Workflow automation streamlines accounting processes by integrating software systems to handle tasks such as invoicing, expense tracking, and financial reporting automatically. Spreadsheet-based accounting relies on manual data entry and formula management, which increases the risk of errors and inefficiencies. Explore how modern workflow automation can enhance accuracy and save time compared to traditional spreadsheets.

Why it is important

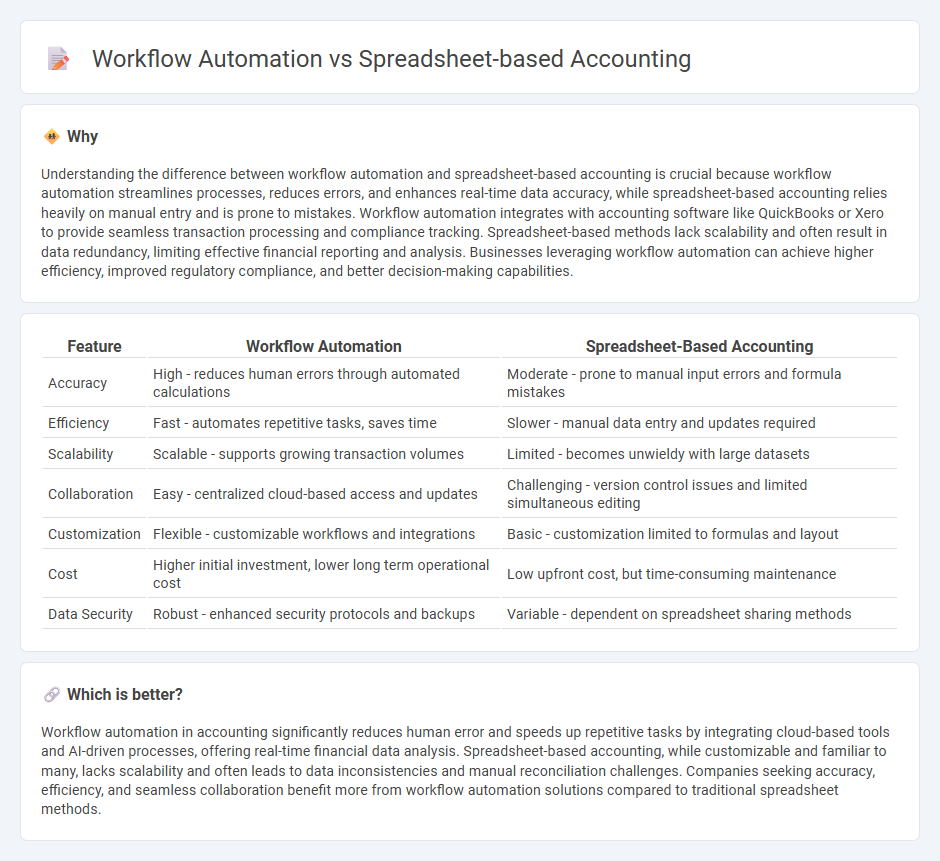

Understanding the difference between workflow automation and spreadsheet-based accounting is crucial because workflow automation streamlines processes, reduces errors, and enhances real-time data accuracy, while spreadsheet-based accounting relies heavily on manual entry and is prone to mistakes. Workflow automation integrates with accounting software like QuickBooks or Xero to provide seamless transaction processing and compliance tracking. Spreadsheet-based methods lack scalability and often result in data redundancy, limiting effective financial reporting and analysis. Businesses leveraging workflow automation can achieve higher efficiency, improved regulatory compliance, and better decision-making capabilities.

Comparison Table

| Feature | Workflow Automation | Spreadsheet-Based Accounting |

|---|---|---|

| Accuracy | High - reduces human errors through automated calculations | Moderate - prone to manual input errors and formula mistakes |

| Efficiency | Fast - automates repetitive tasks, saves time | Slower - manual data entry and updates required |

| Scalability | Scalable - supports growing transaction volumes | Limited - becomes unwieldy with large datasets |

| Collaboration | Easy - centralized cloud-based access and updates | Challenging - version control issues and limited simultaneous editing |

| Customization | Flexible - customizable workflows and integrations | Basic - customization limited to formulas and layout |

| Cost | Higher initial investment, lower long term operational cost | Low upfront cost, but time-consuming maintenance |

| Data Security | Robust - enhanced security protocols and backups | Variable - dependent on spreadsheet sharing methods |

Which is better?

Workflow automation in accounting significantly reduces human error and speeds up repetitive tasks by integrating cloud-based tools and AI-driven processes, offering real-time financial data analysis. Spreadsheet-based accounting, while customizable and familiar to many, lacks scalability and often leads to data inconsistencies and manual reconciliation challenges. Companies seeking accuracy, efficiency, and seamless collaboration benefit more from workflow automation solutions compared to traditional spreadsheet methods.

Connection

Workflow automation enhances spreadsheet-based accounting by streamlining data entry, reducing human error, and enabling real-time financial reporting. Integration of automated processes with spreadsheet tools like Excel or Google Sheets improves accuracy in bookkeeping, reconciliations, and budgeting tasks. This connection leads to increased efficiency and better compliance in managing accounting records.

Key Terms

Data entry

Spreadsheet-based accounting often relies heavily on manual data entry, which increases the risk of human error and slows down financial processes. Workflow automation streamlines data entry by integrating systems to automatically capture and process financial transactions, improving accuracy and efficiency. Discover how automating data entry can transform your accounting workflows for enhanced productivity.

Process efficiency

Spreadsheet-based accounting often leads to manual data entry errors and time-consuming reconciliations, limiting process efficiency. Workflow automation streamlines accounting tasks through real-time data integration, reducing errors and accelerating financial reporting. Discover how adopting workflow automation can transform your accounting processes for greater accuracy and speed.

Error reduction

Spreadsheet-based accounting often leads to manual data entry errors and inconsistencies due to its reliance on human input and limited error-checking features. Workflow automation significantly reduces errors by standardizing processes, enabling real-time data validation, and automating repetitive tasks, which improves accuracy and compliance. Explore how integrating workflow automation can transform your accounting accuracy and efficiency.

Source and External Links

11 Comprehensive Accounting Spreadsheet Templates For Your Firm - Spreadsheet-based accounting uses templates designed by professionals to improve efficiency, reduce errors, and standardize processes in accounting workflows by guiding employees through consistent procedures.

Accounting Spreadsheet Template Google Sheets Free Templates - Using Google Sheets for accounting allows managing financial data with organized sheets for income, expenses, and reports, automating calculations and improving clarity without costly software.

Bkper - Google Workspace Marketplace - Bkper turns Google Sheets into a collaborative double-entry bookkeeping system with real-time account tracking, bank integrations, bots for automation, and team collaboration features.

dowidth.com

dowidth.com