Fair value measurement in accounting reflects the current market price of an asset or liability, providing a more accurate and timely valuation compared to the cost model, which records assets based on their original purchase price minus depreciation. This approach enhances financial statement transparency by capturing real-time market conditions, while the cost model offers simplicity and stability in asset reporting. Explore further to understand the implications of these models on financial reporting and decision-making.

Why it is important

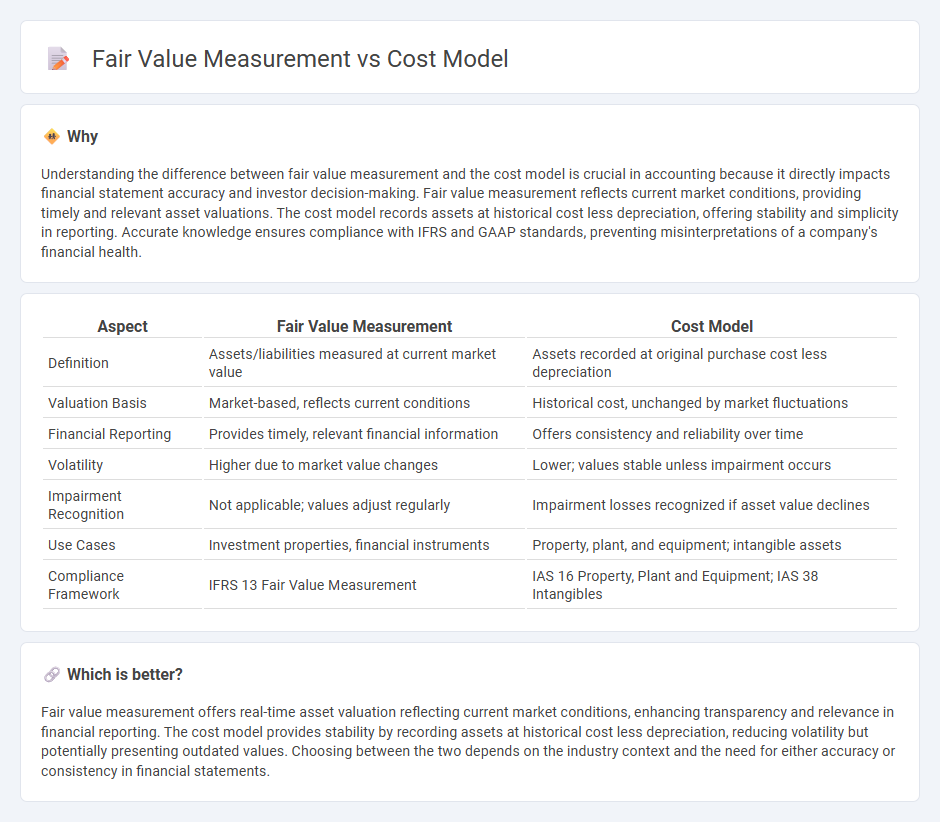

Understanding the difference between fair value measurement and the cost model is crucial in accounting because it directly impacts financial statement accuracy and investor decision-making. Fair value measurement reflects current market conditions, providing timely and relevant asset valuations. The cost model records assets at historical cost less depreciation, offering stability and simplicity in reporting. Accurate knowledge ensures compliance with IFRS and GAAP standards, preventing misinterpretations of a company's financial health.

Comparison Table

| Aspect | Fair Value Measurement | Cost Model |

|---|---|---|

| Definition | Assets/liabilities measured at current market value | Assets recorded at original purchase cost less depreciation |

| Valuation Basis | Market-based, reflects current conditions | Historical cost, unchanged by market fluctuations |

| Financial Reporting | Provides timely, relevant financial information | Offers consistency and reliability over time |

| Volatility | Higher due to market value changes | Lower; values stable unless impairment occurs |

| Impairment Recognition | Not applicable; values adjust regularly | Impairment losses recognized if asset value declines |

| Use Cases | Investment properties, financial instruments | Property, plant, and equipment; intangible assets |

| Compliance Framework | IFRS 13 Fair Value Measurement | IAS 16 Property, Plant and Equipment; IAS 38 Intangibles |

Which is better?

Fair value measurement offers real-time asset valuation reflecting current market conditions, enhancing transparency and relevance in financial reporting. The cost model provides stability by recording assets at historical cost less depreciation, reducing volatility but potentially presenting outdated values. Choosing between the two depends on the industry context and the need for either accuracy or consistency in financial statements.

Connection

Fair value measurement and the cost model are connected through their roles in financial reporting standards, where fair value reflects an asset's current market value while the cost model records the asset at historical cost less accumulated depreciation. Companies choose between these methods under IFRS and GAAP, impacting how asset values and impairments are reported on the balance sheet. The interaction of these models affects key accounting metrics such as net income, equity valuation, and investment decision-making.

Key Terms

Historical Cost

Historical cost measurement records assets and liabilities at their original purchase price, providing a reliable and objective basis for financial reporting. In contrast, fair value measurement reflects current market conditions, potentially causing volatility in financial statements. Explore more to understand how historical cost impacts financial decision-making.

Market Value

Market value is a key component in fair value measurement, reflecting the price at which an asset could be exchanged in an orderly transaction between market participants. The cost model, in contrast, records assets based on their historical cost minus any depreciation or impairment, often ignoring current market conditions. Explore the differences in detail to better understand when market value should drive your asset valuation strategy.

Revaluation

Cost model measures assets based on their original purchase price minus accumulated depreciation, while fair value measurement, especially during revaluation, reflects the current market value of assets, providing a more accurate financial position. Revaluation under fair value adjusts asset values to market conditions, impacting equity and depreciation expenses, which can enhance transparency and investor confidence. Explore more about the implications of revaluation in financial reporting and asset management.

Source and External Links

What is a Cost Model? A Guide for Effective Budgeting - CathCap - A cost model is a tool that helps businesses understand and analyze all costs involved in producing goods or services, with steps including defining scope, gathering data, segmenting costs, and analyzing cost drivers for budgeting and strategic planning.

Recommendations for creating a cost model - Microsoft Azure Well ... - A cost model estimates all costs related to a workload, including infrastructure, licenses, and personnel, by assigning values to cost drivers and linking costs to business metrics to predict expenses and support resource planning.

Three Core Concepts in Building a Cost Model - FocusCFO - A cost model serves as a framework for calculating costs, capturing wages, expenses, and capital costs, understanding cost-volume relationships, and enabling accurate cost and margin calculations with periodic updates.

dowidth.com

dowidth.com