Cryptotax regulations focus on the taxation of digital currency transactions, ensuring accurate reporting of gains, losses, and income associated with cryptocurrencies. VAT (Value-Added Tax) applies to the sale of goods and services, including certain digital assets, and varies by jurisdiction regarding its application to crypto transactions. Explore the differences in accounting treatment and compliance requirements for cryptotax versus VAT to optimize your financial strategy.

Why it is important

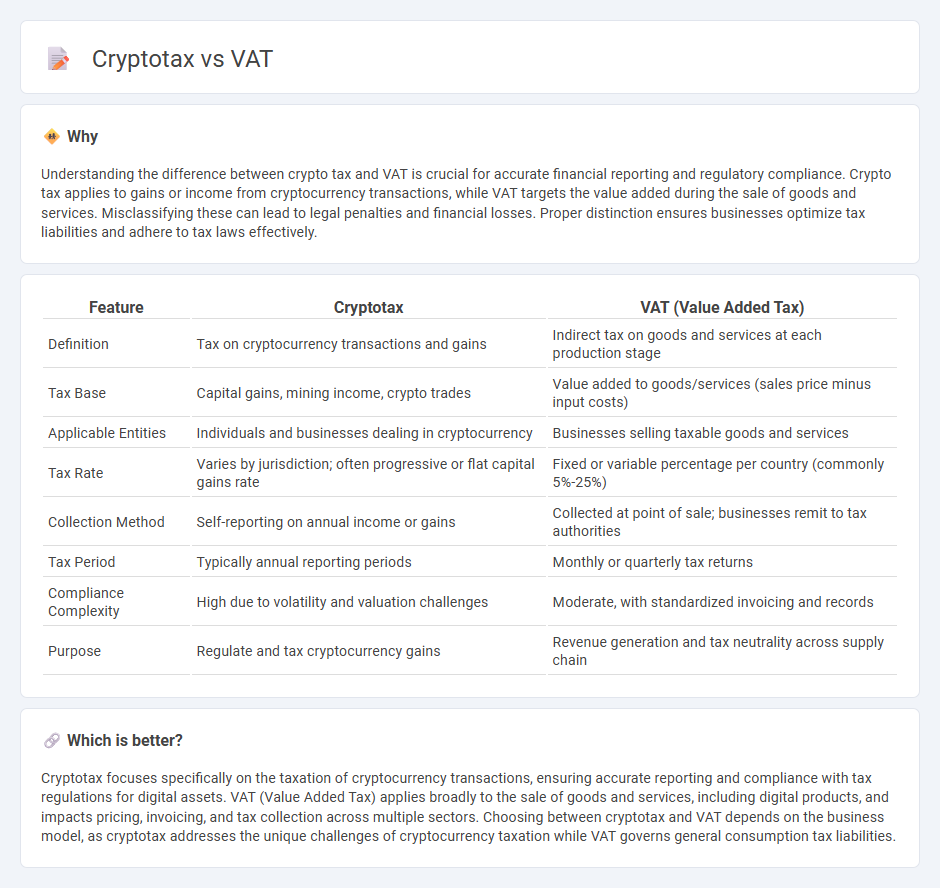

Understanding the difference between crypto tax and VAT is crucial for accurate financial reporting and regulatory compliance. Crypto tax applies to gains or income from cryptocurrency transactions, while VAT targets the value added during the sale of goods and services. Misclassifying these can lead to legal penalties and financial losses. Proper distinction ensures businesses optimize tax liabilities and adhere to tax laws effectively.

Comparison Table

| Feature | Cryptotax | VAT (Value Added Tax) |

|---|---|---|

| Definition | Tax on cryptocurrency transactions and gains | Indirect tax on goods and services at each production stage |

| Tax Base | Capital gains, mining income, crypto trades | Value added to goods/services (sales price minus input costs) |

| Applicable Entities | Individuals and businesses dealing in cryptocurrency | Businesses selling taxable goods and services |

| Tax Rate | Varies by jurisdiction; often progressive or flat capital gains rate | Fixed or variable percentage per country (commonly 5%-25%) |

| Collection Method | Self-reporting on annual income or gains | Collected at point of sale; businesses remit to tax authorities |

| Tax Period | Typically annual reporting periods | Monthly or quarterly tax returns |

| Compliance Complexity | High due to volatility and valuation challenges | Moderate, with standardized invoicing and records |

| Purpose | Regulate and tax cryptocurrency gains | Revenue generation and tax neutrality across supply chain |

Which is better?

Cryptotax focuses specifically on the taxation of cryptocurrency transactions, ensuring accurate reporting and compliance with tax regulations for digital assets. VAT (Value Added Tax) applies broadly to the sale of goods and services, including digital products, and impacts pricing, invoicing, and tax collection across multiple sectors. Choosing between cryptotax and VAT depends on the business model, as cryptotax addresses the unique challenges of cryptocurrency taxation while VAT governs general consumption tax liabilities.

Connection

Cryptocurrency transactions are subject to tax regulations, including VAT, because they involve the exchange of goods or services with digital assets. VAT applies when cryptocurrencies are used as a payment method, necessitating proper valuation and reporting to tax authorities. Accurate accounting ensures compliance with both crypto tax laws and VAT obligations, minimizing the risk of penalties for businesses and individuals.

Key Terms

Input Tax

Input Tax in VAT allows businesses to reclaim VAT paid on purchases, reducing overall tax liability and ensuring tax neutrality. In contrast, cryptotax often lacks clear mechanisms for input tax credits, leading to potential double taxation and increased complexity for cryptocurrency transactions. Explore how these differences impact your tax strategy in the evolving landscape of digital assets.

Output Tax

Output tax in VAT systems is the tax collected on sales of goods and services, calculated based on the value of the transaction. In crypto tax frameworks, output tax can be more complex due to the volatility and decentralized nature of digital assets, often requiring detailed transaction records to accurately assess taxable events. Explore how different jurisdictions handle output tax in cryptocurrency transactions to optimize compliance and tax reporting.

Token Classification

Token classification plays a crucial role in distinguishing VAT obligations from cryptotax liabilities, as different token types--utility, security, and payment tokens--trigger distinct tax treatments. VAT typically applies to the supply of goods and services involving utility tokens, whereas cryptotax rules often target capital gains or income derived from security and payment tokens. Explore more insights on token classification and its impact on tax compliance to navigate the complex crypto regulatory environment effectively.

Source and External Links

What is Value-Added Tax (VAT) - Avalara - This webpage provides an overview of VAT as a consumption tax levied at each stage of the supply chain, explaining how businesses collect and remit VAT.

Value Added Tax (VAT) Definition | TaxEDU Glossary - This glossary defines VAT as a consumption tax assessed on the value added in each production stage of goods and services, emphasizing its credit system for businesses.

VAT - European Commission - Taxation and Customs Union - This webpage explains VAT as an indirect consumption tax in the European Union, highlighting its application to goods and services sold within the EU.

dowidth.com

dowidth.com