Intercompany automation streamlines transactions and reconciliations between related entities by reducing manual tasks and errors, while multi-entity management focuses on consolidating financial reporting and compliance across multiple legal entities within a corporate group. Efficient intercompany processes enhance transparency and accuracy, supporting regulatory adherence and financial consolidation efforts. Discover how these strategies can transform your accounting operations for greater efficiency and control.

Why it is important

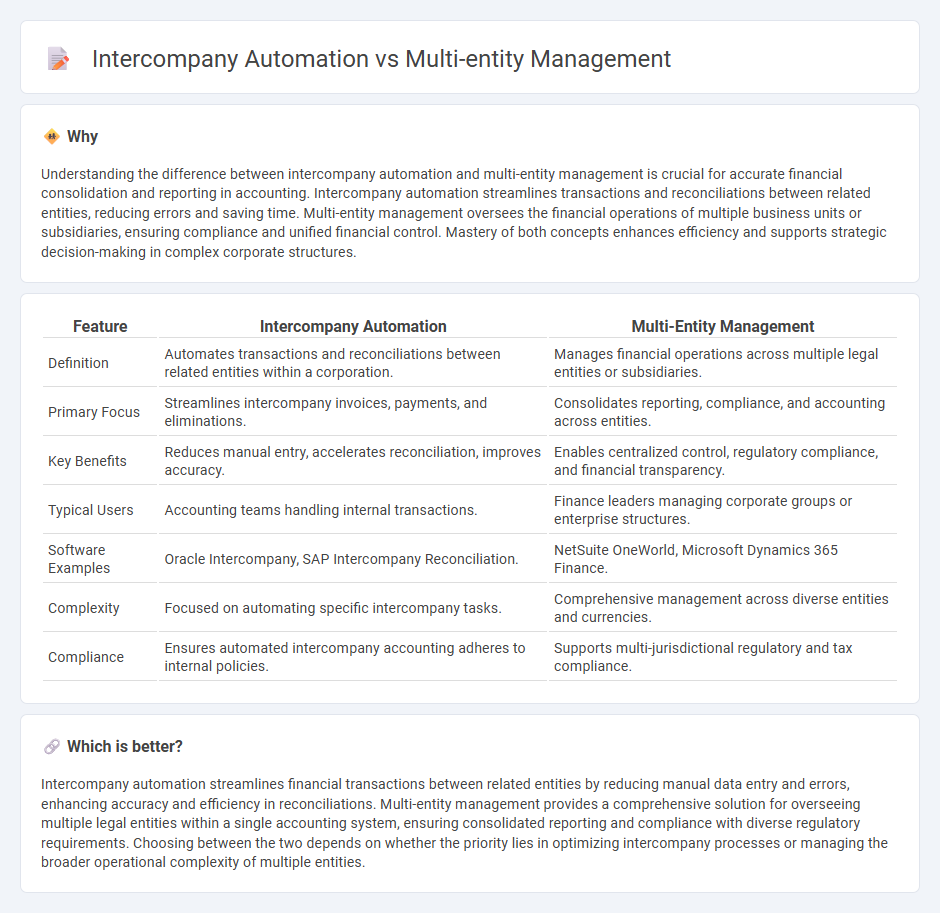

Understanding the difference between intercompany automation and multi-entity management is crucial for accurate financial consolidation and reporting in accounting. Intercompany automation streamlines transactions and reconciliations between related entities, reducing errors and saving time. Multi-entity management oversees the financial operations of multiple business units or subsidiaries, ensuring compliance and unified financial control. Mastery of both concepts enhances efficiency and supports strategic decision-making in complex corporate structures.

Comparison Table

| Feature | Intercompany Automation | Multi-Entity Management |

|---|---|---|

| Definition | Automates transactions and reconciliations between related entities within a corporation. | Manages financial operations across multiple legal entities or subsidiaries. |

| Primary Focus | Streamlines intercompany invoices, payments, and eliminations. | Consolidates reporting, compliance, and accounting across entities. |

| Key Benefits | Reduces manual entry, accelerates reconciliation, improves accuracy. | Enables centralized control, regulatory compliance, and financial transparency. |

| Typical Users | Accounting teams handling internal transactions. | Finance leaders managing corporate groups or enterprise structures. |

| Software Examples | Oracle Intercompany, SAP Intercompany Reconciliation. | NetSuite OneWorld, Microsoft Dynamics 365 Finance. |

| Complexity | Focused on automating specific intercompany tasks. | Comprehensive management across diverse entities and currencies. |

| Compliance | Ensures automated intercompany accounting adheres to internal policies. | Supports multi-jurisdictional regulatory and tax compliance. |

Which is better?

Intercompany automation streamlines financial transactions between related entities by reducing manual data entry and errors, enhancing accuracy and efficiency in reconciliations. Multi-entity management provides a comprehensive solution for overseeing multiple legal entities within a single accounting system, ensuring consolidated reporting and compliance with diverse regulatory requirements. Choosing between the two depends on whether the priority lies in optimizing intercompany processes or managing the broader operational complexity of multiple entities.

Connection

Intercompany automation streamlines transaction processing, reconciliation, and reporting across multiple entities within a corporate group, reducing errors and enhancing efficiency. Multi-entity management centralizes financial data from various subsidiaries, enabling consolidated financial statements and improved compliance with regulatory standards. Integrating intercompany automation with multi-entity management ensures seamless data flow and accurate financial consolidation for complex organizational structures.

Key Terms

**Multi-Entity Management:**

Multi-Entity Management streamlines the governance of multiple business units by consolidating financial reporting, compliance, and operational workflows into a unified platform, reducing manual errors and improving data accuracy. It ensures consistent policy enforcement and centralized control while enabling tailored management for distinct subsidiaries or divisions. Explore how Multi-Entity Management can transform your enterprise efficiency and compliance.

Consolidation

Consolidation in multi-entity management involves aggregating financial data from various subsidiaries to produce unified financial statements that comply with regulatory standards, ensuring accurate visibility across the organization. Intercompany automation streamlines reconciliation processes by automating transactions between entities, reducing errors, and accelerating close cycles for enhanced reporting efficiency. Explore comprehensive solutions to optimize consolidation in complex multi-entity structures.

Chart of Accounts Mapping

Chart of Accounts Mapping plays a critical role in multi-entity management by ensuring consistent financial reporting across subsidiaries with unique account structures. Intercompany automation streamlines reconciliation processes by automatically aligning mapped accounts and facilitating seamless transaction elimination. Explore how optimizing Chart of Accounts Mapping can enhance financial accuracy and operational efficiency across complex corporate structures.

Source and External Links

Multi-entity management: Mastering financial consolidation - This resource discusses the complexity and challenges of managing multiple entities, along with strategies for consolidating financial reports and automating processes.

Multi-Entity Management (NA) - This tool simplifies intercompany accounting and provides real-time consolidated reporting for scalable growth in Microsoft Dynamics 365 Business Central.

Multi-Entity Management in Microsoft Dynamics 365 - It offers advanced intercompany transactions and real-time reporting to streamline financial workflows across multiple legal entities in Dynamics 365 Business Central.

dowidth.com

dowidth.com