomes based on anticipated data at period-end, while rolling close continually updates financials throughout the reporting cycle. This knowledge ensures precise cash flow management and improved accuracy in financial reporting processes. Accurate distinction supports compliance with accounting standards and enhances operational efficiency.

Comparison Table

| Feature | Predictive Close | Rolling Close |

|---|---|---|

| Definition | Uses forecasting models to estimate period-end results before actual close. | Ongoing close process updating financials continuously without waiting for period end. |

| Purpose | Provides early insights for decision-making and planning. | Ensures up-to-date financial data for real-time management. |

| Frequency | Periodic, ahead of standard period close. | Continuous, often daily or weekly. |

| Data Accuracy | Estimates based on predictive analytics; may vary. | High accuracy by integrating actual transaction updates real-time. |

| Complexity | Requires advanced forecasting tools and models. | Requires integrated real-time data systems. |

| Benefit | Early risk identification and proactive adjustments. | Improved financial visibility and agility. |

| Use Case | Companies needing early forecasts for strategic decisions. | Organizations demanding continuous financial accuracy and updates. |

Which is better?

Predictive close leverages artificial intelligence and historical data to forecast financial outcomes, enabling faster and more accurate period-end reporting. Rolling close continuously updates financial records throughout the accounting period, enhancing real-time accuracy and reducing the workload during traditional close cycles. Organizations seeking efficiency and proactive decision-making often prefer predictive close for its ability to anticipate variances, while rolling close suits businesses prioritizing continuous financial visibility.

Connection

Predictive close and rolling close are connected through their shared goal of enhancing financial close efficiency by leveraging real-time data analytics and automation. Predictive close uses historical data and AI to forecast potential closing issues, while rolling close continuously updates financial records during the accounting period, reducing last-minute adjustments. Both methodologies streamline the closing process, minimizing errors and accelerating the delivery of accurate financial reports.

Key Terms

Continuous reconciliation

Rolling close ensures continuous reconciliation by updating financial records regularly throughout the period, minimizing discrepancies and last-minute adjustments. Predictive close utilizes data analytics and forecasting to anticipate issues, accelerating the closing process and enhancing accuracy. Explore how these approaches boost efficiency and accuracy in financial close management.

Forecasting accuracy

Rolling close uses continuous data updates to refine forecasting accuracy by incorporating the latest financial information within a moving time window. Predictive close leverages advanced algorithms and AI to forecast end-of-period results before actual data is available, enhancing early decision-making. Explore how these methods improve forecasting precision and operational efficiency.

Real-time data

Rolling close leverages real-time data to continuously update financial results, enabling more accurate forecasting and quicker identification of variances within the reporting period. Predictive close uses advanced analytics and historical data patterns to anticipate closing outcomes before period-end, improving decision-making and resource allocation. Explore the benefits of integrating real-time data with predictive closing techniques to enhance your financial closing process.

Source and External Links

What is a Rolling Close? - Netcapital Help Center - A Rolling Close is when funds are disbursed from escrow to the issuer before the offering deadline, allowing early access to capital while continuing the fundraising until the deadline, with investors notified and able to withdraw before closing.

Rolling Close - Propel(x) - A Rolling Close means an offering has multiple closing dates enabling the company to accept investments as soon as investors are ready, thereby accommodating different investor timing constraints.

Rolling Close | Counsel for Emerging Companies and Startups - A Rolling Close is a fundraising structure allowing a company to receive investments continuously in the same round after an initial closing, usually within a set window of 30 to 180 days.

dowidth.com

dowidth.com